As a seasoned crypto investor with a knack for deciphering market trends and patterns, I must admit that the recent Bitcoin breakout has piqued my interest. Having weathered several bull and bear cycles, I’ve learned to read between the lines of technical analysis. The successful retest of the upper trendline, as pointed out by Gert van Lagen, is a promising sign that the current bullish structure could indeed lead us to a new all-time high in the coming weeks.

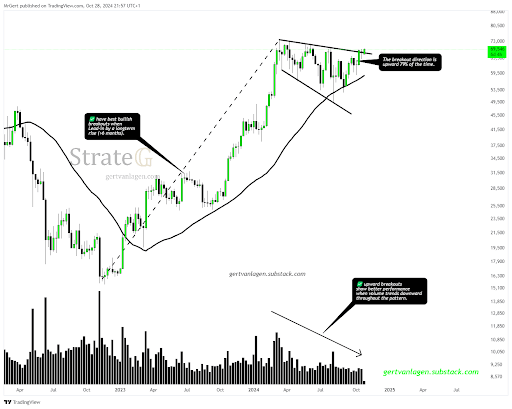

In simpler terms, the cost of Bitcoin has recently burst free from a seven-month pattern known as a descending broadening wedge. Crypto expert Gert van Lagen suggests that last week’s breakout could be the start of a significant increase in price, with investors aiming for levels above $70,000. Notably, Van Lagen emphasizes that Bitcoin’s successful retest of the upper trendline gives the current bullish trend considerable strength.

In simpler terms, when we see a pattern called a “descending broadening wedge” in technical analysis, it usually indicates a significant change in direction is about to occur after a breakout. If Bitcoin manages to break above its upper trend line, this suggests an increase in bullish sentiment and possibly reaching new record highs within the next few weeks.

Bullish Retest Validates Strong Support For Next Rally

When van Lagen conducted his analysis, the price of Bitcoin was revisiting a downward-sloping trendline that has been limiting its price surges since it hit an all-time high of $73,737 in March. At this point, Bitcoin had already exceeded this trendline as part of the descending broadening wedge pattern and was now on its third candle.

When Bitcoin touched the top trendline, van Lagen referred to it as a “confirmed bullish attempt.” He also emphasized that the success rate for an upward breakout in such patterns is approximately 79%.

If the cost of Bitcoin exceeds the identified channel now, it might lead to further increases and propel the cryptocurrency beyond $70,000. The analyst added that hitting a fresh peak would be crucial for confirming the ongoing bullish trend.

Key Bitcoin Price Levels To Watch

According to van Lagen’s analysis, while breakout and retest indicators look hopeful, there’s a significant level to watch out for: $58,700 as a weekly closing price. If the price falls below this point, the bullish trend could be nullified. Such a drop would halt the progress of wave five continuation and completely alter the setup aiming for a new record high into a bearish one.

Remarkably, Bitcoin has been on an upward trend following its breakout, with significant progress made. In fact, it has surpassed $71,000 for the first time since June, marking a new milestone in its growth trajectory.

Currently, as I’m typing this, Bitcoin is being traded at around $71,150, and it peaked at $71,450 within the last 24 hours. Right now, Bitcoin is just 3.6% shy of entering uncharted territory in terms of price. The significant resistance level to keep an eye on at this moment is the current record high.

It appears that several key indicators suggest a persistent upward trend in Bitcoin’s price over the near future, at least temporarily. The current open interest in Bitcoin stands at an all-time high of $42.6 billion, indicating a significant amount of trading action within the Bitcoin market.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-30 03:04