Last night, Bitcoin experienced a significant rebound following a brief dip below the $90,000 threshold. Over the past 24 hours, it has climbed by approximately 2.45%, currently trading around $96,845. The overall market cap stands at roughly $1.92 trillion, with a daily volume of $69.97 billion.

Bitcoin Price Analysis

On a day-to-day basis, the Bitcoin price trend suggests robust bullish backing at approximately $92,000. Yesterday, the Bitcoin price pattern created an extended Doji candle to prevent a downward close below this essential support level.

As an analyst, I observed that yesterday’s lowest point for Bitcoin was at $89,028, but today it has shown resilience and rebounded to close at $94,500. Currently, the intraday performance shows a gain of 0.90%, with the BTC price standing at $95,357.

The strong recovery in Bitcoin’s price has broken the ‘head-and-shoulder’ pattern, which was forming near the $92,000 level. This means that a bullish trend is now in play, and an opportunity to invest at a favorable price presents itself. In the short term, experts predict that Bitcoin could reach as high as $102,735.

This way, we’ve taken a complex financial concept (head-and-shoulder pattern) and explained it in a more accessible manner, while still maintaining the essence of the original statement.

If the left shoulder on the chart indicates a breakout, the price trend seems to suggest a fresh record high could be reached. According to the chart pattern, the potential for upward movement increases to approximately $112,835.

Affirming an upward trajectory, the rising exponential moving averages on the daily graph indicate a favorable direction. Meanwhile, the daily Relative Strength Index (RSI) suggests a steady buildup of bullish energy, hinting at potential growth in positive momentum.

Rising Funding Rate Signals Bitcoin Buying Opportunity

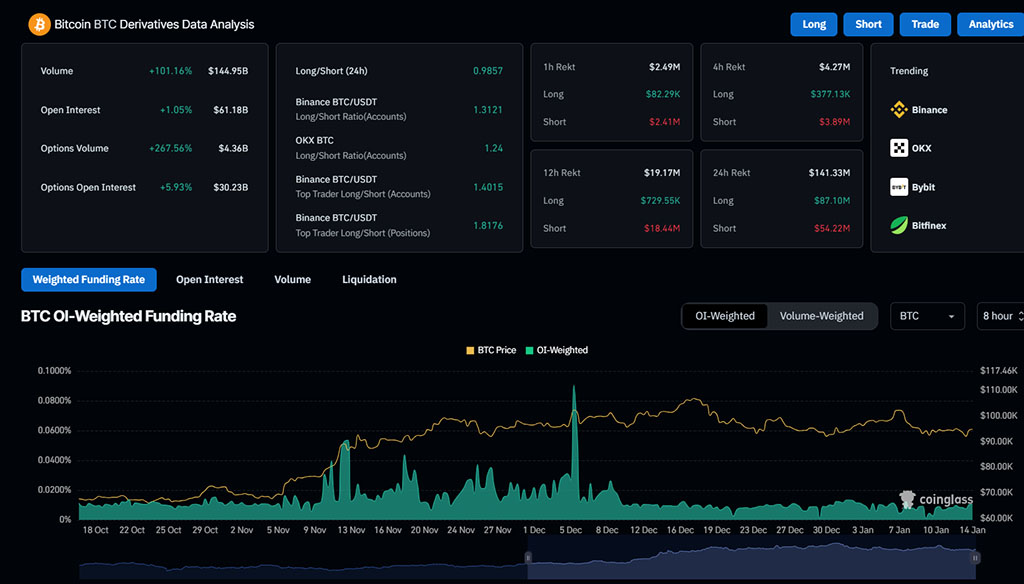

After an overnight improvement, the analysis of Bitcoin derivative contracts indicates a surge in optimistic feelings. The total value of open Bitcoin positions has increased by approximately 1.05%, now standing at around $61.18 billion.

In summary, the market has seen a significant sell-off over the last 12 hours, amounting to approximately $19.17 million in total. This massive sell-off appears to be due to shortsighted traders exiting their positions. The value of these shortsighted positions being liquidated was approximately $18.44 million.

During the healing process, the funding rate climbed to 0.0105%, indicating a substantial jump from 0.0074% during the adjustment period. This suggests that the derivatives market may be hinting at an opportunity for purchasing Bitcoin, potentially.

Institutional Support Lacks amid $284M Outflows

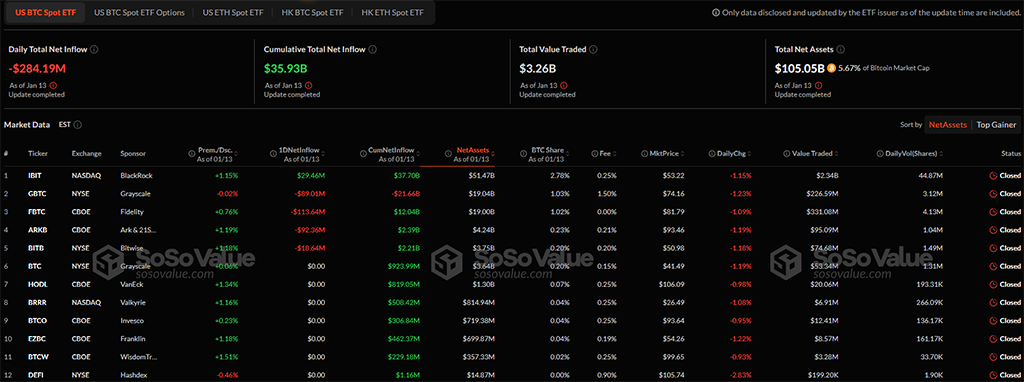

On January 13, the combined daily net influx of U.S. Bitcoin spot ETFs showed a deficit of approximately $284.19 million. However, it’s worth noting that BlackRock is the only ETF still experiencing a positive flow, to the tune of $29.46 million.

Conversely, Fidelity experienced a significant withdrawal of about $113.64 million. Meanwhile, ARK, 21Shares, Grayscale Bitcoin Trust, and Bitwise combined for an outflow close to $200 million.

Bitcoin Network Transaction Surge

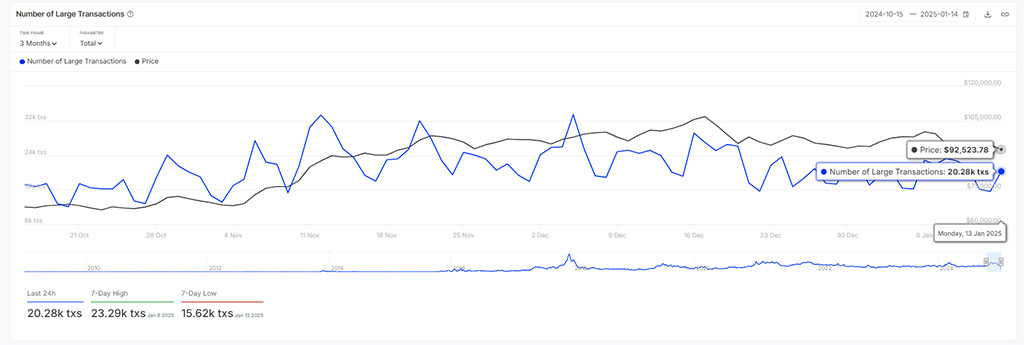

With Bitcoin bouncing back during the night, there’s been a substantial rise in larger transactions on its network. The total number of transactions climbed from 15,620 to 20,280.

Additionally, both the quantity and the size of these volumes have grown, moving from $39.4 billion to $57.95 billion. As more activity happens on the Bitcoin network, it’s reasonable to expect a rise in optimistic feelings among investors.

Conclusion

Although Bitcoin hasn’t yet received significant backing from institutions, there’s an increasing sense of optimism in the market for both derivatives and on-chain activity. The recent price movements suggest a breakdown in the previous bearish trend, potentially setting the stage for a turnaround.

It’s reasonable to anticipate that the inauguration of Donald Trump on January 20 may generate excitement in the cryptocurrency market for a while. As a result, we might expect Bitcoin’s upward trend to persist throughout this week.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2025-01-14 13:33