As a seasoned analyst with over two decades of experience in global financial markets, I have witnessed numerous market shifts and trends that have defied conventional wisdom. However, the current surge in Bitcoin price, propelled by the “Trump Pump,” is truly unprecedented.

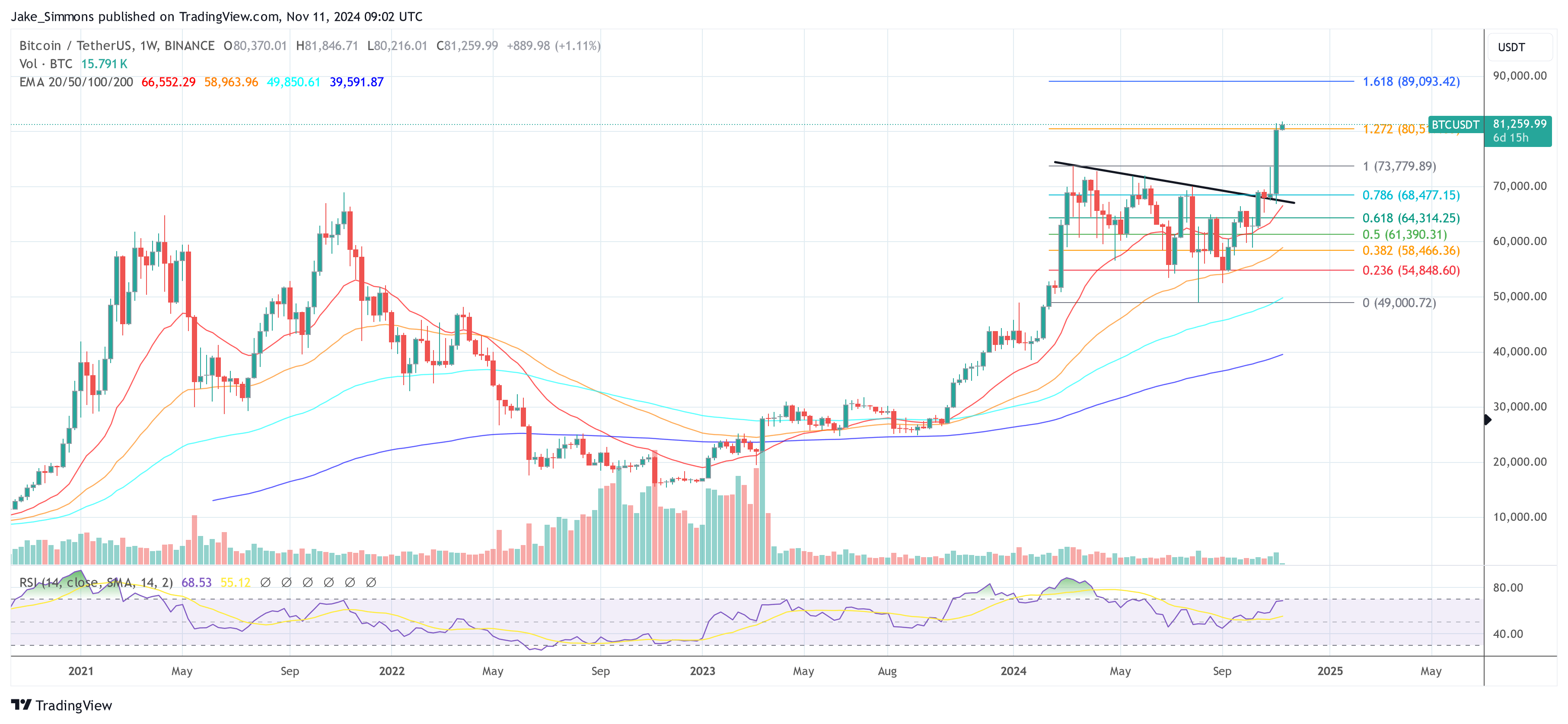

Bitcoin experienced a significant leap beyond $82,000 on Binance recently, marking an impressive 17% rise since the announcement of Donald Trump’s triumph in the U.S. presidential election on November 6. Over the weekend, the price of BTC saw an unusual surge, climbing by over 6%. Although multiple factors contribute to this growth spurt, one undeniably dominant reason emerges: The election of Donald Trump as president.

#1 The Bitcoin “Trump Pump”

Winning the election by Donald Trump has noticeably strengthened the general outlook for Bitcoin in the market, largely due to his campaign promises and favorable legislative proposals. During his campaign, Trump expressed an intention to create a national Bitcoin reserve, which would involve maintaining ownership of the approximately 208,000 Bitcoins seized through law enforcement actions over time.

As a passionate crypto investor, I’ve always been intrigued by the advocacy of Senator Cynthia Lummis, often referred to as the “Bitcoin Senator.” Recently, she proposed a groundbreaking legislation known as the Bitcoin Act. This bill, if passed, would see the acquisition of one million Bitcoins within a five-year timeframe – a move that could significantly bolster our nation’s digital currency holdings.

According to reports from Bitcoinist, the realization of a Bitcoin reserve might happen swiftly. Notably, David Bailey, a significant Bitcoin advisor to President Trump, has suggested that this could occur during the initial 100 days of his term.

As a researcher examining the crypto landscape, I find myself intrigued by Matrixport’s recent investor note. They posit that, with anticipation of Trump’s presidency in 2025 leading to more cryptocurrency-friendly US regulations, the bullish trend may persist. This optimistic momentum seems hard to curb, and given his inauguration scheduled for January 2025, there are several weeks ahead for the market to maintain this upward trajectory.

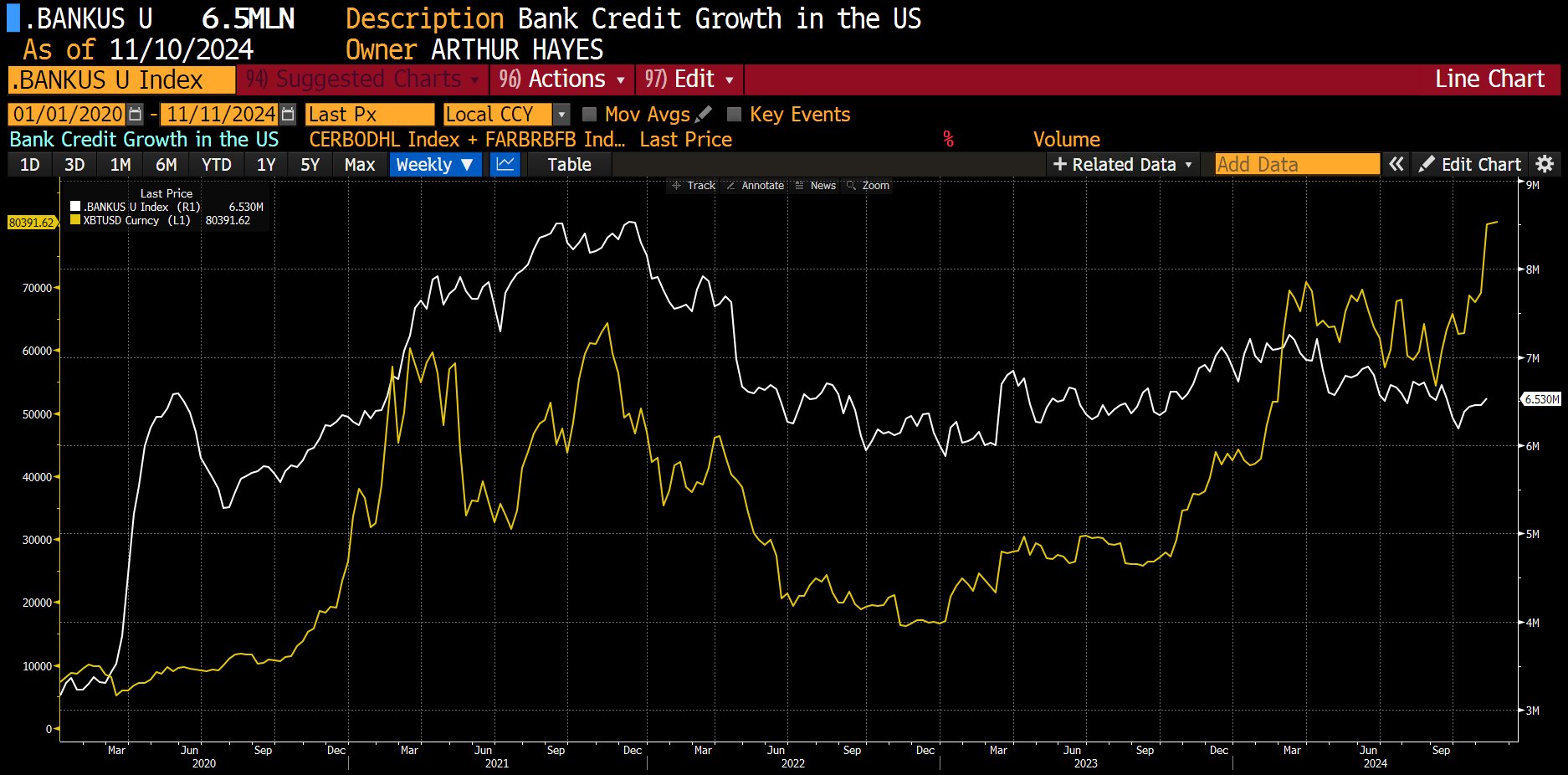

Arthur Hayes, the founder of BitMEX, expressed similar enthusiasm for X: “Some of you don’t think Trump will devalue the dollar by printing more money. Bitcoin seems to have a different opinion. Here is Bitcoin outpacing my newly developed money supply indicator (US Bank Credit). Pay attention to the market’s message.

MacroScope (@MacroScope17) emphasized that it’s crucial for Bitcoin traders to grasp the shift that occurred after the election, particularly for institutional investors. Now, investment strategies are largely based on a well-defined thesis. The current situation significantly alters this thesis regarding Bitcoin, given the political and policy aspects.

#2 Rumors About Bitcoin Nation-State Adoption

The strategic plans to establish a national Bitcoin reserve under Trump carry substantial geopolitical weight, potentially igniting a global race to amass Bitcoin reserves. David Bailey remarked, “The Bitcoin Space Race has begun,” noting that “the game theory is playing out faster than anyone could have expected.”

Mike Alfred, founder and Managing Partner of Alpine Fox LP, expressed his enthusiasm about X: “I received an unexpected call today. It was from a significant figure who informed me that a massive entity is purchasing Bitcoin in large quantities tonight. I found it hard to believe when they mentioned the name involved. Incredible! We are set to reach even greater heights.

On November 10, Bailey remarked, “At least one country is amassing Bitcoin and now ranks among the top five holders. I’m looking forward to their official announcement.” The meme he shared hinted at a strong conviction rather than mere speculation. He also clarified that this nation holds a significant amount of Bitcoin, ranking among the top 5 users in terms of ownership.

It’s known that at least one country is amassing Bitcoin and currently ranks among the top five holders. I hope they share their reasons soon.

— David Bailey $0.85mm/btc is the floor (@DavidFBailey) November 9, 2024

#3 Short Squeeze

A substantial “squeeze” event has played a part in Bitcoin’s recent price increase. Charles Edwards, founder of Capriole Investments, noted on Twitter: “Approximately $1 billion worth of short positions were forced to buy back Bitcoin due to its rise from $76,000 to $81,000 over the weekend. The open interest at this level is similar to when Bitcoin was trading at $62,000. If market conditions stabilize, we could see a strong upward trend.

Data from Coinglass corroborates this, revealing that on Sunday, $133.15 million in BTC shorts were liquidated, with additional $33 million on Saturday. This substantial liquidation of short positions has reduced selling pressure, thereby fueling further upward momentum in Bitcoin’s price.

One way to rephrase the given text for easier understanding could be: “Another significant factor contributing to Bitcoin’s recent surge has been a renewed interest from retail investors. As Cameron Winklevoss, founder of Gemini, stated on X, “The path towards $80k bitcoin is being laid down by consistent demand for ETFs. This isn’t driven by fear of missing out (FOMO) among retail investors, but rather a steady accumulation. Investors tend to hold onto ETFs instead of selling them, which creates a solid base of capital that doesn’t easily give way. The floor price keeps climbing. Where are we in the cycle? We’ve just flipped a coin, the game hasn’t even started yet.

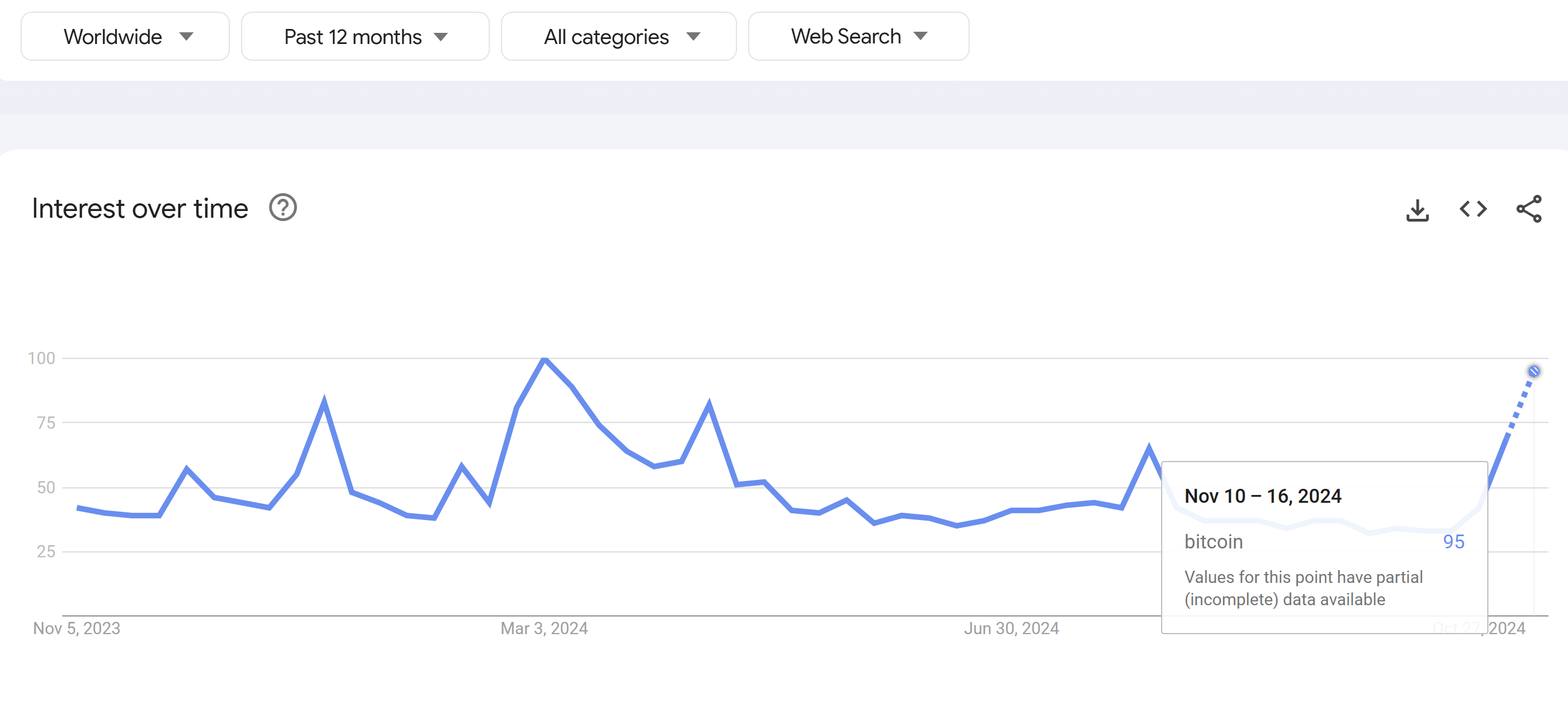

The data from Google Trends reinforces this storyline, showing a significant jump of approximately 53% in Bitcoin-related queries since the first weekend of October. On November 10 alone, searches for Bitcoin reached an astounding 95, compared to just 42 points at the end of October. This spike in search activity implies growing retail curiosity and a possible influx of new investors entering the market.

At press time, BTC traded at $81,259.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-11-11 15:05