As a seasoned crypto investor with over a decade of experience navigating the volatile and unpredictable world of digital currencies, I find myself cautiously optimistic about the recent surge of Bitcoin above $100,000. On one hand, analysts like Xanrox suggest that this rally could be a bull trap, pointing to potential correction levels and symmetrical triangles on the charts. However, another respected analyst, Ali Martinez, argues that we might not see a major correction anytime soon, comparing the current bullish cycle to those of 2017 and 2020.

For the very first time, the value of Bitcoin has surpassed $100,000, causing excitement among investors. As a result of this rise, crypto analyst Xanrox offers his analysis on whether further growth is expected for Bitcoin or if this surge above $100,000 might instead be a false signal, potentially leading to a trap for bullish investors.

What Next For Bitcoin Price Following Rally To $100,000

In a recent TradingView post, Xanrox suggested that the Bitcoin price will unlikely enjoy a sustained rally for now. He explained that this is unlikely because a sustained rally could easily put Bitcoin at $600,000 by December 2025, which is impossible. As such, he believes that BTC would need to slow down.

The analyst pointed out that there hasn’t been a significant decrease in Bitcoin’s price recently, which makes him hesitant to purchase BTC at the moment. Xanrox added that a market turbulence, possibly resulting in a steep decline or flash crash, is needed before any further changes occur. He speculated that the price of Bitcoin could potentially fall to around $85,000 during this anticipated correction.

Xanrox explained that the $85,000 mark could act as strong support due to it signifying the close of a significant gap in fair value on the daily candles. He also mentioned that this price point represents the beginning of the initial trading activity based on the volume profile. In simpler terms, Xanrox shared that he plans to purchase Bitcoin at this level.

The cryptocurrency expert suggests that the recent surge in Bitcoin’s price towards $100,000 may be a ‘bull trap’, as he points out a symmetrical triangle on a four-hour chart. He explains that this pattern appears to be a ‘bull trap’ for individual investors because many will buy into the breakout. Consequently, he predicts that Bitcoin might make one final push to drain liquidity.

A Major Correction Might Not Come Anytime Soon

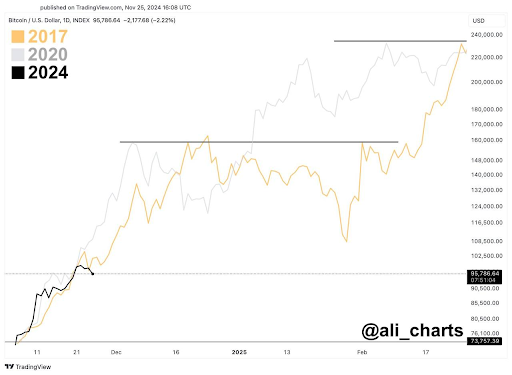

Contrarily, crypto analyst Ali Martinez presents an opposing viewpoint, predicting that a significant drop in Bitcoin’s price may not occur imminently. In his latest post, he compares the current bullish trend to those seen in 2017 and 2020, implying similarities between the cycles.

As an analyst, I’m projecting that if this trend persists, we might not witness a significant initial correction of approximately 15% to 30% in Bitcoin price until it reaches anywhere from $135,000 to $159,000. Interestingly, the accompanying chart suggests that the market peak for Bitcoin could be as high as $240,000, implying there’s still potential for significant upward movement, even following this projected correction.

Currently, the Bitcoin cost is approximately $102,800 per unit, representing an increase of more than 6% within the past day, as indicated by statistics from CoinMarketCap.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-12-06 02:46