As a seasoned crypto investor with a decade of rollercoaster rides under my belt, I’ve learned to navigate the turbulent seas of the digital asset market with a mix of cautious optimism and healthy skepticism. The recent sell-off, with Bitcoin plummeting by 26% from its July highs, has sent shivers down the spines of even the most hardened investors.

The value of cryptocurrencies has taken a significant hit due to a large-scale selling spree, causing the price of Bitcoin to drop by 26% from its peak in July, which was around $70,000. This steep fall coincides with a more extensive downturn in international financial markets, suggesting rising economic anxiety and increased caution among investors.

Crypto Winter Returns?

In the world of cryptocurrencies, Monday saw a wave of caution sweep through, leading to a significant drop. Bitcoin plummeted by 16%, touching an all-time low of $48,860 on Binance. Similarly, Ethereum, the second-largest digital currency, suffered its steepest decline since 2021, reaching $2,116.

Significantly, the impact was widespread, affecting stocks related to cryptocurrencies. Companies like Coinbase Global, MicroStrategy, mining firms Marathon Digital Holdings, and Riot Platforms all experienced substantial decreases in their stock prices as a result.

Amidst a worldwide stock market downturn, my worries about the future economy multiplied, especially when it comes to my investments in AI. The geopolitical tensions in the Middle East only increased this uncertainty, fueling my concerns and making me more anxious as an investor.

Bitcoin Price Predicted To Hit $15,000

Over the last 24 hours, I’ve observed an impressive $1.2 billion worth of crypto bets being liquidated, one of the largest such events since early March. Key factors contributing to this market turbulence include the unraveling of yen carry trades and responses to higher interest rates in Japan.

As a researcher immersed in the world of cryptocurrencies, I find myself optimistic about the market’s future despite the present downturn. Justin Bennett, a renowned crypto analyst, posits that a Bitcoin price of $15,000 and an Ethereum value of $700 are not out of reach, indeed they seem very much within the realm of possibility.

Additionally, as you can see from the image, historical trends suggest that Bitcoin’s performance in August and September has traditionally been poor, with an average decline of about 7.82% in August and 5.58% in September – making these months the most unfavorable on record.

Light At The End Of The Tunnel?

Although several bearish elements are present, crypto expert Ali Martinez highlights the Bitcoin MVRV Ratio on a 30-day scale, which hasn’t been this low since November 2022, following the FTX crash. In his words, “This period indicated a bottom and a fantastic buying opportunity.”

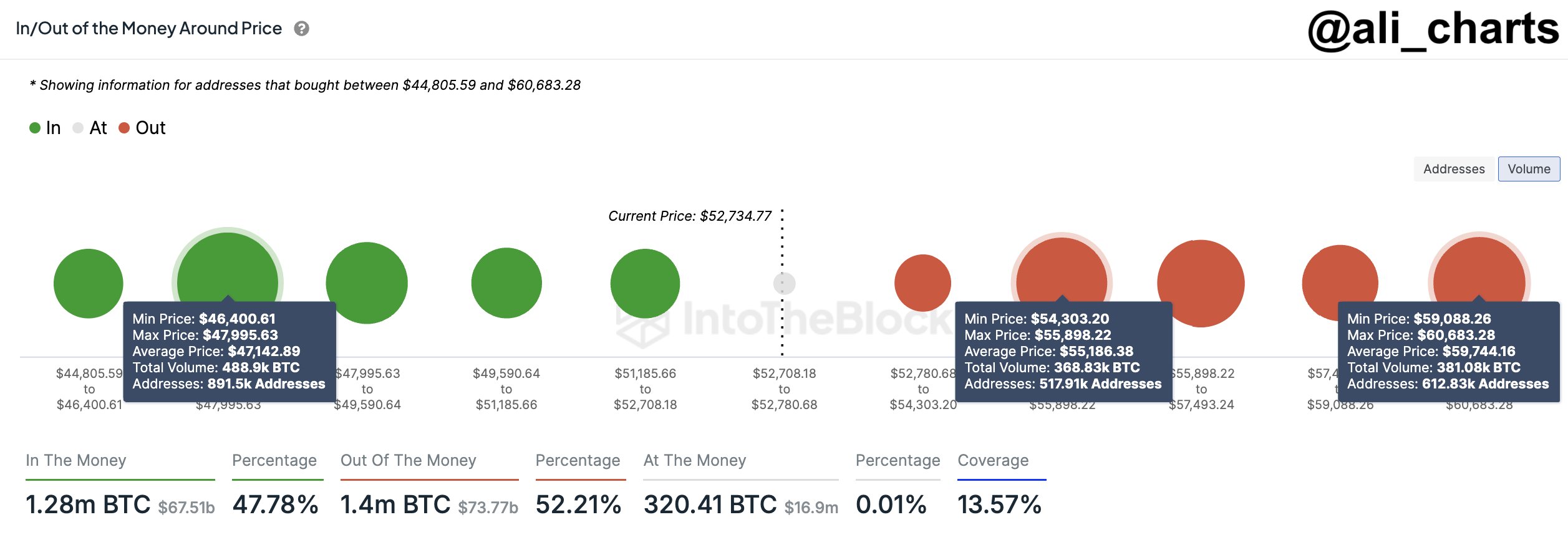

Additionally, Martinez pointed out an important level of support that the bulls should maintain to prevent additional drops in the price of Bitcoin. He mentioned that approximately 900,000 addresses previously purchased around 489,000 BTC at roughly $47,140. Even though the Bitcoin price hasn’t touched this point yet, it is a significant area to keep an eye on and hold for any potential price advancements of BTC.

Furthermore, crypto expert Rekt Capital highlights a significant surge in selling activity, which could indicate a possible short-term low and an upcoming rally towards higher prices, as observed in previous market scenarios.

According to economist and analyst Timothy Peterson’s findings, when Bitcoin’s price decreases by 25% within a 10-day span, it tends to bounce back approximately 62% of the instances, with an average increase of 17%. In some cases, Bitcoin has managed to fully recover from these drops after 20 days, happening about 15% of the time.

Additionally essential is the behavior of the Bitcoin exchange-traded fund (ETF) market on the stock exchange, as it has historically influenced Bitcoin’s price, contributing to the record highs achieved in March.

As I pen this analysis, it’s worth noting that the dominant cryptocurrency in the market has effectively minimized its losses and staged a comeback, currently trading at approximately $53,260.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-08-06 01:35