Despite some potential for fluctuations, Bitcoin remains relatively stable near the $60,000 mark. Following its rejection of August lows, it surged past the significant figure of $60,000 and reached as high as $63,000 by the end of last week, a notable rise.

As I analyze the daily price movements, it appears we’re witnessing a sideways trend that could be indicative of an accumulation phase. This range is defined by the robust bullish engulfing bar that occurred on August 8.

Bitcoin Is Moving Sideways And “Boring”

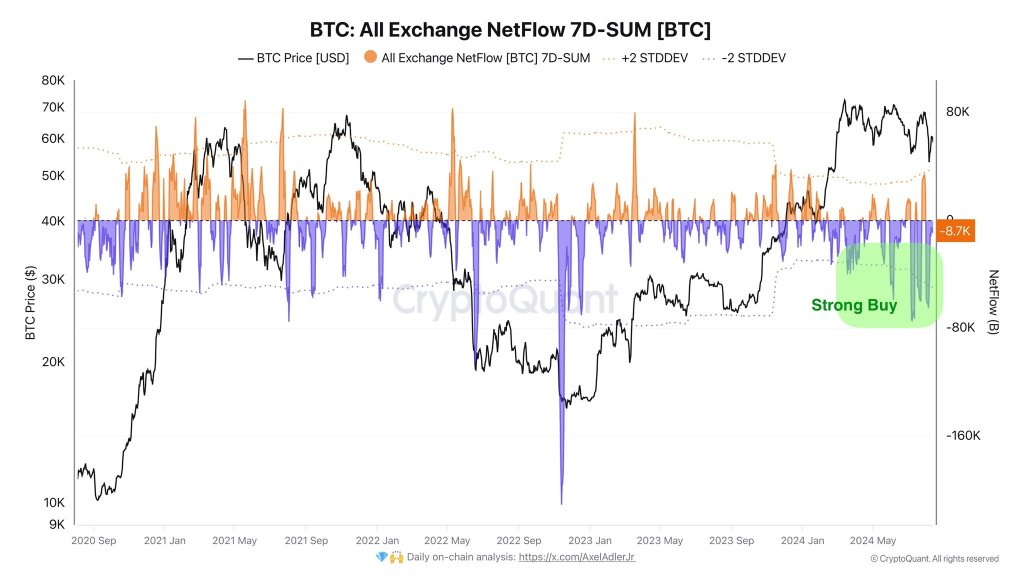

As a crypto investor, I’ve noticed an unexpected calmness in the market, almost bordering on boredom amidst the usual optimism. An analyst from X has pointed out that this lethargy is reflected in the low overall activity. For example, they mentioned that the Bitcoin netflow stood at -8,748 BTC over the last week. This indicates a significant outflow of Bitcoin, suggesting a lack of buying pressure in the market.

As someone who has been following the cryptocurrency market for several years now, I have learned to read between the lines and interpret market trends. The recent data suggesting that more Bitcoin (BTC) was bought than sold indicates a trend of accumulation amidst the general market lull. This is a positive sign, as it suggests that traders and investors are confident in the current prices, which can help steady prices even after the steep fall to as low as $49,000 on August 5th. In my experience, such accumulation during a downturn can often lead to a bullish reversal in the long term. So while it’s important to stay vigilant and cautious, I see this trend as a potential opportunity for those willing to ride out the market fluctuations and potentially reap rewards in the future.

It’s not unexpected that accumulation is happening, as it mirrors the overall trend in the cryptocurrency market. So far, Bitcoin, along with Ethereum and XRP, have shown signs of a bullish recovery following the early August crash. While the bullish trend on August 8 boosted optimism, there hasn’t been a sustained continuation of that momentum.

Right now, the immediate level of resistance stands at around $63,000. However, if this level is broken by buyers, it could pave the way for further increases towards approximately $70,000, and potentially reaching new record highs. The current support levels can be found between $57,000 and $60,000.

Miner Liquidation Risk Low, BTC Holders Accumulation

Despite this, prior to that point, Bitcoin was trading horizontally within a bullish candlestick, which is generally favorable for optimistic traders as it suggests more effort may result in higher returns.

Based on on-chain data, this suggests that Bitcoin is currently in a holding phase, with many users eagerly accumulating. This choice to invest further when rates are low might indicate a sense of confidence and anticipation for potential additional profits in the near future. (Glassnode reports this data)

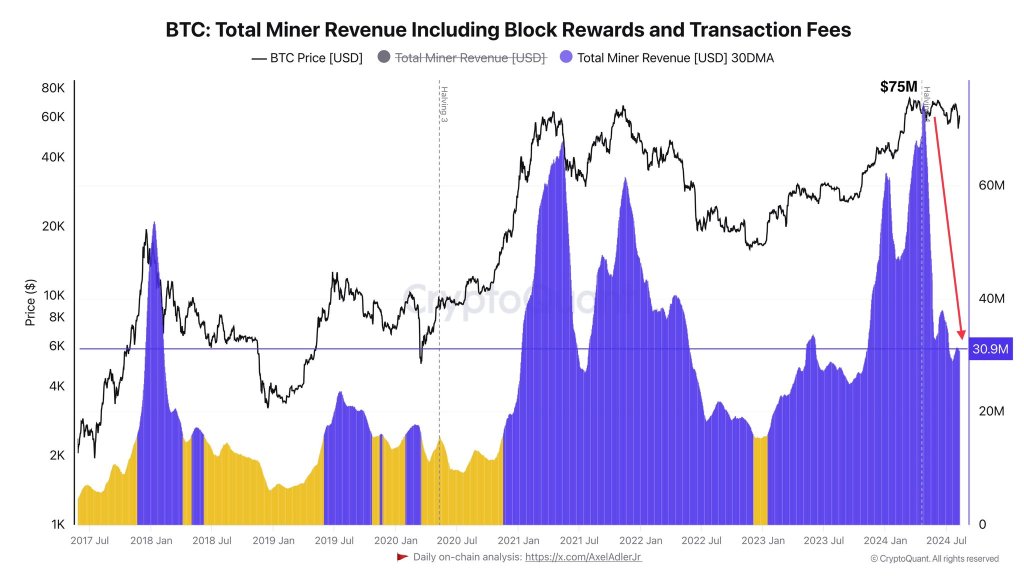

Optimistically, it appears that the potential advantage won’t be met with resistance, particularly from miners who could decide to offload their Bitcoin. Following the Halving in late April, miners started selling BTC, causing prices to decrease noticeably throughout June. However, currently, there’s a sense of stability as the hash rate, which represents computing power, is increasing. According to YCharts, this trend is observed.

As a seasoned cryptocurrency analyst with years of experience under my belt, I’ve witnessed the ebb and flow of this dynamic market. The recent drop in daily miner revenue from $75 million to as low as $30 million following Halving has caught my attention. Having closely monitored the mining industry for some time now, I can tell you that such a significant decline is not unheard of, but it’s certainly concerning.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-08-14 05:10