As a seasoned researcher with a knack for deciphering complex financial trends, I find Luke Broyles’ analysis of Bitcoin’s future outlook intriguing and plausible, given my personal experience in observing the cryptocurrency market’s volatility and resilience. The concept of Bitcoin as a hedge against inflation aligns with my understanding of its inherent value proposition.

Optimism about the Bitcoin future outlook remains strong, with a crypto analyst forecasting a massive $100,000 price increase for the pioneer cryptocurrency. With expectations of an even greater price surge, the analyst believes that a $100,000 ATH for Bitcoin in 2025 is a nominal price target.

Why Bitcoin Will Rise To $100,000 In 2025

Luke Broyles, a well-known cryptocurrency analyst and Bitcoin supporter, recently delved into a talk about how U.S. inflation influences Bitcoin’s value over time. He suggests that by the year 2025, the nominal price of Bitcoin could hit $100,000 as a result of inflation. Yet, this predicted surge in value wouldn’t approach the heights attained in 2021.

Prior to stating his optimistic prediction of Bitcoin reaching $100,000, Broyles had suggested earlier that the cryptocurrency could reach around $65,000 shortly. He likened this potential price jump to Bitcoin’s record high in 2021, which surpassed $69,000 at its peak.

Analyst calculations suggest that when adjusted for inflation, the highest price Bitcoin reached in 2021 equates to approximately $83,000 in today’s market value. This means that even if Bitcoin’s current price soars to unprecedented heights around $65,000, its buying power would still be less than what it had in 2021 due to inflation.

According to Broyles’ forecast, it’s possible that over the next six to eight months, there may be increased money printing, which could potentially worsen inflation. He believes this escalating inflation could serve as a trigger, propelling Bitcoin’s value up to around $95,000.

In response to the analyst’s forecast about Bitcoin’s future direction, a member within the crypto community expressed doubt, pointing out that predicting an upward movement of $95,000 could actually be considered bearish (optimistic but expecting a downturn).

Another crypto member claimed that inflation in the US is much higher than what is reported, stating that “the real Bitcoiners” believe that inflation is at least 21% per year, as such Bitcoin should be worth $210,000. Responding to the member, Broyles expressed skepticism about the 21% inflation claim but admitted that inflation could be as high as 12%, 14%, and 16% annually.

Previously, Broyles examined where we stand in the ongoing Bitcoin bull market. The analyst suggests that we’ve already passed the midpoint of the market cycle, having completed around 50% of its projected duration and realizing approximately 40% of potential returns. Furthermore, the market sentiment for Bitcoin has grown only by about 10%, and FOMO (Fear Of Missing Out) is just starting to surface, currently at a low 5%.

Analyst Predicts Next BTC Top

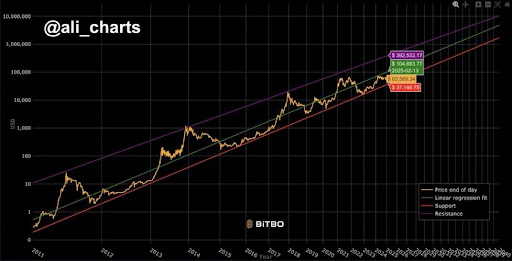

On September 24, crypto analyst Ali Martinez projected when Bitcoin might hit its next high point in this cycle. Based on his analysis, if Bitcoin’s Long Term Power Law stays valid, we could see the cryptocurrency reaching a peak of approximately $400,000.

The Bitcoin Power Law is a concept or theory that suggests a specific mathematical relationship between the price of Bitcoin and its market behavior or adoption. As of writing, the price of Bitcoin is trading at $63,807, reflecting an 8.76% increase over the past week.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The games you need to play to prepare for Elden Ring: Nightreign

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

2024-09-25 05:10