As a seasoned crypto investor with a knack for spotting trends and patterns, I find Henrik Zeberg’s latest analysis intriguing. His historical data and technical indicators alignment have caught my attention, particularly his emphasis on the RSI, MACD, and RVGI.

According to macroeconomist Henrik Zeberg, who specializes in business cycles, he predicts a significant surge of around 60% for the Bitcoin price based on his recent technical analysis. This seasoned analyst has noticed a specific pattern across three key technical indicators that have previously indicated substantial upward price trends when all are aligned.

Bitcoin Price Set For Next Bull Run

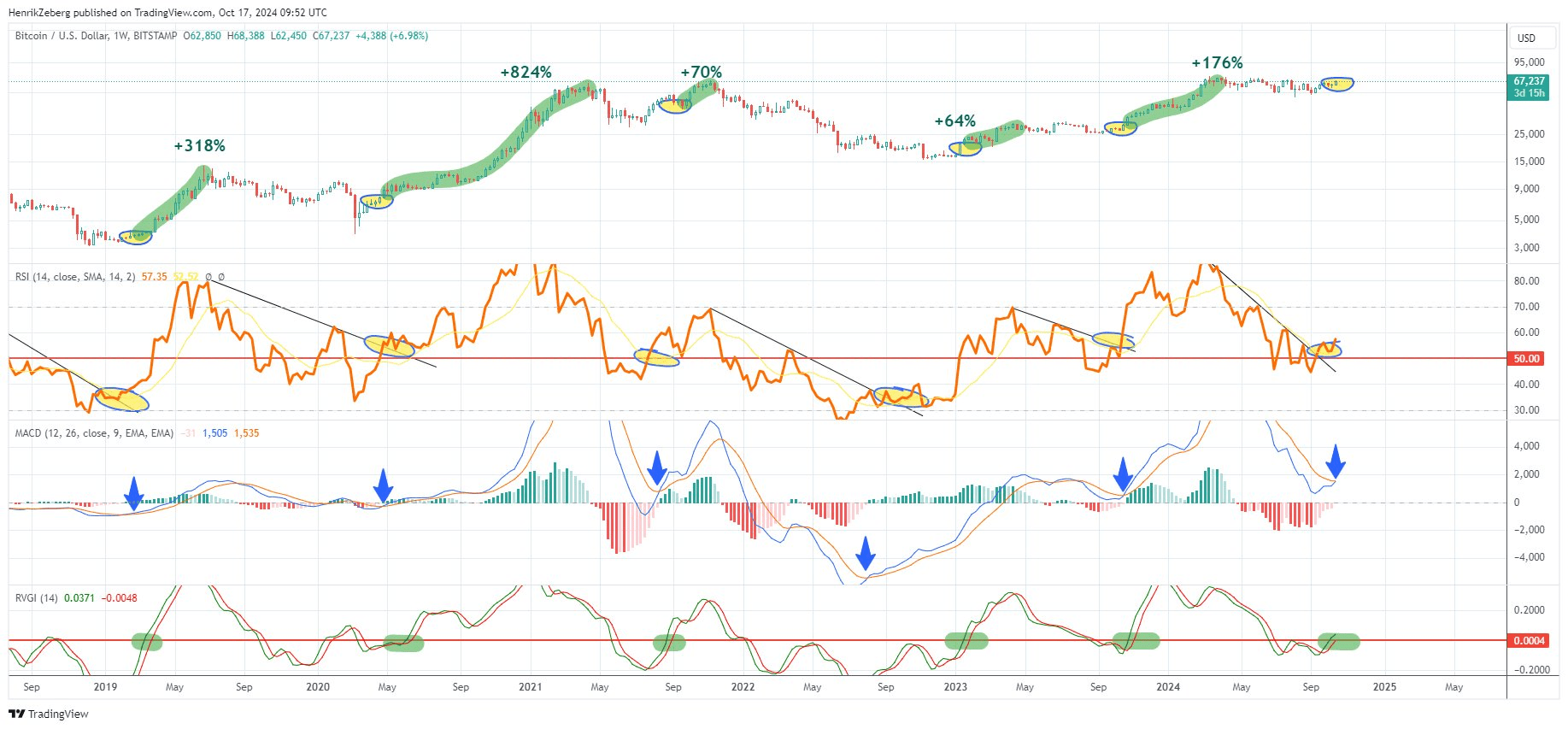

In simpler terms, Zeberg emphasizes the Relative Strength Index (RSI), a tool commonly used to determine if an asset is overbought or oversold. Right now, the RSI is sitting above the 50 mark, usually suggesting increasing bullish energy. What makes this significant is that the RSI has surpassed a downward trendline which previously restricted momentum. Historically, such a break suggests strong price growth ahead.

In addition to the Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD) indicates a bullish trend. This happens when the faster-moving blue line, which represents MACD, surpasses the slower red signal line. Traders often use this crossover to verify a possible shift from negative to positive market trends. The importance of this crossover, as highlighted by Zeberg, is in line with its reputation for predicting the beginning of a bullish period.

The third metric, the Relative Vigor Index (RVGI), may not be as well-known, but it’s equally important. This particular metric is currently showing a bullish trend, signaled by the green line surpassing the red line. Essentially, the RVGI gauges the strength of price fluctuations, and its crossover suggests a robust bullish sentiment.

Zeberg’s chart shows multiple instances in history where these specific conditions occurred, which were preceded by notable price surges. For instance, there was a 318% increase in 2019, an 824% increase in 2020, a 70% surge in late 2021, a 64% rise in January 2023, and a 176% jump in the latter half of 2023. These aren’t just small upticks; they represent substantial upward trends or bull markets. Given this historical context, it seems plausible that we might witness a similar trend again in the near future.

Each instance when these specific Bitcoin technical indicators align as Zeberg notes, has historically triggered a rally with a minimal gain of 60%.

His confidence in this pattern is evident as he describes the potential for what he calls a “Blow-Off Top,” a term that suggests an intense and rapid increase in price. As reported by NewsBTC, Zeberg forecasts that a US recession is unavoidable, yet it will be preceded by a significant surge in financial markets, which includes a major rally in Bitcoin, potentially reaching between $115,000 and $120,000 in a “Blow-Off Top” scenario.

At press time, BTC traded at $67,956.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-10-18 11:46