Bitcoin Nervous Breakdown: Shorts Scream and Sells Accelerate as Price Crashes! 😂📉

In a spectacle worthy of another Bulgakov novel, Bitcoin, that capricious beast, flirted dangerously close to the sacred $100,000 threshold last week. The short-term holders, those madcap gamblers clutching their digital treasures for less than 155 days, suddenly decided to abandon ship with the grace of a ballet dancer slipping on a banana peel. Their hearts, so recently inflated with confidence, now flutter madly—selling with the desperation of a man caught in a traffic jam, all while Bitcoin did its best impression of a rollercoaster gone rogue.

Fear Resurfaces Among the Short-Term Horde

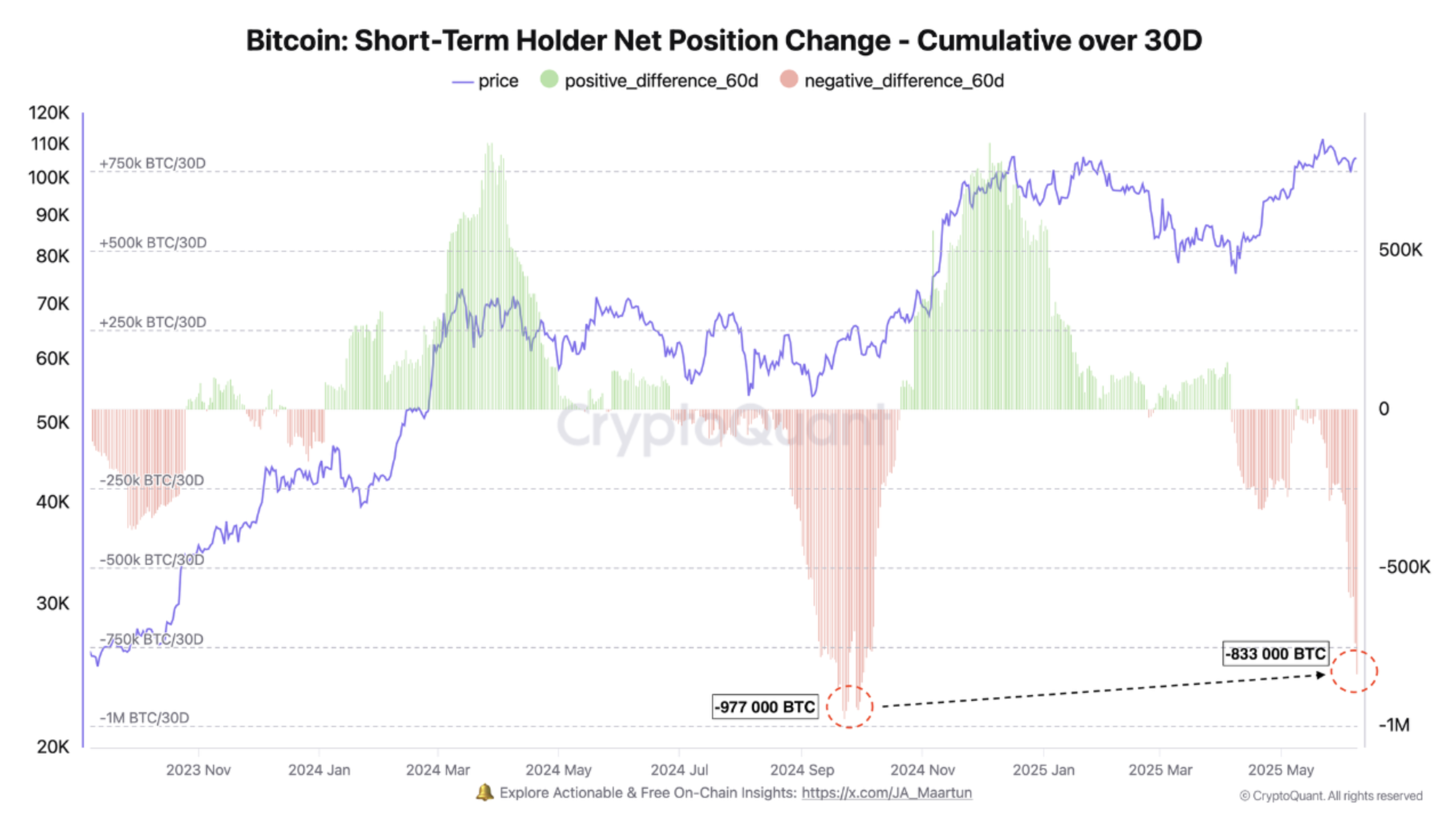

But don’t you worry, dear reader. According to the wise cryptic oracle CryptoQuant – that posthumous prophet penned by the mysterious Darkfost – the net position of these short-term desperados has plummeted a staggering 833,000 BTC over the past month. A tragic figure, considering that during the April’s epic showdown, they lost nearly 977,000 BTC. Clearly, the short-term crowd is a fickle bunch, prone to tantrums especially when Bitcoin dares to dip below $80,000 and wail at $74,508. As Darkfost ominously remarks, they have become “much more sensitive,” as if their emotional baggage had grown a few sizes last week.

Their latest behavior is reminiscent of a circus act—clowns jumping at shadows, all triggered by a mere breath of market weakness.

Bitcoin’s Quirky Tango: From Doom to Boom?

Meanwhile, our beloved coin, ever the drama queen, initially stumbled from its crown jewel high of $111,814 but then, in a surprising twist, picked itself up like a typical Bulgakov hero—despite the tumults and the fools who bet against it. Over the weekend, Bitcoin showed signs of quick recovery, as if tired of being the court jester. Experts like Ali Martinez, that oracle of digital fortune-telling, proclaimed that BTC has broken through the stifling resistance of $106,600 and might just waltz up to $108,300 or even a grand $110,000 if the winds of market fate blow favorably.

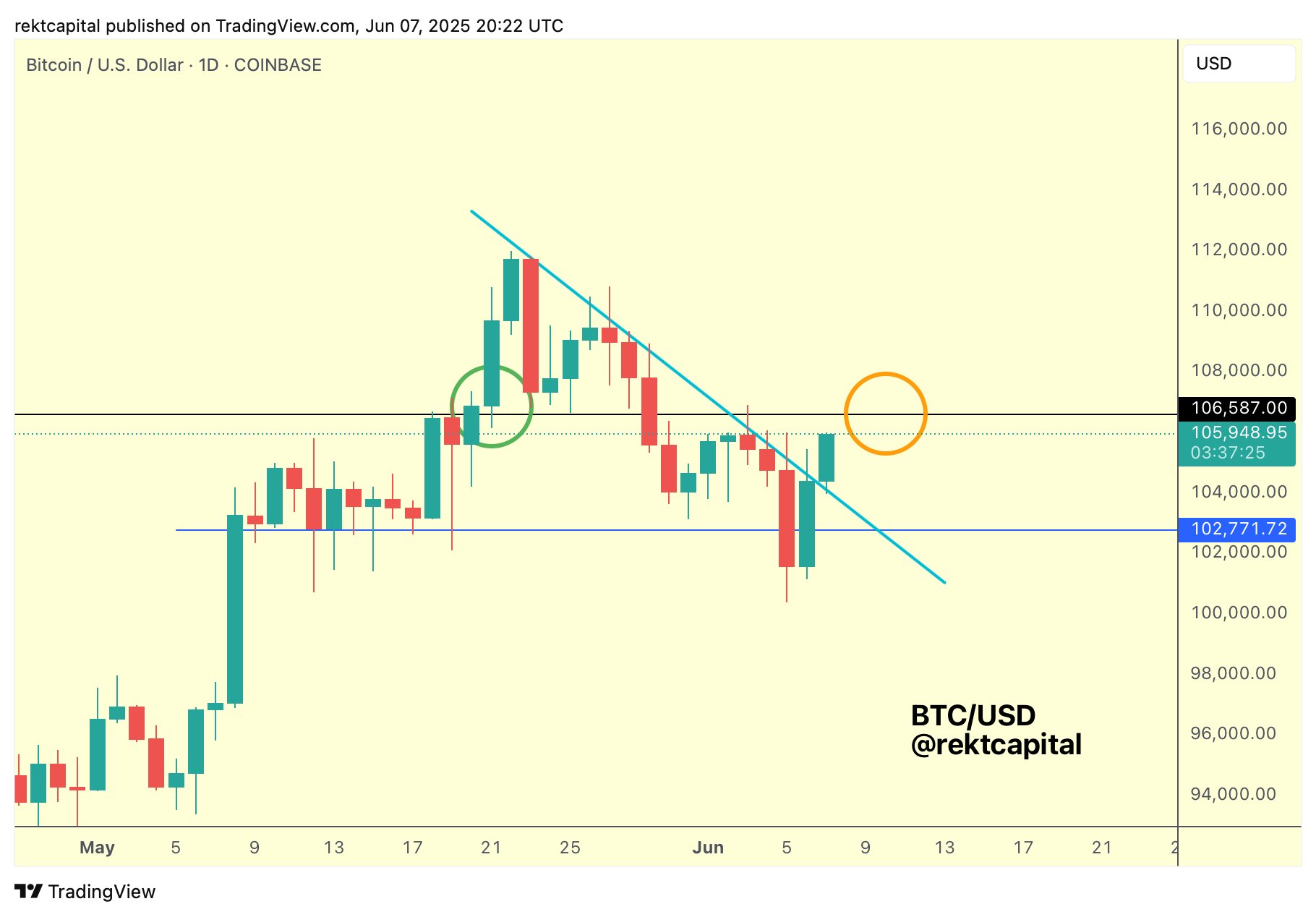

And behold, Rekt Capital, the man with the cryptic charts, revealed that Bitcoin has shrugged off its two-week era of blue gloom—breaking out of its technical prison and possibly transforming former resistance into a new, comfy support like a cat curling up in sunshine.

Further, the mystical Hash Ribbons flashed a “Buy Me” sign, and whispers of a short squeeze — driven by a negative funding rate at Binance, no less — dance like ghosts in the data halls. Yet, don’t get too comfy; long-term investors seem to be leaving the party, and retail investors—those perpetual enfants terribles—may spice up the chaos even more. Currently, Bitcoin stands at a modest $107,627, up 1.9%, as if shrugging off its recent nervousness and saying, “Let’s see how far this carnival ride goes.”

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

2025-06-10 08:12