As a seasoned crypto investor with a knack for reading market trends and understanding the nuances of Bitcoin’s volatile nature, I find myself both enthused and cautious about the latest developments. The bullish predictions of $110K and even $120K by options traders by 2025 certainly pique my interest, especially considering the recent surge past the $100K mark.

Even with the anticipated fluctuations of approximately $100K, Bitcoin is currently valued at around $97,615 and has seen a daily volatility of 5.3%. The total market capitalization stands at a staggering $1.93 trillion, with a 24-hour trading volume of $158.30 billion. Interestingly, options traders have upped their wagers on Bitcoin reaching prices of $110K and even $115K by January 2025, as suggested by data from the options exchange Deribit. Particularly noteworthy is the increase in purchases of call options (a bullish bet) for a $115K price target by January 31, 2025.

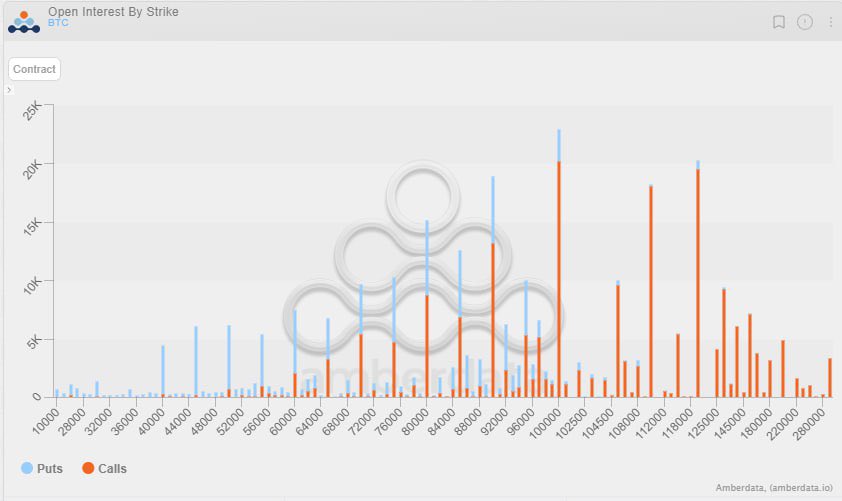

As of now, the options with the highest volume (Open Interest) are scheduled to expire in December 2024 and March 2025. Kelly Greer from Galaxy Digital mentioned that approximately $4 billion is being wagered on the potential Bitcoin price reaching $100,000 and $110,000 by the end of 2024 or during Q1 2025 (the specified prices are the strike prices).

Nevertheless, as Bitcoin (BTC) has just reached $100K, there have been bold predictions that it might even reach $120K.

Leverage Risk Remains

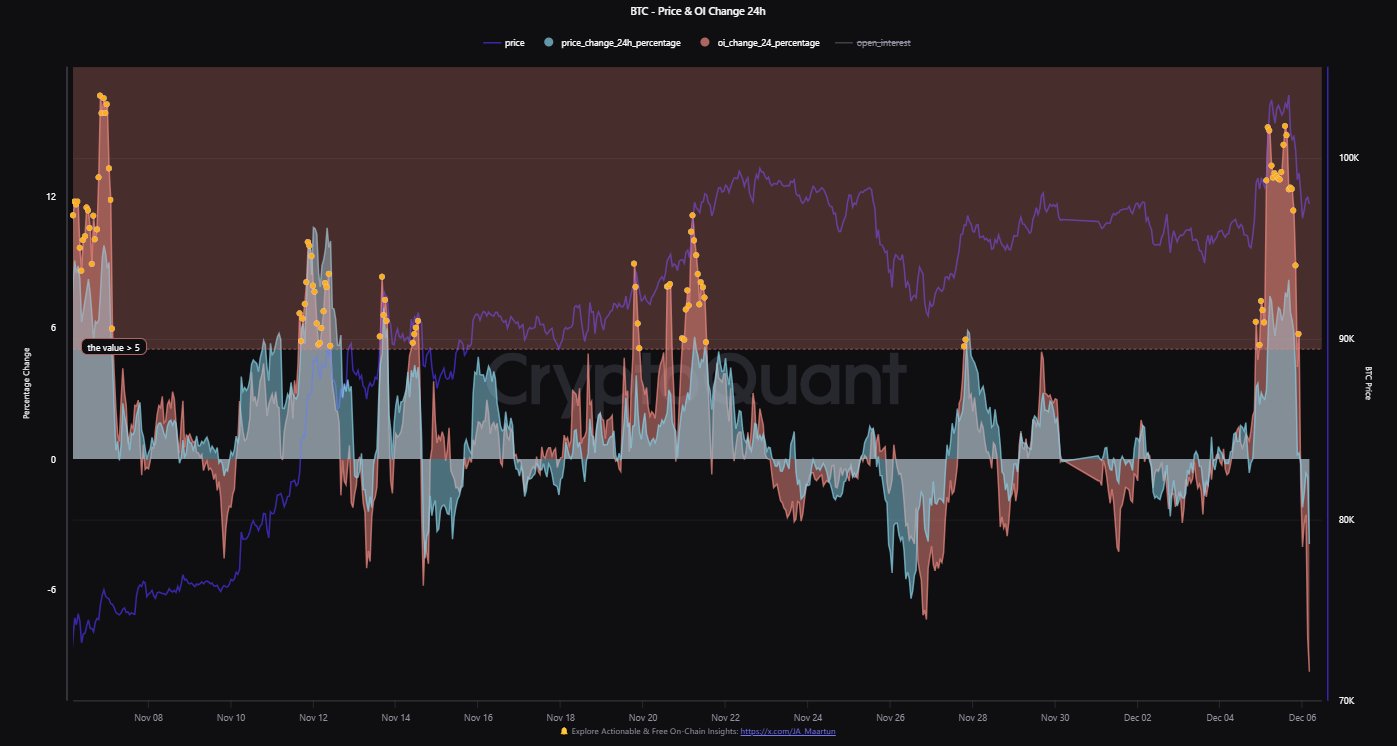

Regardless of optimistic predictions from the options market, Bitcoin might experience dramatic price fluctuations due to speculative traders who use borrowed funds and are driven by greed, as suggested by some analysts. As per JA Martunn’s analysis on CryptoQuant, the recent plunge from $104K to $90.5K was primarily caused by excessive leverage.

In Martunn’s words, “The rapid increase in prices suggested a high level of risk, since it was primarily driven by leveraged positions. The number of open contracts also saw an uptick of over 15%.

Historically, Bitcoin (BTC) has experienced steep corrections and temporary highs following periods driven by excessive leverage. This situation often leads to significant market volatility as leveraged positions are closed, intensifying price fluctuations. A recent example is the flash crash of BTC that resulted in approximately $1 billion worth of liquidations across the broader market.

Regarding this topic, Jake Ostrovskis, a trader specializing in options and Over-the-Counter transactions at the market maker Wintermute, highlighted a potential risk: the Bitcoin market might experience increased volatility moving in both directions.

Ostrovsksis stated to Bloomberg that the flow’s strength is indisputable, as it persists in blocking, but the high usage of leverage suggested by funding rates could make us vulnerable to both upward and downward market swings.

Regardless of the optimistic feelings about Options, there’s still a chance for a $10,000 fluctuation in the market, either up or down, similar to what happened on December 5th.

Previously mentioned, the Bitcoin price had returned to its temporary upward trendline established in mid-November. Yet, it struggled to break through a significant barrier at $98,000. If it manages to surpass this hurdle, it could potentially reach the mid-range and the short-term optimistic target of $105,000.

However, a breach below the channel could still push the cryptocurrency to the recent lows at $90.5K or $85K.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

2024-12-06 16:06