As a researcher with a background in financial markets and experience in analyzing cryptocurrency data, I find the current market dynamics of Bitcoin (BTC) intriguing. Despite the recent downturn, options traders are making strategic bets, as evidenced by the call option bias on Deribit. This suggests that sophisticated investors expect a strong bounceback and an extension to even higher levels.

Amidst Bitcoin‘s (BTC) persistent price decline in the last 24 hours, dropping below $65,000, and a 10% pullback over the past two weeks from its peak at $72,000, data from Deribit reveals that options traders are making calculated bets against the trend.

Based on Deribit’s crypto derivatives data, there is a notable preference for call options in Bitcoin with prices significantly above the current Bitcoin market value. This trend indicates that experienced investors anticipate the current Bitcoin price downturn to lead to a substantial rebound and potential advance to even greater heights.

As a researcher studying financial instruments, I can explain that a call option represents a contract conferring me the privilege, not the requirement, to acquire an underlying asset, like Bitcoin, at a specified price in the future. By opting for a call option, I’m signaling my optimistic outlook on the market.

According to the latest report from QCP Capital in Singapore, there has been a significant increase in investments in Bitcoin options with expiry dates in December and March, specifically for calls worth $90-$100K. This indicates that experienced traders believe a price bottom for Bitcoin is imminent and are preparing for a potential prolonged surge, potentially reaching levels as high as 2025.

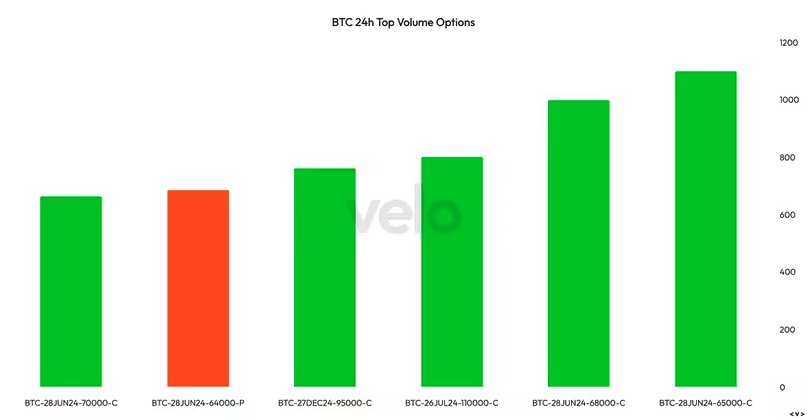

In the past 24 hours, this Bitcoin options chart showcases the busiest trading areas. A significant portion of the action centers around call options set to expire in June at the prices of $65,000, $68,000, and $70,000. Moreover, there is a noticeable level of interest in July calls priced at $110,000 and December calls at $95,000.

Photo: Velo

A Look Into Bitcoin Call-Put Ratio

As an analyst at Amberdata, I’ve noticed an intriguing disparity between Bitcoin’s current market price and the sentiment of options traders. This discrepancy is evident in the call-put skew, which indicates that traders seeking asymmetrical payouts are actively purchasing these options. In simpler terms, they’re willing to pay a premium for both potential upward and downward price movements.

Photo: Amberdata

In various time periods – a month, two months, three months, and half a year – the skew has persistently shown a positive bias, signifying a dominant trend towards call options or probable price increases. However, contrary to this pattern, the weekly skew has shifted negatively, reflecting heightened interest in put options, which suggest hedging against potential losses.

In the past few weeks, Bitcoin has largely gone its own way, diverging from the robust rally of the Nasdaq. This decoupling can be attributed primarily to two factors: the mass selling by long-term investors and Bitcoin miners, as well as substantial withdrawals from Bitcoin spot ETFs in the last week.

On Thursday, June 20, the German government transferred a quantity of 1,700 Bitcoins each to the crypto exchanges Coinbase, Kraken, and Bitstamp, with plans to dispose of them.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-06-21 13:18