As a seasoned researcher who has closely observed the crypto market for over a decade, I must admit that the current Bitcoin surge is nothing short of exhilarating. The past few days have been reminiscent of a rollercoaster ride, with the price spike following Trump’s victory in the US presidential election adding an interesting political twist to the equation.

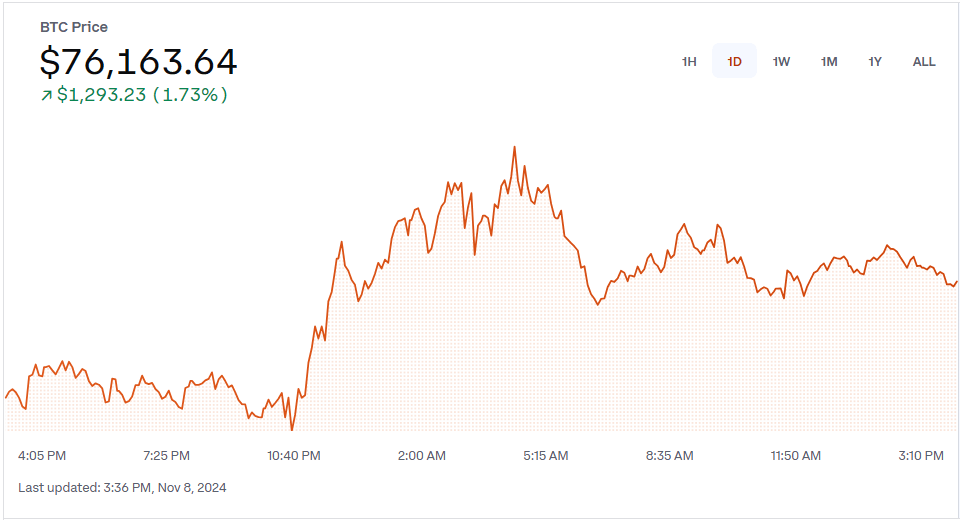

For the first time ever, Bitcoin has soared past $76,000, reaching new record heights. This surge can be linked to Donald Trump’s win in the U.S. presidency, as some investors speculate that this victory may foster a more supportive environment for cryptocurrencies.

The price of Bitcoin soared up to $76,152 on TradingView, marking a 2% rise over the past 24 hours, and a significant 10% climb when viewed within a week’s timeframe.

Election Euphoria Fuels Bitcoin’s Surge

As a researcher exploring the dynamic world of cryptocurrencies, I find myself captivated by the optimistic buzz permeating this market. For years, investors have speculated that a Trump presidency could potentially benefit digital assets. Interestingly, President Trump’s stance on cryptocurrencies has noticeably evolved, and he now appears to embrace the crypto sector wholeheartedly, positioning himself as an advocate for these digital assets.

The outcome of his campaign’s initiative, which includes accepting cryptocurrency payments and advocating for America to become a leading hub for crypto, resulted in an increase in the value of Bitcoin, thereby elevating the stocks of related firms like Coinbase and MicroStrategy.

The growth of Bitcoin is not just speculation; it’s being fueled by institutional investment. Over $50 billion has been poured into Bitcoin ETFs, demonstrating that mainstream financial institutions are embracing cryptocurrencies. Experts predict that Bitcoin could reach $150,000 by 2025 if current trends persist.

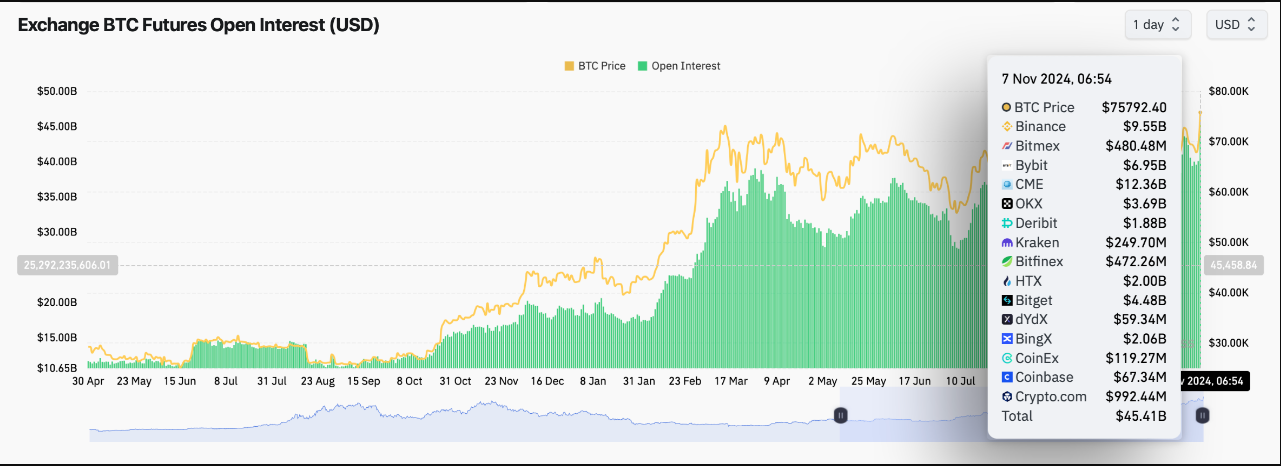

Record Open Interest Signals Confidence

The total quantity of Bitcoin futures and options agreements that are yet to be settled (Open Interest or OI) has risen in lockstep with its value. Over just two days, there was a substantial 13.29% jump in OI, amounting to an impressive $45.41 billion.

The recent spike indicates that traders are not just watching from the sidelines; instead, they’re proactively making moves to anticipate possible price hikes. While there’s always risk involved, an uptick in open interest is often seen as a positive sign reflecting faith in the market’s growth trajectory. Therefore, it’s crucial to examine the market’s behavior by considering multiple aspects.

Enthusiasm for Bitcoin among market players is growing, as more people anticipate an increase in institutional investment as regulatory certainty increases under President Trump’s leadership. The blend of economic trends and political situations could potentially lead to even higher levels of Bitcoin value.

What Are The Future Prospects For Bitcoin?

The turbulence in the crypto market is likely to continue as the outcome of the U.S. election becomes clear. Preliminary indications suggest that Trump’s actions might boost the popularity and backing of cryptocurrencies. With such changes in perspective, a lot of investors are pondering how high Bitcoin could potentially rise.

Historically, Bitcoin has shown strength during election cycles, often hitting record highs after elections. Given the continued optimism among institutional investors and surging retail interest, it’s not a question of whether Bitcoin will increase – but rather at what pace it will grow in this new political climate.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- Simone Ashley Walks F1 Red Carpet Despite Role Being Cut

- How to Update PUBG Mobile on Android, iOS and PC

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

2024-11-08 20:10