As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed the rise and fall of various asset classes, from tech stocks during the dot-com bubble to precious metals like gold. However, the trajectory of Bitcoin (BTC) has been nothing short of extraordinary.

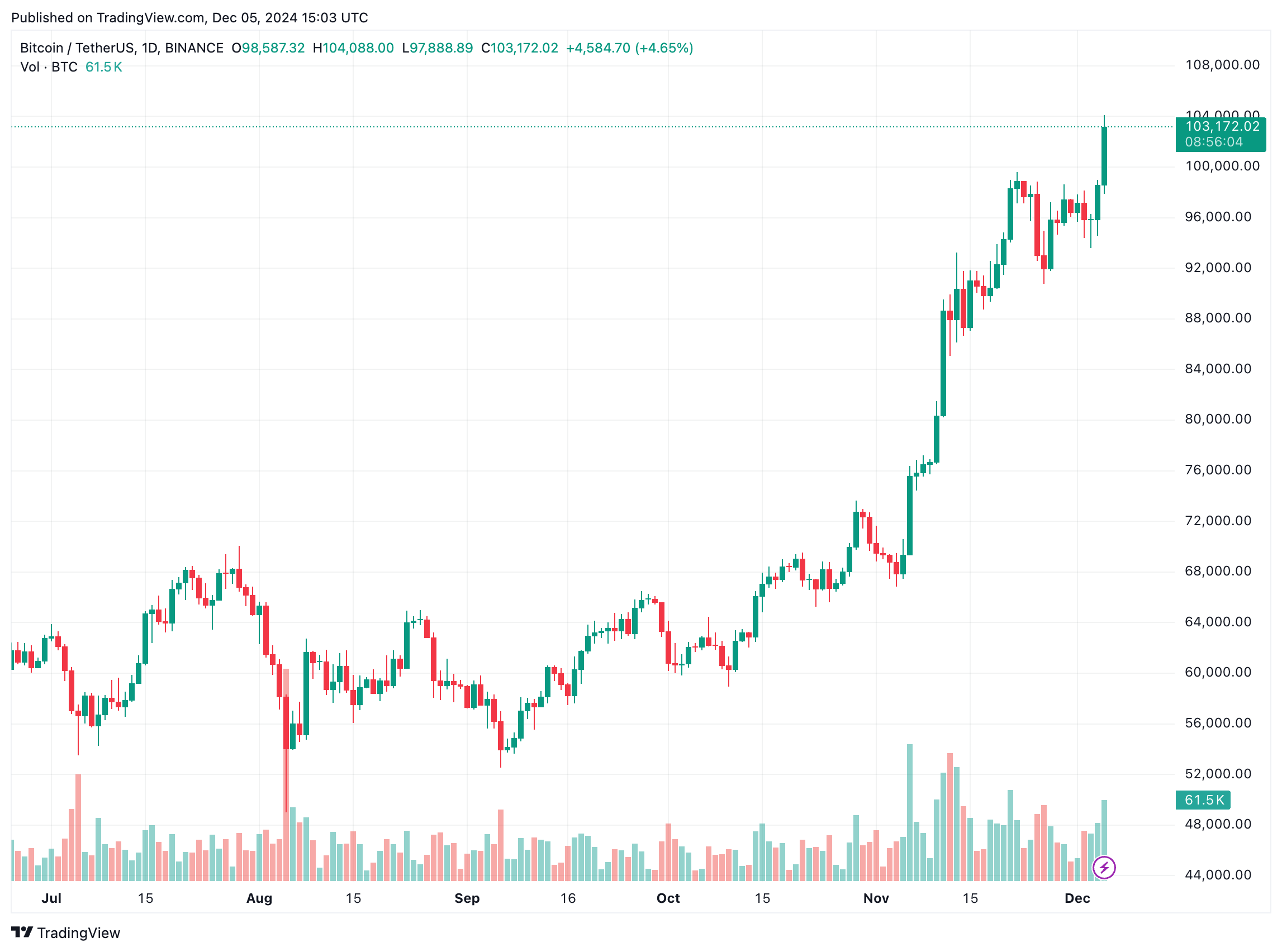

Yesterday, Bitcoin (BTC) surpassed the $100,000 mark, peaking at $104,088 on the Binance cryptocurrency exchange. This groundbreaking price movement has led analysts from Bernstein’s trading firm to predict that within the next ten years, Bitcoin could potentially supplant gold as a leading asset.

Bitcoin Poised To Outshine Gold Over Next Decade, Bernstein Says

According to a recent client update from Bernstein, analyst Gautam Chhugani and his team believe that Bitcoin could eventually take on the role of a dependable safe-harbor investment like gold. In simpler terms, they are optimistic about Bitcoin’s potential to serve as a secure haven asset in the future.

It is anticipated that Bitcoin will evolve into a leading “value storage” asset in the future, surpassing gold’s status within the next ten years. It is likely to become an integral component of institutional investment portfolios, as well as a benchmark for corporate cash reserves management.

In the current year so far, Bitcoin has experienced a significant increase of 141%. A large portion of this growth occurred after the electoral win of candidate Donald Trump, who is supportive of cryptocurrencies, in the November U.S. presidential election.

The value of cryptocurrencies has significantly grown since Trump’s election win, as optimism arises due to expectations of a beneficial regulatory climate for digital assets. In just a span of days from November 4th, the overall crypto market capitalization has risen from $2.4 trillion to an impressive $3.9 trillion at this moment – representing a massive 62.5% jump.

In the memo, Bernstein suggests that Bitcoin could reach $200,000 by the end of 2025. This forecast is consistent with Charles Edwards’ prediction, founder of Capriole Investments, who believes that Bitcoin might double in value quickly due to its smaller market size allowing for more swift price fluctuations.

BTC Adoption Major Driver Behind Its Success

Bernstein’s bullish outlook was reinforced by Gil Luria, a D.A. Davidson analyst, who identified mainstream adoption as the key driver behind Bitcoin’s success. However, he cautioned that Bitcoin still has a “long path ahead” before it is widely accepted as a medium of exchange and unit of account. Luria added:

Bitcoin’s primary role at present is serving as a form of value storage – an asset that grows in value and has a minimal correlation with other financial markets, effectively taking the place of gold as a protective measure during periods of economic instability.

Although Bitcoin hasn’t become commonly used as a regular currency, it’s made a strong impact as a dependable investment category for corporate portfolios. Notably, Hut 8, one of the major players in cryptocurrency mining, has disclosed intentions to create a strategic Bitcoin savings account.

In November, the video-hosting service Rumble announced their intentions to increase their Bitcoin holdings. Meanwhile, a decrease in Bitcoin reserves on cryptocurrency exchanges might be contributing to the asset’s scarcity, which could be driving its price higher. Currently, Bitcoin is trading at approximately $103,172, marking an increase of 7.9% over the past day.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-06 11:10