As an experienced financial analyst, I’ve witnessed numerous market cycles and trends throughout my career. The recent sluggish price action and historically low on-chain activity in Bitcoin is a trend that has caught my attention.

Since reaching a new peak price in mid-March, Bitcoin‘s cost has remained relatively stable within a narrow band. This price stagnation has left many investors uneasy, particularly after Bitcoin failed to hold its position above the $60,000 mark.

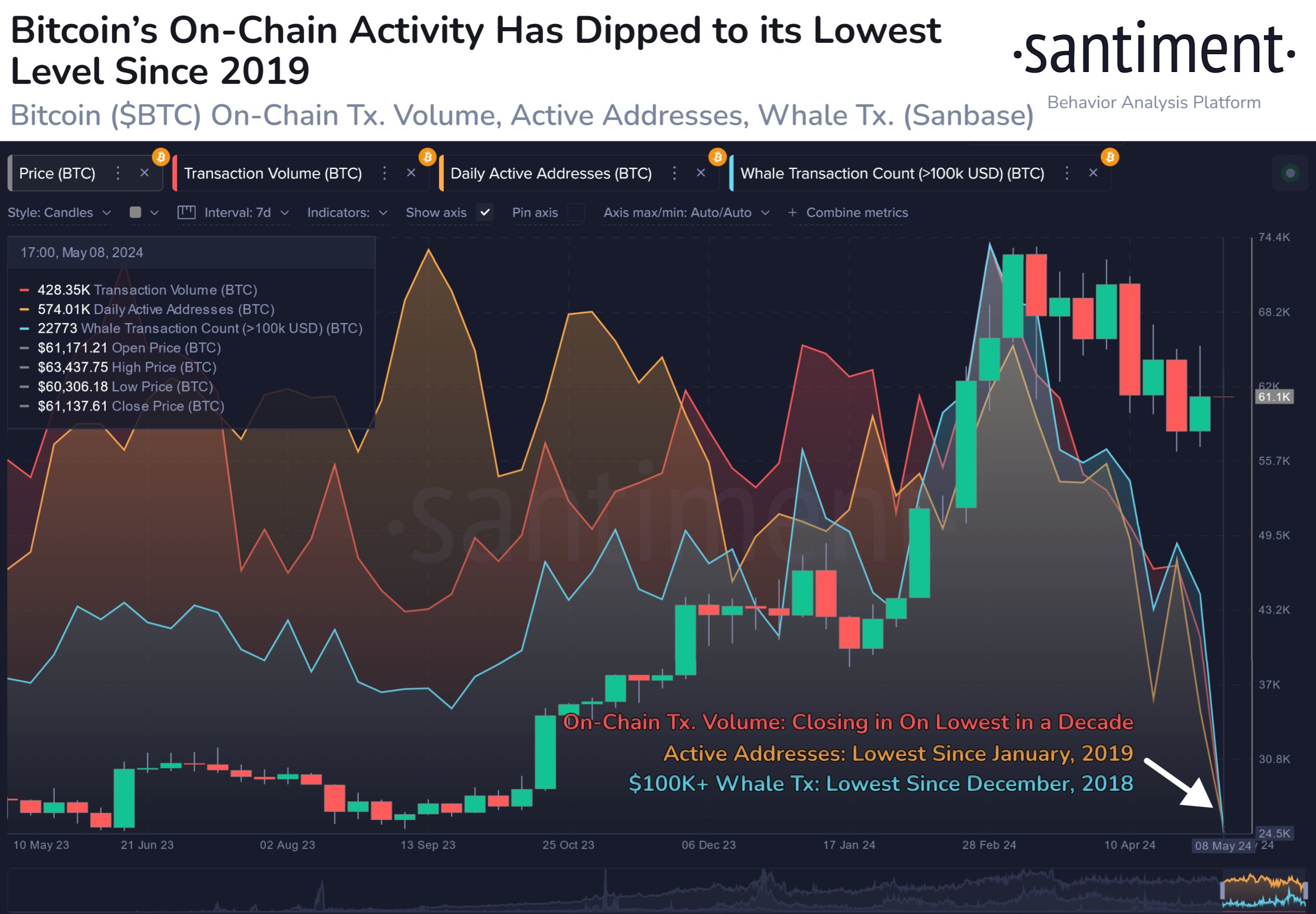

As a data analyst, I’ve observed an intriguing development in the Bitcoin market: price isn’t the only metric experiencing a downturn since the beginning of the year. The insights from data analytics firm Santiment reveal that on-chain activity on the Bitcoin network has also decelerated over the past few months.

How Historically Low On-Chain Activity Affects BTC Price

As a researcher studying the cryptocurrency market, I’ve recently noticed an intriguing update from Santiment on the X platform. They reported that Bitcoin’s on-chain activity is nearing historic lows, as evidenced by the declining trends in several key metrics. Specifically, transaction volume, daily active addresses, and whale transactions have all been decreasing notably.

Based on data from a blockchain analysis firm, there has been a decrease in Bitcoin transactions among investors following its recent record-breaking price peak. Consequently, the cryptocurrency’s on-chain activity has reached its minimum level since the end of 2019.

Analyzing the data, Santiment determined that the number of transactions on the first blockchain has dropped to its lowest point over the last ten years. They explain that transaction volume represents the sum of all coins exchanged for a specific asset during a designated period.

Additionally, according to Santiment’s report, the count of unique Bitcoin addresses involved in daily transactions has touched a new low not seen since early 2019.

According to the blockchain intelligence platform’s analysis, the frequency of large-scale Bitcoin transactions by whales has decreased significantly. The data from Santiment indicates that the number of such transactions, which exceed $100,000, has reached its lowest point since late 2018.

As a crypto investor, I’ve noticed the decrease in on-chain activity and can’t help but feel concerned about the potential implications for the market’s stability. However, after delving deeper into the data using Santiment’s insights, I’ve come to understand that this dip isn’t always indicative of an impending Bitcoin price drop. In fact, I’ve seen instances where similar patterns have played out in recent weeks without significant price declines.

As a researcher studying the Bitcoin market, I’ve noticed that recent data from the analytics company suggests a decrease in on-chain activity. This reduction in activity could be a reflection of traders’ fear and uncertainty, collectively known as “crowd sentiment.” Ultimately, this finding underscores the significance of monitoring on-chain activity to gain insights into market sentiment.

Bitcoin Price At A Glance

Based on information from CoinGecko, the current price of Bitcoin is approximately $60,770, representing a minimal decrease of 0.2% over the past day.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Gold Rate Forecast

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

2024-05-12 13:16