As an analyst with over two decades of experience in the financial markets, I find Charles Edwards’ latest analysis compelling. His comparison of Bitcoin’s current market behavior to Gold’s 2008 rally is not only insightful but also plausible given the historical parallels he has drawn.

In a recent issue of the Capriole Investments newsletter published on August 20, 2024, Charles Edwards, our founder and CEO, points out some intriguing similarities between the present-day market trends of Bitcoin and the past surge of Gold during its 2008 rally.

Bitcoin Mirrors 2008 Gold Rush

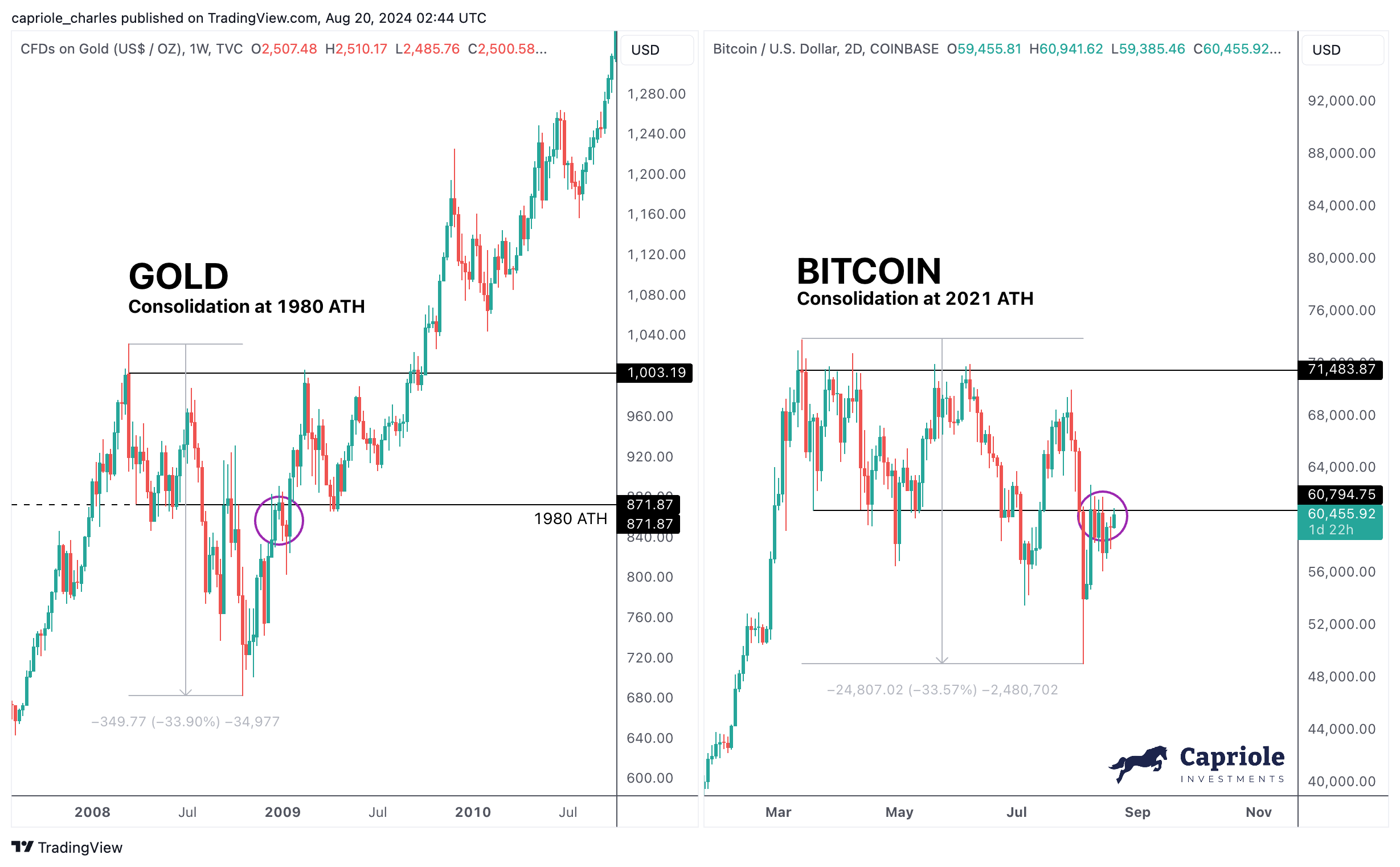

Edwards observes that Bitcoin has been holding steady near $60K, similar to how Gold behaved prior to its major surge. He remarks that this is Bitcoin’s longest period of consolidation at an all-time high (ATH), indicating potential pressure. This prolonged phase might be a sign of a forthcoming significant breakout, he suggests, drawing a parallel with the Gold market in the late 2000s. During this time, Gold consolidated for nine months around its 1980 ATH before embarking on a notable two-year rally in 2008.

As a crypto investor, I can’t help but draw parallels to the gold market, particularly after noticing the striking similarities following significant events. Just like gold experienced a substantial consolidation period post-ETF launch that was followed by a rally where its value skyrocketed by 180% within approximately two years, Bitcoin is mirroring this pattern in response to its own ETF launches and periods of consolidation. This could suggest potential for significant growth ahead.

According to Edwards, during Gold’s consolidation period in 2008, it experienced a significant drop of about 33%. This event is often viewed by investors as a generational low point. Interestingly, Bitcoin’s recent drop to $48,000, which represents a similar 33% decline, seems to echo this historical pattern in Gold’s price behavior. Edwards points out that Bitcoin saw a 28% decrease in July 2021 and another dip in August 2021 that was almost identical to Gold’s final plunge, falling just half a percent short of matching it. This suggests a striking correlation between the two assets’ historical price movements.

According to Edwards’ analysis, Bitcoin’s price trajectory might mirror that of gold, potentially reaching $140K without any significant drops by May 2025. While he admits that one data point doesn’t guarantee a repeat of gold’s history for Bitcoin, he considers it the most analogous asset at this stage in its history, offering a potential roadmap for future price movements.

Although the historical and technical analysis seems positive, Edwards maintains a cautious optimism. He is aware of inconsistencies in the fundamental data indicators and advises adopting a more conservative approach until we see additional bullish signs for confirmation.

“Edwards points out that we’re yet to complete the monthly closing, and it might be prudent to hold off on making bold moves until we see more positive signs (and possibly Q4) to better understand and navigate through what is often the most challenging quarter for Bitcoin and other risky assets.”

If Bitcoin manages to break through its monthly support level, Edwards anticipates a highly favorable technical configuration. In his view, the current market stabilization phase is likely nearing an end as we transition from summer, and he remains confident that the next twelve months will offer the most promising investment opportunity in Bitcoin over the past three years.

At press time, BTC traded at $60,712.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- How to Update PUBG Mobile on Android, iOS and PC

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-08-20 23:11