As a seasoned analyst with over two decades of experience in financial markets, I have witnessed numerous bull and bear cycles that have shaped my understanding of market dynamics. The recent fall of the Bitcoin Network Value to Transactions (NVT) Golden Cross into a crucial region has piqued my interest.

Based on recent blockchain statistics, the Bitcoin Network Value to Transactions (NVT) ratio has entered a significant area. This development might hint at possible implications for the value of the leading digital currency.

What Does The Falling NVT Golden Cross Mean For Price?

A cryptocurrency expert going by the name Burakkesmeci, in a recent post on CryptoQuant, suggested that the price of Bitcoin could potentially hit a “temporary low point.” This optimistic prediction stems from the latest signals given by the “NVT Golden Cross” indicator.

In simpler terms, the “Network Value to Transactions” (NVT) ratio is a tool used on the Bitcoin blockchain to compare the market value of Bitcoin with its transaction activity. When the NVT value is high, it means that the Bitcoin’s price is relatively high compared to the volume of transactions on the network, which could indicate that Bitcoin is overpriced in that context.

In other words, when the NVT (Network Value to Transactions) metric is relatively low, it’s suggesting that the coin’s market value is smaller compared to the transaction volume it processes. Typically, this situation might mean that the asset is undervalued and its price may potentially increase further due to upward momentum.

Presently, the Golden Cross indicator represents an enhanced version of the NVT ratio. It assists in identifying slow yet distinct buy and sell regions within short-term trends as per Burakkesmeci’s explanation. When the NVT GC surpasses 2.2 (referred to as the “red zone”), it suggests that the price during a short-term trend may be overextended, potentially leading to the creation of a local peak.

Conversely, when the NVT Golden Cross falls beneath -1.6, it might indicate that the downward price trend is nearing exhaustion, hinting at a possible turning point or potential floor in the market. As Burakkesmeci pointed out, these peaks and troughs are more like zones than specific thresholds.

Looking at the graph, it’s clear that the NVT Golden Cross has dipped below 1.6 and is now around -3.3. This indicates that the Bitcoin price may have reached a temporary low point. As per a CryptoQuant analyst’s view, this situation could present a gradual buying opportunity for investors eager to enter the market.

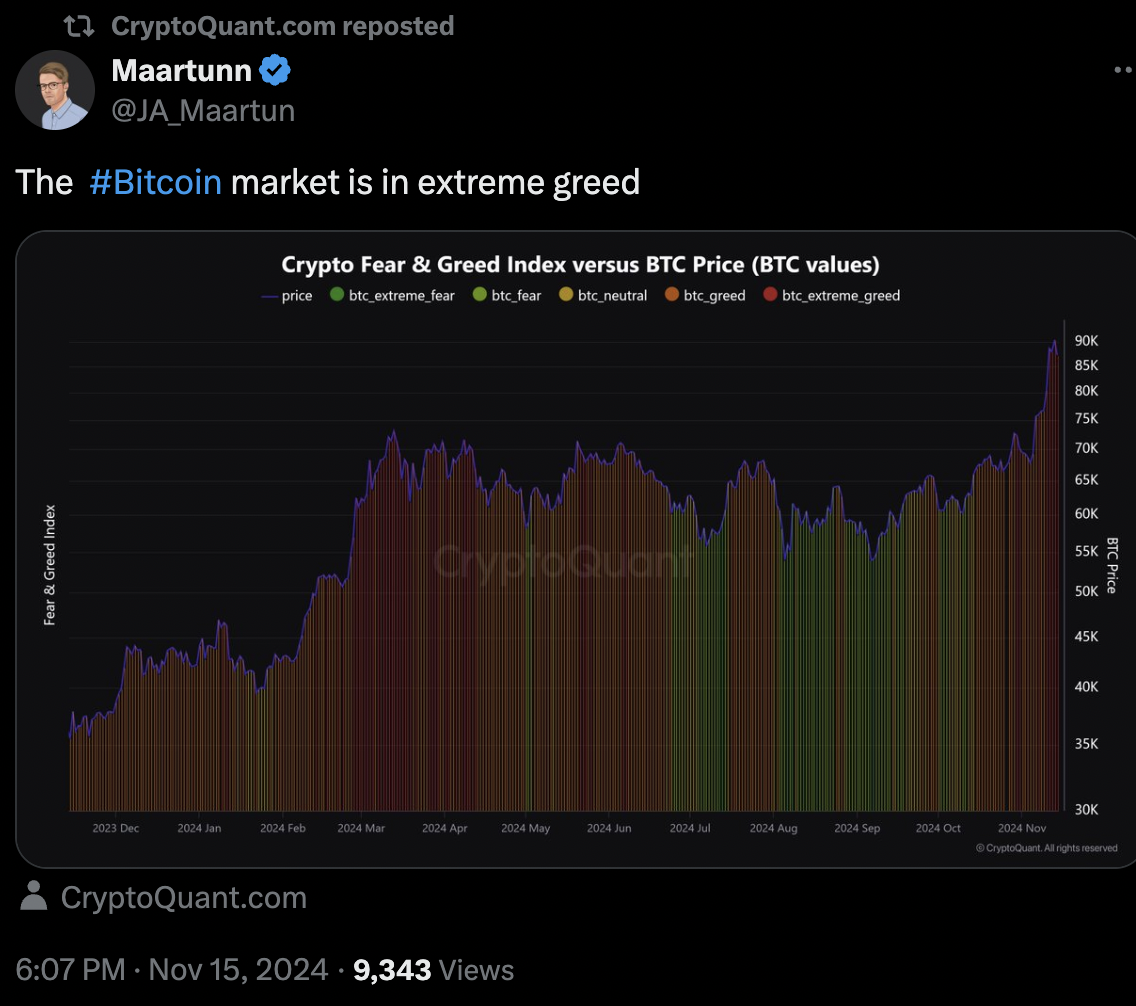

Bitcoin Market In Extreme Greed

Users may be advised to tread carefully since the Bitcoin market appears to be reaching a boiling point in the long run. As per a CryptoQuant expert, the Fear & Greed Index indicates extreme enthusiasm for Bitcoin.

Generally speaking, if the Fear & Greed Index leans significantly towards one extreme (like extreme greed), it might signal an upcoming change in market direction based on investor sentiments. In the current scenario, where the market is showing excessive optimism, there’s a possibility that Bitcoin’s price could experience a correction soon.

Currently, Bitcoin’s value hovers slightly below $91,000, marking a 3% rise over the past day. As per CoinGecko’s latest figures, it has soared an impressive 19% in the previous week, solidifying its position as the market leader.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-11-16 19:13