According to the data provided by Glassnode, Bitcoin needs to increase to a certain level for it to reach its previous high price range, as per their pricing model.

Bitcoin Hasn’t Surpassed Last MVRV Pricing Band Yet

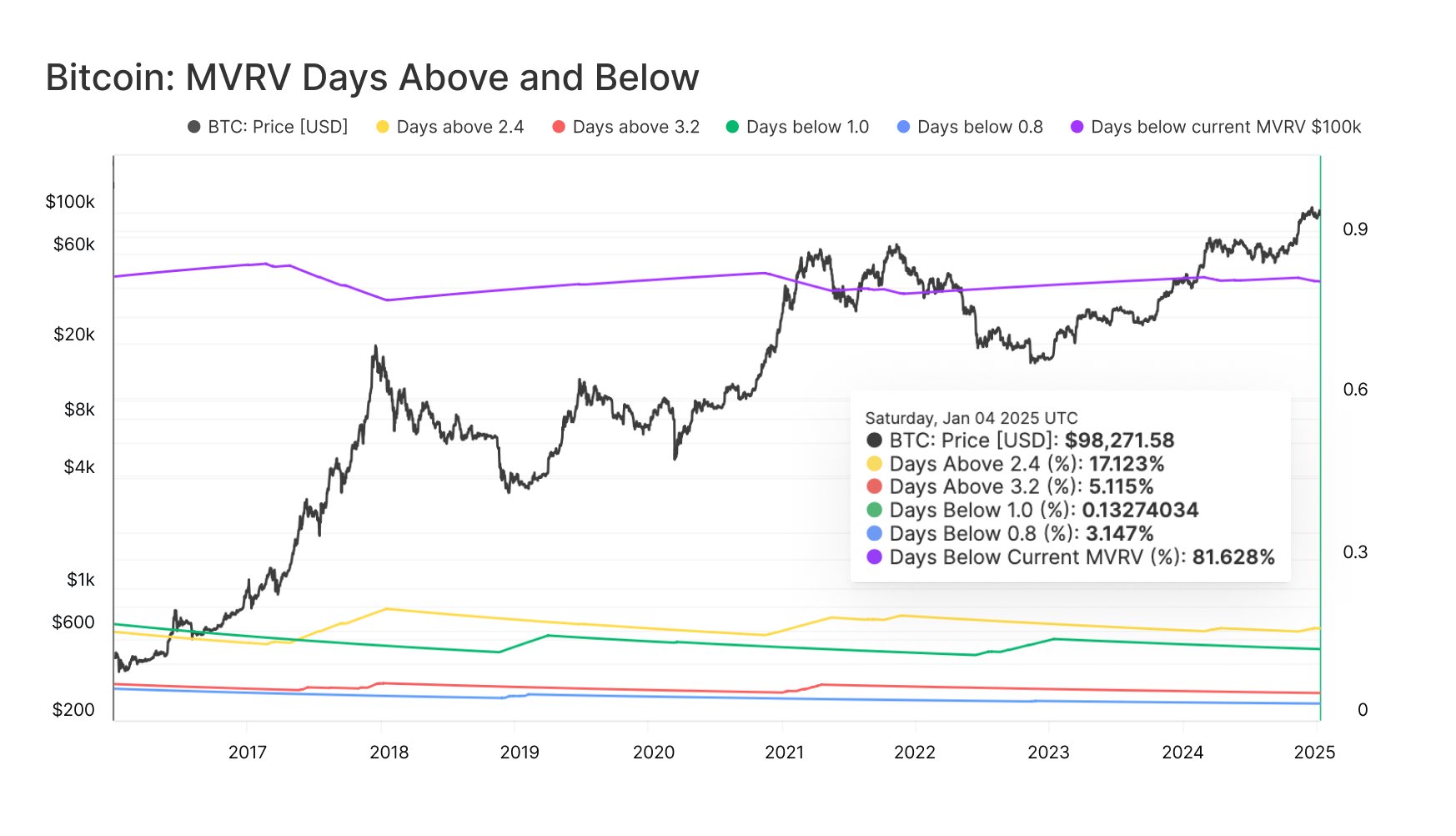

In their latest update on platform X, Glassnode discusses the high level of excitement in the Bitcoin market as indicated by the extreme threshold of the Market Value to Realized Value (MVRV) pricing bands. The MVRV Pricing Bands is a unique model used for cryptocurrencies, which is derived from the MVRV Ratio.

The “MVRV Ratio” is a commonly used on-chain measurement that examines the relationship between the current market value of Bitcoin held by investors (which we call the market cap) and the initial value they invested (the realized cap). If this ratio exceeds 1, it means that investors have gained more value than their original investment, signifying they are in a profitable position. Conversely, when the ratio is below 1, it implies that collectively, the market’s worth is less than what was initially invested, suggesting the overall market may be experiencing losses.

Historically, when holders are making excessive profits from Bitcoin, it usually indicates overheated market conditions because it becomes likely that mass selling for profit will occur. On the other hand, prolonged periods of loss have tended to signal market bottoms, as there aren’t many sellers left during these times due to a lack of incentive.

The MVRV Pricing Bands are designed to reflect the correlation between them. They establish specific price points for the cryptocurrency that align with significant values within the MVRV Ratio.

Below is a diagram demonstrating the evolution of Bitcoin’s price range, as presented by Glassnode, over the past few years:

(or)

This diagram illustrates how Bitcoin’s pricing bands have changed over the course of several years, according to Glassnode’s analysis:

(or)

Check out this graph showing the development of Bitcoin’s price ranges over the last few years, as per Glassnode’s research:

(or)

The following chart displays the trend in Bitcoin’s pricing bands over the past several years, based on data from Glassnode:

Looking at the graph, it’s clear that the 0.8 pricing band, where the MVRV Ratio matches 0.8, often coincides with bear market bottoms for the asset. However, currently, Bitcoin is significantly higher than this level, sitting at around $33,100. The price of the coin is also far from the $41,300 mark, which represents the average cost basis for addresses or investors on the network, corresponding to the 1.0 level.

At the moment, Bitcoin is being traded within two price ranges: $99,300 (2.4 level) and $132,400 (3.2 level). Historically, the $99,300 band has indicated an intensifying bull market.

For a period, Bitcoin could remain within this range, but if its market capitalization exceeds $3.2 trillion, there’s a strong possibility that a market peak might be reached fairly quickly.

The chart below illustrates just how rare it is for the asset to trade in the region above 3.2:

According to the analysis by the firm, only about 5% of BTC trading days have seen the price rise above the 3.2 MVRV level in the past. This underscores the scarcity of such peaks and supports the notion that this region is frequently considered a sign of “extreme optimism” or euphoria.

To date, Bitcoin hasn’t managed to exceed a particular threshold during the ongoing market cycle. Historically, if we look at past bull markets, the peak usually occurs above this point, suggesting there could still be potential for growth in the current cycle. However, it’s uncertain whether this pattern will hold true this time around.

BTC Price

Currently, Bitcoin is being exchanged for approximately $93,400, representing a decrease of over 3% in its value over the past week.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2025-01-10 03:40