As a seasoned analyst with years of experience navigating the volatile and fascinating world of cryptocurrencies, I find myself cautiously optimistic about Bitcoin’s current price action. The bullish sentiment is palpable, but as history has shown us, it pays to be prudent in this space.

Bitcoin traders are optimistic, predicting prices to recover from recent downturns and potentially surge beyond current resistance levels, reaching as high as $73,800. However, it’s crucial for buyers to demonstrate strong conviction before Bitcoin breaks through these critical resistance zones. Furthermore, a significant increase in new investments is required to maintain this upward trend, preferably from investors who are worried about missing out on the opportunity.

At the moment, Bitcoin is holding steady within the boundaries of its recent bearish trend, which has been established since last week. Interestingly, this trend is contained within a significantly volatile candlestick from early September. Despite the current prices being higher and receiving support around $56,500 and $57,000, some traders remain skeptical.

Bitcoin Needs To Break $70,000 For The Uptrend To Continue

It’s important to exercise caution due to several factors. As per IntoTheBlock’s analysis, the bullish trend predicted for Q1 2024 could hold if there’s sufficient support. Their data shows that around seven million wallets purchased Bitcoin when its price ranged from $61,700 to $70,500, which might play a crucial role in upholding the bullish trend.

At spot rates, the analytics platform indicates that these addresses are experiencing a loss. Consequently, when prices get close to their breakeven point, they tend to sell more often.

According to analysis by IntoTheBlock, the consistent selling pressure and a desire for safety among investors are hindering Bitcoin from reaching new record highs. For Bitcoin to surge, the bullish sentiment must persist and push prices above the $60,000 mark.

Furthermore, it’s essential for them to make a clear and significant break through the $70,000 mark, aiming for increased trading activity. Preferably, the level of involvement should surpass the trade volume recorded on August 5. Later, prices dropped significantly, reaching as low as $49,000 in early August.

Over 30% Of All Supply In The Hands Of HODLers, Paper BTC Declining

Although it’s possible that approximately seven million Bitcoin addresses may choose to sell their holdings, a substantial portion of Bitcoin’s supply is controlled by long-term investors (LTHs). These LTHs are defined as addresses that have held onto their Bitcoins for at least 155 days. Data from IntoTheBlock indicates that more than one-third of the total Bitcoin supply has remained stationary for over five years.

Meanwhile, another bullish factor that can support prices in the coming days is how the market has been absorbing supply from German authorities, the United States Department of Justice (DoJ), and Mt. Gox.

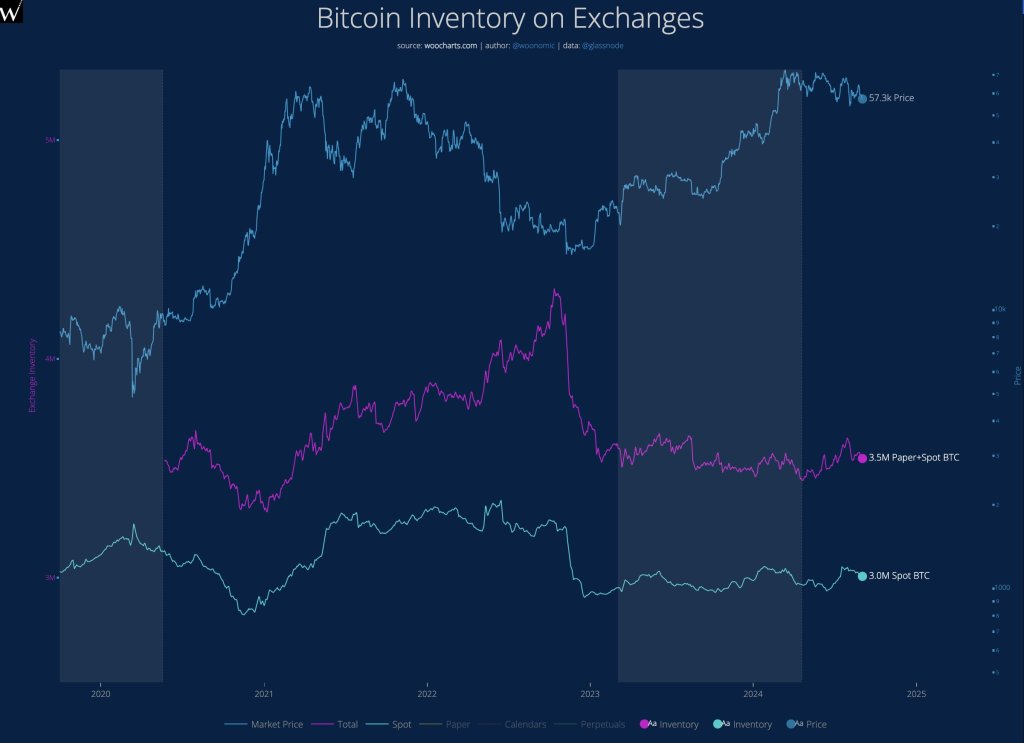

One blockchain expert observes that the rate at which Bitcoin is being absorbed is noteworthy. This trend, combined with a decrease in Bitcoin held on derivatives exchanges such as Binance, might help sustain the price.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-09-03 08:11