As a seasoned researcher with over a decade of experience in financial markets and cryptocurrencies, I find myself constantly intrigued by the dynamic nature of Bitcoin’s price action. The recent surge has been nothing short of spectacular, pushing the market leader to new all-time highs. However, as Amr Taha’s analysis suggests, we should not overlook the potential for profit-taking and subsequent corrections.

In the recent week, Bitcoin displayed an impressive surge in value, increasing by approximately 19.16%. As per CoinMarketCap’s data, this digital currency reached a new peak of $93,434 on Wednesday. Now, speculations that it might reach a seven-figure market price before the year ends have grown stronger compared to earlier predictions.

In the midst of the ongoing market excitement, crypto expert Amr Taha from CryptoQuant has provided some intriguing market predictions suggesting a potential drop in prices could be on the horizon.

Bitcoin Enters Profit-Taking Zone – Sell Or HODL?

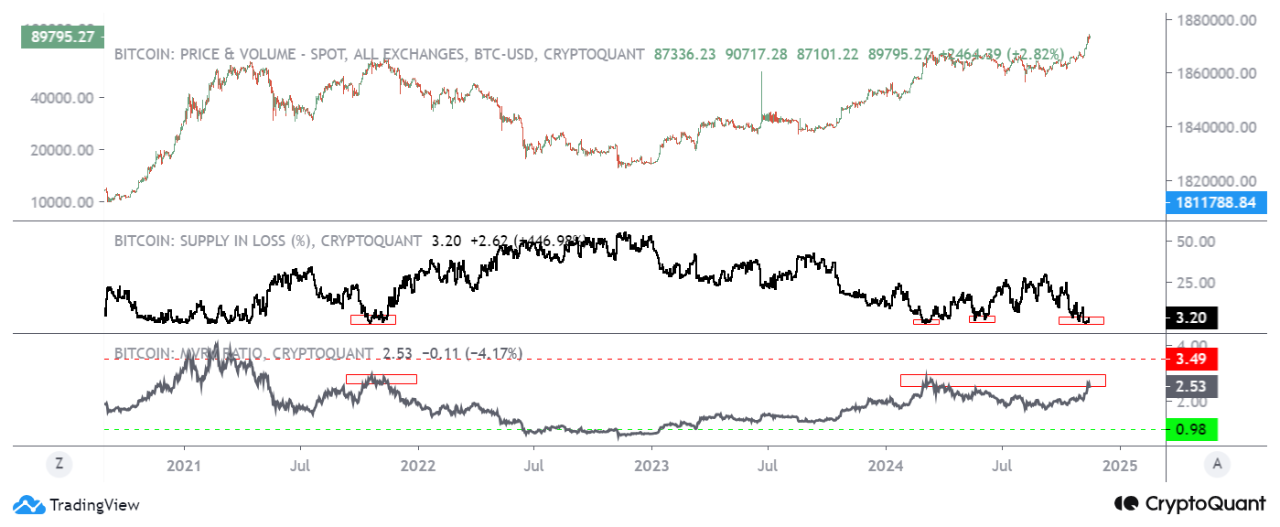

On Friday, Amr Taha mentioned in a Quicktake post that some investors might be considering selling off their Bitcoin, as the MVRV ratio hit 2.64. The Market Value to Realized Value (MVRV) is often used by traders as an analytical tool to assess whether an asset is overpriced or underpriced, or to spot market peaks and troughs.

As an analyst, I’ve found that when the Bitcoin MVRV ratio surpasses 2, it suggests investors are currently sitting on substantial unrealized profits. However, looking back at data from the last quarter of 2021 and the beginning of 2022, profit-taking tends to happen more consistently as the MVRV ratio reaches a range of 2.5 to 3.5, often coinciding with sizable corrections in the market.

Over the last several weeks, a Multiplier of Values (MVRV) ratio of 2.64 suggests significant opportunity for a significant price decrease in Bitcoin, even though there have been only minor price declines recently. This view is supported by the fact that the asset’s Relative Strength Index (RSI) remains within the overbought range.

Ama Taha goes on to point out that Bitcoin could continue its upward trend, given it’s currently at 2.64 on the MVRV ratio. If bullish market conditions remain, this means the cryptocurrency might not have reached its major market top yet. The analyst suggests keeping an eye on the MVRV ratio since a rise towards 3 could hint at further price increases. On the other hand, if the ratio drops to between 1.5 and 2, it may suggest that a local market top is being formed.

Short-Term Holders Realized Cap Hits $30 Billion

Beyond the high MVRV ratio of Bitcoin, Taha additionally pointed out that short-term holders have accumulated a market cap of more than $30 billion, a figure last seen in March 2024. This CryptoQuant analyst indicated that Bitcoin has tended to experience significant price corrections when the realized market cap held by short-term investors reached comparable levels, serving as another cautionary sign for investors about the possibility of an upcoming price drop.

As I’m typing this, Bitcoin is being exchanged for approximately $91,738 each, marking a 3.97% increase over the past day. Yet, the trading volume of this asset has decreased by 7.42%, currently standing at $80.73 billion.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-11-17 06:04