As a researcher with extensive experience in the cryptocurrency industry, I’m closely monitoring the recent developments in Bitcoin mining difficulty. The 7.8% drop in mining difficulty, which has returned it to pre-halving levels, comes as welcome news for miners who have been struggling since the halving event.

Based on the latest data from Coinwarz, I, as an analyst, observe that Bitcoin‘s mining difficulty has experienced a substantial decrease. This reduction in the computational power required to validate transactions could potentially lead to a profitable period for miners, particularly smaller ones who have been struggling post-halving event.

Bitcoin Mining Difficulty Falls to Pre-Halving Levels

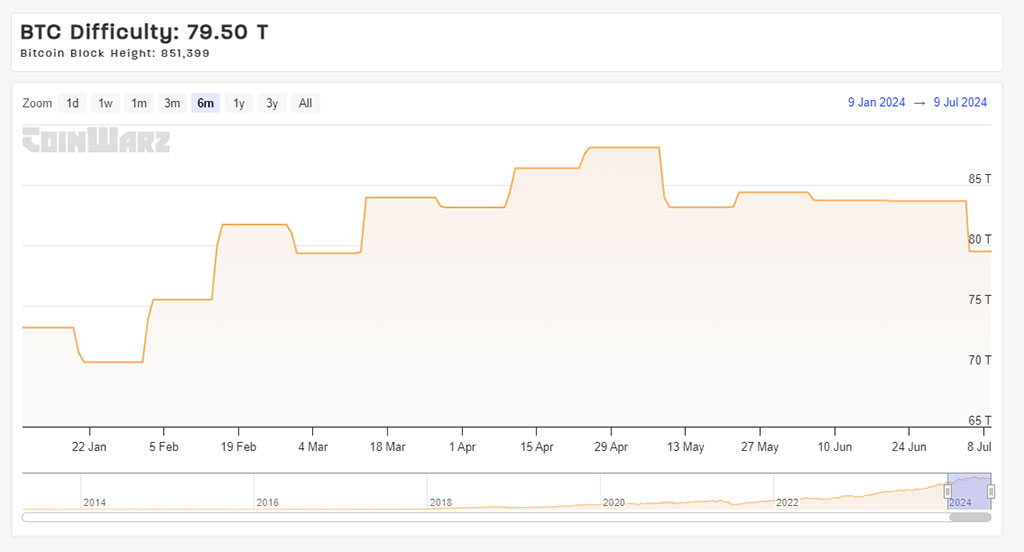

As a crypto investor, I’ve noticed an interesting development in the Bitcoin mining scene. On June 5th, the mining difficulty for Bitcoin took a significant dive of approximately 7.8%. This drop brought the difficulty level down from 83.6 terahashes per second (TH/s) to 79.50 TH/s. This change effectively returned us to pre-halving levels, giving miners renewed optimism.

Photo: Coinwarz

As a crypto investor, I’ve noticed that the recent price decline is among the most pronounced since the FTX collapse in December 2022. This unfortunate event set off a chain reaction that caused Bitcoin prices to plummet by approximately 10% within a single week. Analysts at CryptoQuant, a trusted data provider in the crypto space, have identified striking similarities between the two situations.

“According to Julio Moreno, head of research at CryptoQuant, the computational power of the cryptocurrency network has seen a 7.8% decrease in hashrate – a drop akin to that following the FTX collapse in late December 2022. Consequently, miner earnings have taken a hit with daily revenues plummeting from $78 million prior to the halving event to $26 million at present.”

I’ve noticed that the mining difficulty has decreased recently, according to expert analysis by Moreno. This reduction is believed to have originated from a drop in hashrate starting in early May. Miners appear to be closing shop due to shrinking profit margins, which could be the cause.

Mining Difficulty Decline Brings Relief

Lowering the mining difficulty results in a decrease in the total computational power of the network. This adjustment could benefit smaller miners, allowing them to face less competition and possibly regain profitability. Previously, high mining difficulties forced some miners to halt their operations due to operational costs surpassing reward earnings.

Although reducing the level of difficulty may offer a brief respite, it’s crucial to remember that miners have been a major selling force for Bitcoin in June. Over a two-week period, they disposed of more than a billion dollars’ worth of BTC as its price oscillated between $65,000 and $70,000.

The relentless pressure from sales, along with other influential factors such as the Mount Gox controversy and the German government disposing of its Bitcoins, significantly contributed to the market’s downturn, resulting in a record-low price of $53,500 last week.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-07-09 15:40