As an analyst with over two decades of experience in the tech and finance industries, I’ve seen my fair share of booms and busts. The Bitcoin mining landscape presents a unique challenge, one that requires not only technical acumen but also financial foresight.

Participating in Bitcoin mining today has become a demanding and costly endeavor that requires more than just financial investment. It’s not just about spending money but also about possessing advanced technical knowledge. Aspiring miners need to acquire specialized hardware, reliable internet access, a consistent energy source, and a good deal of expertise to handle the mining process effectively, as the industry continues to expand rapidly.

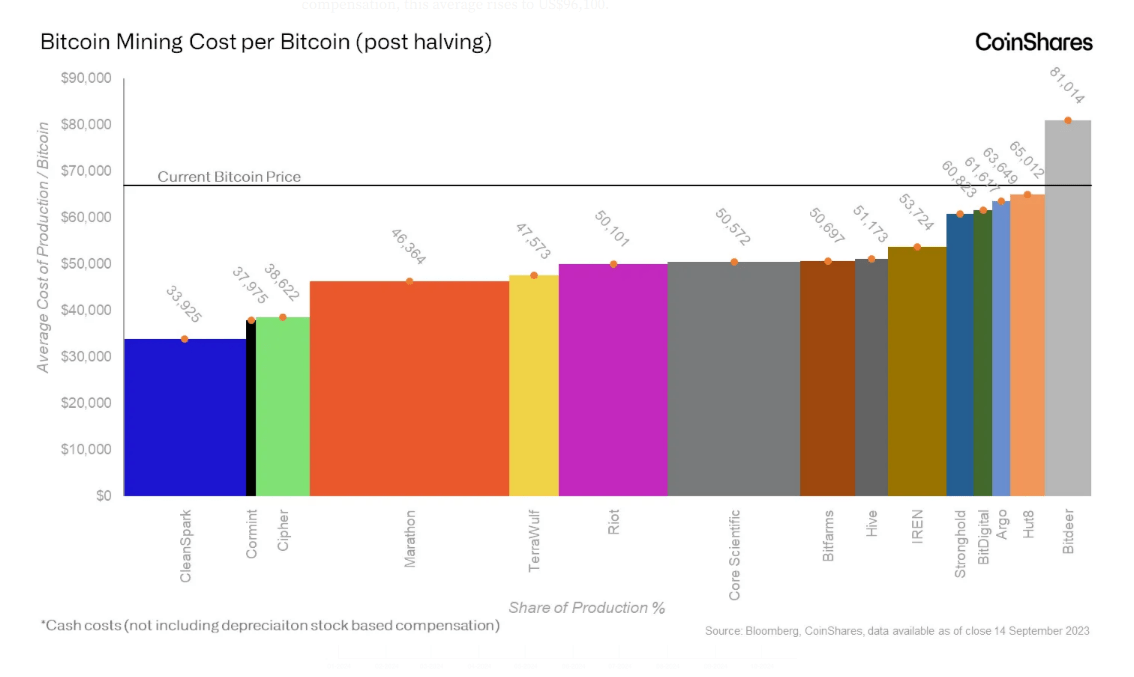

In many cases, miners resort to obtaining loans or credit lines to finance their mining activities. It’s important to note that currently, mining expenses are on the rise, according to certain specialists, and they reached an impressive level of approximately $49,500 during the second quarter.

According to CoinShares’ report, the cost of mining during the second quarter was approximately $2,300 higher than in the first quarter when average mining costs were around $47,200. The investment firm added that miners typically spend an additional $85,900 on cash expenses and have predicted costs totaling $96,100.

As a researcher, I’ve observed that many Bitcoin miners are expressing concerns about not being able to acquire a credit line, a problem that seems to be increasingly prevalent in the mining community. Furthermore, they express that elevated interest rates exacerbate their current predicament.

BTC Miners Fail To Capitalize On Recent Price Rallies

Bitcoin mining is closely tied to the digital currency’s high price fluctuations. In fact, numerous miners missed out on profiting from the Bitcoin ETF rumors that were prevalent in late 2023. (Paraphrased)

By January 2024, the Securities Exchange Commission (SEC) granted approval for at least 11 ETF applications, causing Bitcoin’s value to surge past $70k. The swift rise in the asset’s worth demonstrated the mining industry’s responsiveness to such price fluctuations, particularly following the activation of the reward halving.

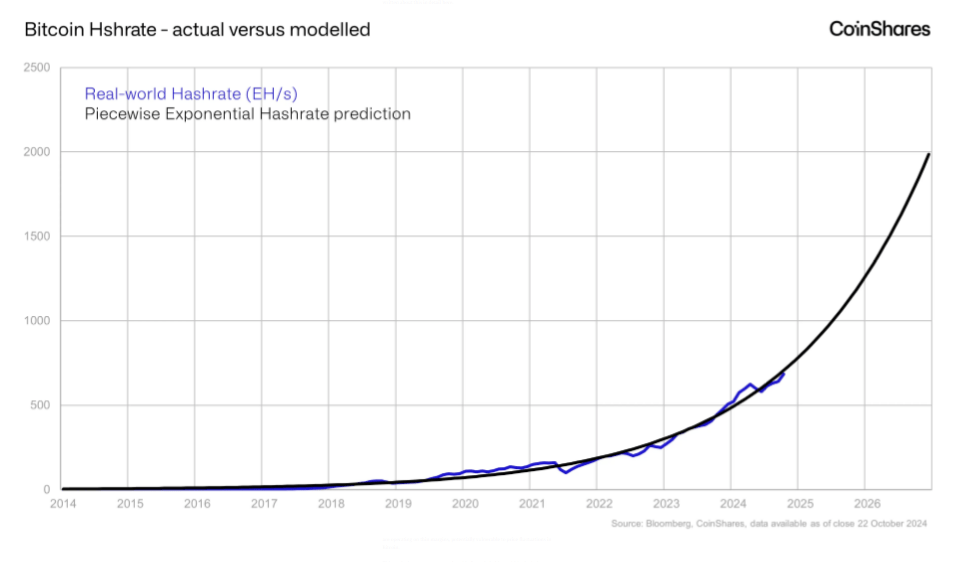

Currently, numerous mining analysts are examining predictive models aimed at forecasting the ongoing growth of a cryptocurrency’s hash rate. The majority of existing models project that the hash rate will reach approximately 765 Exahash per second (EH/s).

Time For BTC Mining To Embrace Alternative Energy Sources?

One of the complaints against BTC mining is that it hurts the environment due to the massive energy requirements, not to mention the carbon footprint it emits. Experts say that if miners use alternative energy sources, we can reduce our carbon footprint by 63% by 2050.

Miners might want to prepare themselves for adopting other energy sources, as costs tend to rise proportionately with an increase in hash rate.

As Costs Rise, Some Bitcoin Miners Turn To AI

As the efficiency of mining operations begins to decline, miners are seeking out alternative methods to boost their income. For instance, some seasoned miners are opting to hold tokens rather than mine them directly. Meanwhile, others are exploring AI-based solutions as a possible revenue stream.

It’s clear that the Bitcoin mining sector is about to embark on a fresh chapter. As miners and other involved parties strategize and progress, they should take into account the hurdles, including expenses, regulations, and rivalry. With costs continuously climbing, miners need to discover effective solutions and alternatives to maintain profitability.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-11-05 01:34