As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of price movements and market dynamics. Bitcoin’s current trajectory is nothing short of impressive, and it’s fascinating to witness its meteoric rise. However, as we all know too well, what goes up must eventually come down – or sideways, in this case.

Bitcoin has maintained its bullish momentum over the weekend, solidifying its position above the $90,000 mark. This milestone showcases Bitcoin’s resilience as it continues to captivate investors with its upward trajectory. The market has been buzzing with optimism as Bitcoin inches closer to new highs. However, recent on-chain data suggests that a potential pullback could be on the horizon.

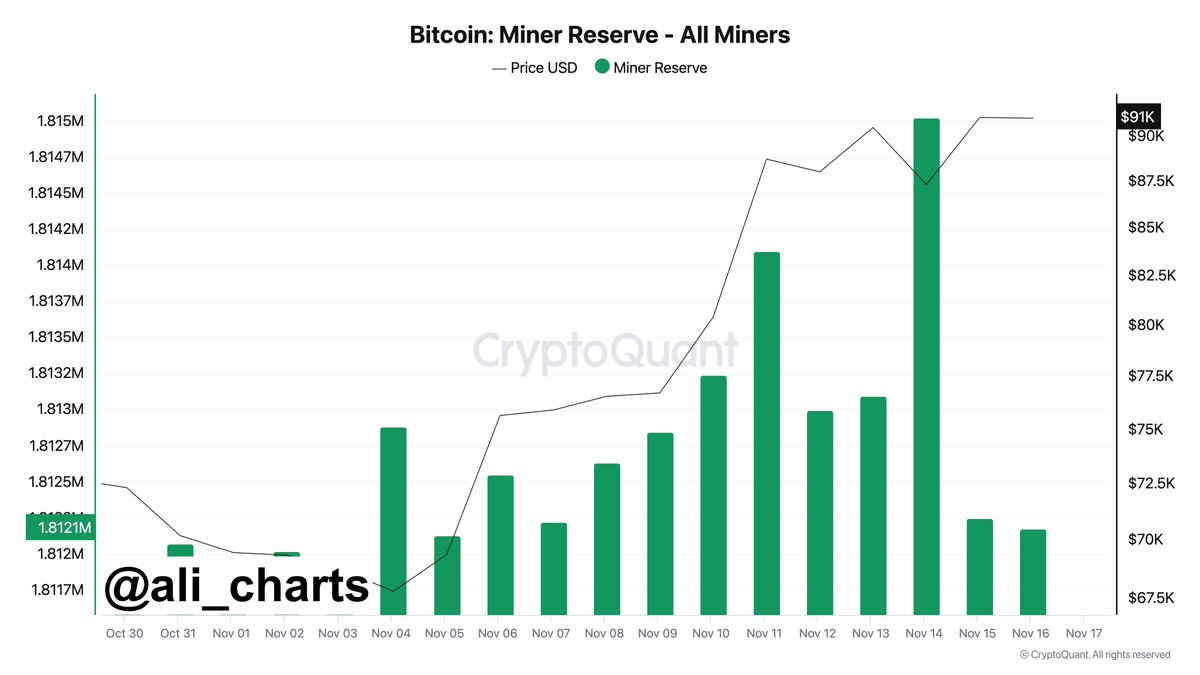

Information from CryptoQuant indicates that Bitcoin miners have offloaded more than 3,000 Bitcoins in the last two days. This mass selling by miners typically hints at a cooling period, as it increases the market’s supply. Although such selling activity is often observed during times of intense price movement, it might trigger a temporary phase of consolidation that falls short of the all-time high of $93,400 achieved earlier this week.

As a crypto investor, I find it encouraging that despite recent turbulence, Bitcoin has managed to stay above the $90,000 mark. This resilience suggests a solid foundation of demand and optimistic market sentiments. The coming days will be crucial as we observe whether Bitcoin can withstand this selling pressure and continue its bullish momentum.

Bitcoin Looks Very Strong

Over the last 11 days, Bitcoin’s price performance has been strong, repeatedly hitting new record highs, which underscores its ongoing bullish trend. Yet, following this intense surge, the market seems to be shifting into a phase of stabilization, as certain investors and organizations seem to be taking advantage of profits by selling.

Crypto expert Ali Martinez recently provided important insights about X, revealing that Bitcoin miners have offloaded more than 3,000 BTC within the past two days, equivalent to around $273 million in value. This selling behavior suggests that miners, who are often long-term investors, are cashing out during the recent price increase. Such actions are common during robust bull markets and could imply that market players foresee a brief period of price stagnation or dip.

While miner selling is a natural part of market dynamics, sustained activity of this kind could signal a shift in sentiment. If selling pressure persists, it might push Bitcoin toward lower demand zones, providing potential re-entry opportunities for sidelined investors.

At the moment, whether Bitcoin can handle this wave of selling will decide if its current bullish momentum continues. A short period of stabilization might be advantageous, giving the market time to build a sturdier base before another rise. For now, investors are keeping an eye on crucial points to predict if there’ll be more growth or a significant downturn.

BTC Holds Steady Above $90,000

As an analyst, I’m observing that currently, Bitcoin is being traded at approximately $90,600. The past few days have been quite volatile, with its price fluctuating between its all-time high of $93,483 and a temporary low of $86,600. This period of consolidation follows a significant bullish momentum that established new records, causing a heightened interest among investors and analysts who are now closely monitoring the next moves in the market.

Regardless of the recent dip, Bitcoin’s performance remains robust, underpinned by growing interest and an overall optimistic outlook. If Bitcoin manages to stay above the $86,000 mark over the coming days, a new spike aiming to break its record high might be possible. The market has demonstrated strength as fresh demand persists, even during brief periods of profit-taking.

If Bitcoin drops below $86,000, there’s a possibility of a more significant downward correction. In such a scenario, it might probe lower areas where demand is stronger, seeking a solid foundation to initiate another uptrend. Significant support zones could serve as a base for increased buying activity and pave the way for the next bullish cycle.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-11-18 01:16