As a seasoned crypto investor with a keen interest in on-chain data and market trends, I find the recent decline in selling pressure from Bitcoin miners to be an encouraging development for the flagship cryptocurrency. The reduced quantity of Bitcoin being sent from miners to exchanges for sale, coupled with the depletion of the OTC Desk volume, suggests that there may no longer be significant selling pressure from this group.

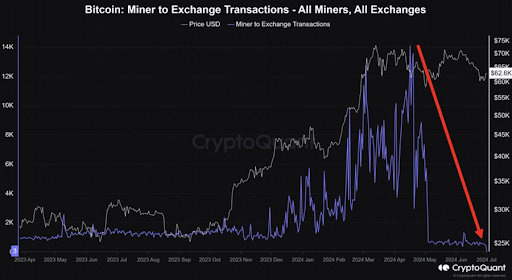

Bit miner selling, as indicated by on-chain data, has decreased lately. This reduction in selling is noteworthy since it could potentially influence Bitcoin‘s pricing trend as we approach the third quarter.

Bitcoin Miners’ Selling Pressure Has Significantly Declined

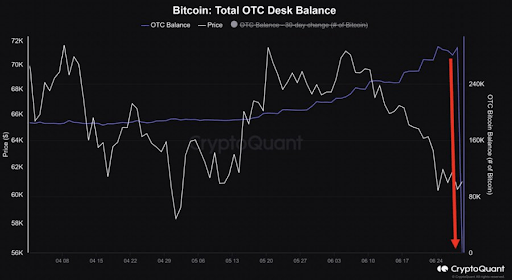

As a crypto analyst closely monitoring data from the on-chain analytics platform CryptoQuant, I’ve observed a notable decrease in selling pressure from miners for two primary reasons. Firstly, the amount of Bitcoin miners have transferred to exchanges with the intention of selling has dropped dramatically since May.

A crypto analyst noted that the amount of Bitcoins sold by miners through the Over-the-Counter (OTC) desk had been entirely bought up by someone, indicating a significant purchase occurred before June 29th. The OTC desk had accumulated an extensive volume of Bitcoin during this period, with no apparent buyer found to take it off the miners’ hands.

Bitcoin mining operations played a significant role in the price declines experienced by Bitcoin in June. According to market intelligence platform IntoTheBlock, these miners offloaded approximately 30,000 Bitcoins, worth around $2 billion, during the month. This substantial sale volume put immense downward pressure on Bitcoin’s price and caused it to dip below $60,000 at certain points.

In simpler terms, the decrease in demand to sell Bitcoin signifies a positive trend for the cryptocurrency and may prolong its bullish momentum during the third quarter of 2021, as per Crypto Dan’s analysis.

According to cryptocurrency expert Willy Woo, miner capitulation – a point where miners are selling more bitcoins than they’re mining – is a significant indicator for Bitcoin price recovery. Once past this hurdle, Bitcoin could potentially experience an uptrend and substantial gains in the current month.

BTC’s Uptrend Has Begun

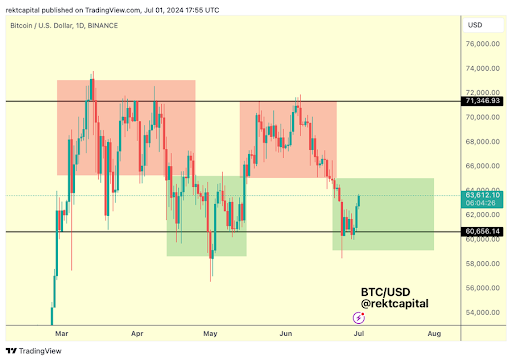

Crypto analyst Rekt Capital made a recent observation on X (previously Twitter) about Bitcoin’s price trend. He pointed out that Bitcoin has officially started an uptrend based on the confirmation of its higher low. Furthermore, Bitcoin is currently forming a bullish flag pattern in its macro chart, suggesting a positive outlook for the cryptocurrency.

In a previous Bitcoin-related post, a cryptocurrency expert indicated that after an impressive beginning in July, the objective for Bitcoin’s price development is to establish a solid base enabling it to reach the “peak zone” of around $71,500 gradually.

As a dedicated cryptocurrency investor, I’ve been closely following the market trends and analysis provided by Michaël van de Poppe. According to his latest insights, Bitcoin’s downtrend has come to an end, and a bullish reversal is currently underway. He strongly believes that Bitcoin has already hit its bottom at $60,000, making it highly unlikely for the flagship crypto to decline below this price level again in the near future.

As I analyze the current market situation, Bitcoin is presently priced at approximately $62,900 based on data obtained from CoinMarketCap within this moment. However, it’s important to note that its value has decreased slightly over the past 24 hours.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-07-02 21:41