As a seasoned crypto investor with a few years under my belt, I’ve learned to keep a close eye on miner behavior and its potential impact on Bitcoin’s price. The recent data from CryptoQuant indicating a significant drop in miner reserves and a surge in OTC selling activity is a cause for concern.

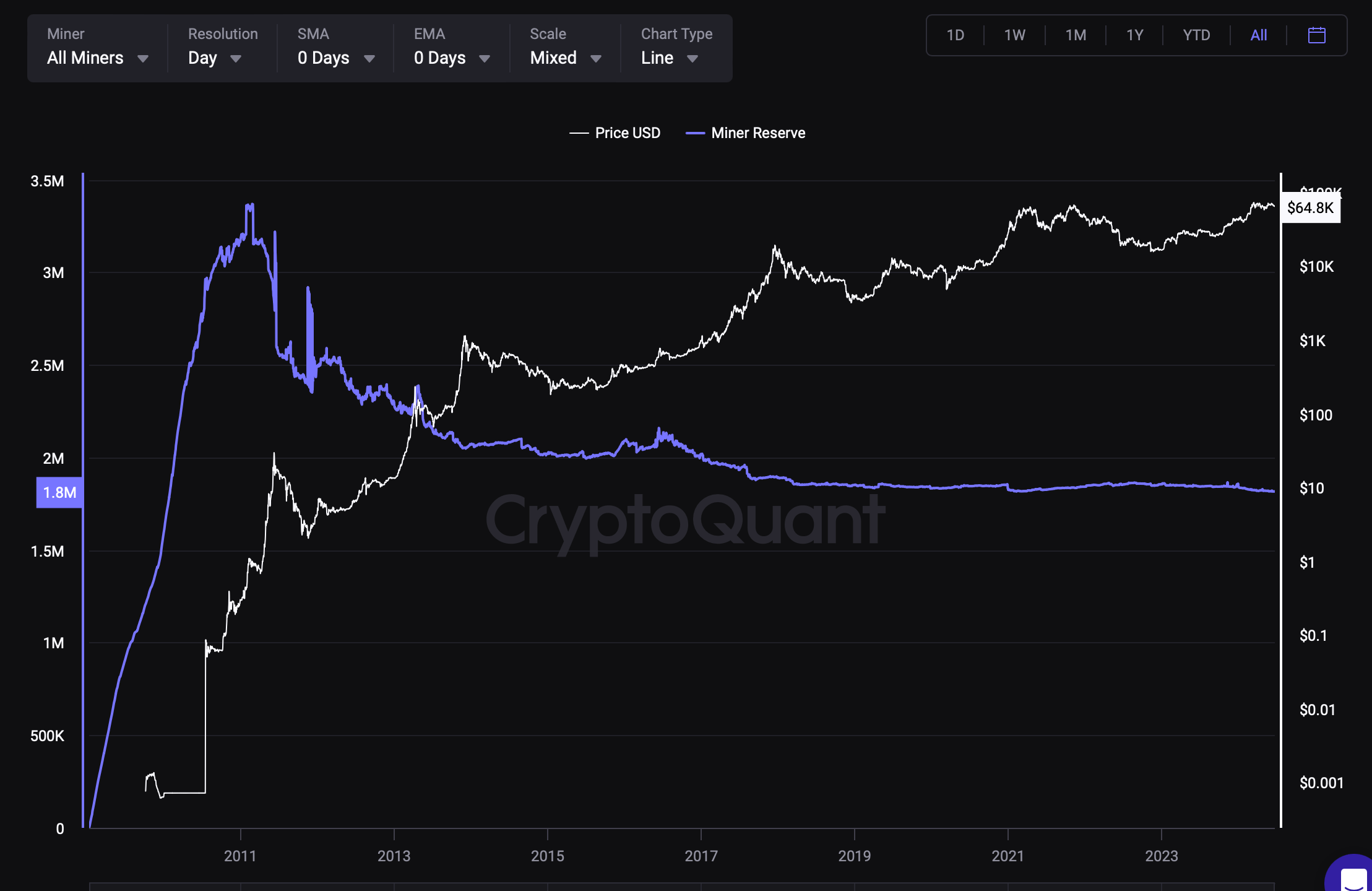

According to the latest figures from CryptoQuant, there’s been a noticeable change in mining patterns for Bitcoin. Miner reserves have reached their lowest point since 2010, while OTC sales have spiked significantly.

What This Means For BTC

As a crypto investor looking back at the year’s beginning, miner reserves amounted to around 1.87 million BTC. However, these reserves have since shrunk to roughly 1.81 million BTC – a figure last seen over a decade ago in 2010. This significant decrease in miner reserves is worth noting as it suggests miners have been more inclined to sell off their Bitcoin holdings this year.

Normally, such a situation might result in higher market supply and possible price decreases. However, this year things have taken an unexpected turn.

In spite of miners having less Bitcoin than before, the worth of their Bitcoin reserves is still substantial due to a nearly 150% price surge since October the previous year. Consequently, the collective value of miner holdings in US dollars remains close to record highs, exceeding $130 billion.

As a researcher analyzing market trends in the cryptocurrency sector, I’ve noticed an intriguing pattern emerging based on data from CryptoQuant. Specifically, the sales of Bitcoin by miners through over-the-counter (OTC) channels have reached their highest daily levels since March.

Bitcoin In The Spotlight

The mining process is taking place against the backdrop of wider market trends, which have resulted in considerable price swings. Bitcoin’s value has decreased by approximately 7% within the last day, falling from a high of $66,436 to around $65,269.

The downward trend in the crypto market matches the wider volatility pattern that has emerged lately. According to analyst Willy Woo, Bitcoin may not reach new record highs until the ongoing miner sell-offs and market apathy are resolved. Historically, such periods have been followed by strong market rallies.

As a researcher studying the cryptocurrency market, I can tell you that reaching new all-time highs for Bitcoin (BTC) may require enduring more hardships and monotony before it becomes a reality. It’s not an ideal situation, but past trends suggest that significant price growth often follows periods of market stagnation or correction.

As a crypto investor, I find it encouraging that miners are currently experiencing difficulties and even selling off their coins en masse. Historically, this trend has often signaled the end of a bearish market and the beginning of a strong bull run. So, while we may be facing some tough times now, I remain optimistic about the potential for significant price increases in the near future.

Look for compressions in this ribbon. Buy and hodl in these regions.

— Willy Woo (@woonomic) June 19, 2024

Currently, MicroStrategy – a significant supporter of Bitcoin among corporations – persists in buying Bitcoins despite volatile market circumstances. After raising $800 million through the issuance of convertible notes in a recent fundraising round, they have acquired an additional 11,931 Bitcoins for their reserves.

This purchase, which cost an average of $65,883 per Bitcoin, has increased MicroStrategy’s Bitcoin holdings to a total of 226,331 coins. The accumulated cost for acquiring these Bitcoins amounts to around $8.33 billion, resulting in an average price paid of $36,798 per coin.

I, as a crypto investor, am excited to share that MicroStrategy has recently purchased an extra 11,931 Bitcoins for approximately $786 million. We utilized the proceeds from convertible notes and excess cash, with each Bitcoin costing us around $65,883. As of June 20, 2024, MicroStrategy holds a total of 226,331 Bitcoins, acquired for approximately $8.33 billion. The average price we paid per Bitcoin was $36,798.

— Michael Saylor (@saylor) June 20, 2024

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-06-20 23:10