As a seasoned analyst with years of observing and navigating the tumultuous waters of the crypto market, I find myself intrigued by the recent developments surrounding Bitcoin. The sudden offloading of 85,503 BTC by miners, equivalent to a whopping $8.56 billion, has certainly raised eyebrows in the industry.

Over the last seven days, Bitcoin has consistently been the main news topic in the cryptocurrency sector, ranging from reaching high six-figure prices to experiencing a market downturn. Amidst these swift changes for the largest digital coin, data analysis firm Santiment has noted a significant drop in mining reserves.

Bitcoin Miners Offload 85,503 BTC In 48 Hours

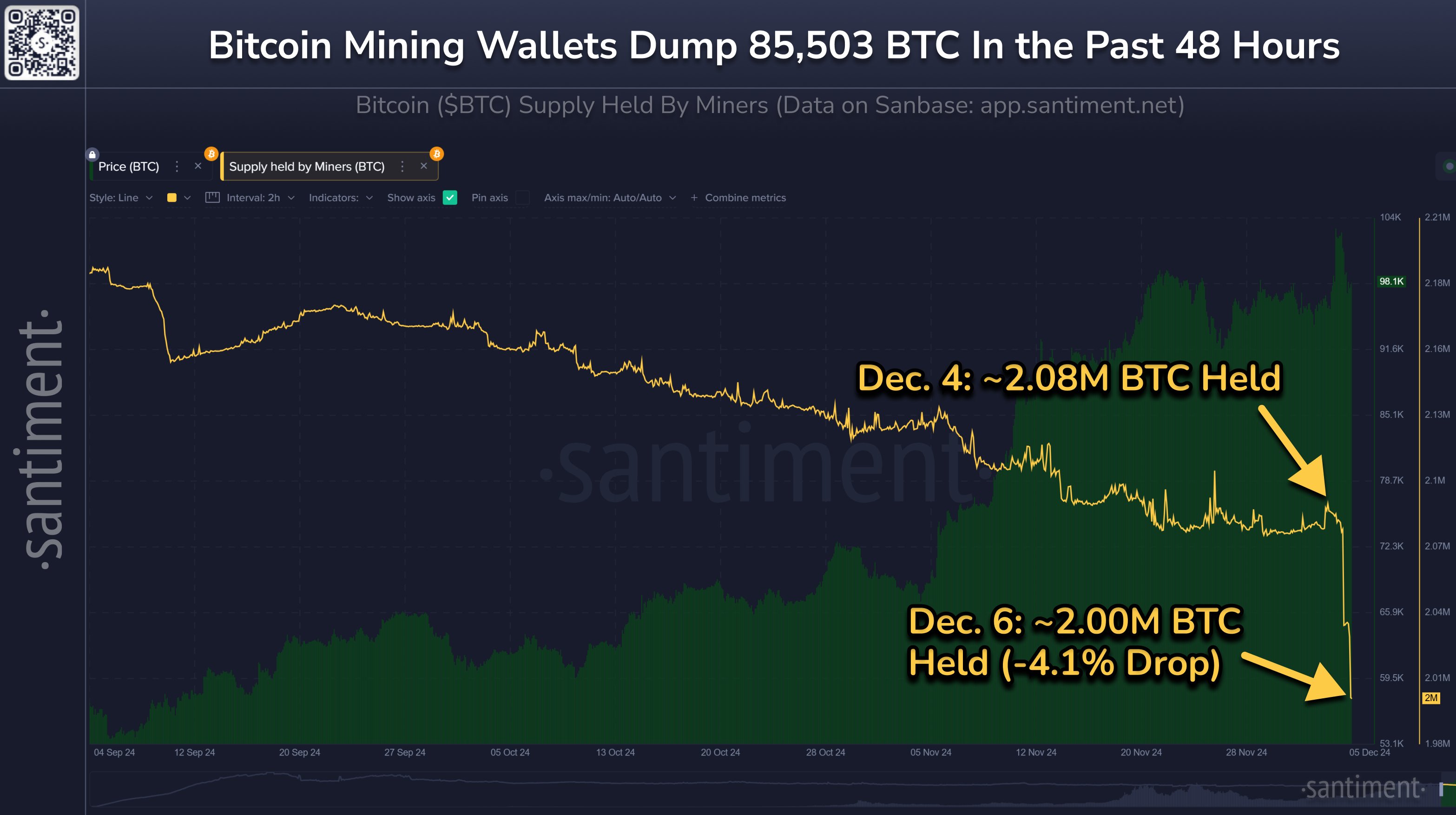

Last Friday, Santiment posted a report about the activity of Bitcoin mining wallets in relation to its price. According to their analysis, there has been a steady decline in the total Bitcoin mining balances since April 2024, suggesting that miners have either been offloading their Bitcoin or transferring it to different wallets.

In the past 48 hours, Santiment reports a significant decrease in mining wallet holdings of Bitcoin, with approximately 85,503 BTC worth around $8.56 billion being transferred out. This is the largest reduction in miner balances since late February, just before Bitcoin reached its peak of $73,000.

Typically, higher sell-offs from miners might suggest a potential downturn in Bitcoin’s price trend. Nevertheless, the Santiment team proposes that the recent Bitcoin sell-off could be seen as a neutral sign, providing no clear indication about future price changes for Bitcoin.

In the year 2024, it appears that the relationship between Bitcoin miner balances and price is relatively weak most of the time. However, large investors known as ‘whales’ and ‘sharks’, who are not miners themselves, have been consistently buying Bitcoin. This action suggests faith among investors in the potential profitability of Bitcoin, even though mining activity may be less influential.

It’s worth noting that prominent crypto analyst Ali Martinez recently shared an update about a growing trend: In the last day, large Bitcoin holders (referred to as ‘whales’) have bought approximately 20,000 BTC, which amounts to around $2 billion.

Despite the ongoing decrease in Bitcoin miner’s reserves, this issue continues to be a significant worry for Bitcoin investors. Beyond creating a pessimistic atmosphere, miners selling their BTC could spark questions about the mining’s profitability, a crucial factor in maintaining the Bitcoin network’s stability.

Bitcoin Price Overview

As I pen this down, I’m noting that Bitcoin is currently exchanging hands at $100,119, a 3.67% surge over the past day. Looking beyond the short-term perspective, Bitcoin has been profitable on larger timeframes, with a 2.92% growth in the last week and an impressive 32.60% increase over the past month.

In simpler terms, after being turned down previously, Bitcoin, the biggest digital asset, is expected to encounter some minor obstacles at around $102,000. However, if the market’s bullish sentiment continues, Bitcoin could sustain its upward trend that started in early October and potentially reach higher prices.

According to historical patterns of bull markets, it’s been suggested that the leading cryptocurrency could increase by approximately 38.86% in December. It might even reach a maximum value of around $140,000 before the end of 2024.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-08 05:10