As a seasoned crypto investor with years of experience under my belt, I find the recent decline in Bitcoin miner exchange inflows quite intriguing. Having witnessed numerous market cycles and understanding the dynamics of miner behavior, I can’t help but see this as a potential bullish sign for BTC‘s price.

Recent on-chain data indicates that the inflow of Bitcoins from miners to exchanges has decreased noticeably. This could potentially be a positive signal for the asset’s price.

Bitcoin Miner Exchange Inflow Has Been Declining Recently

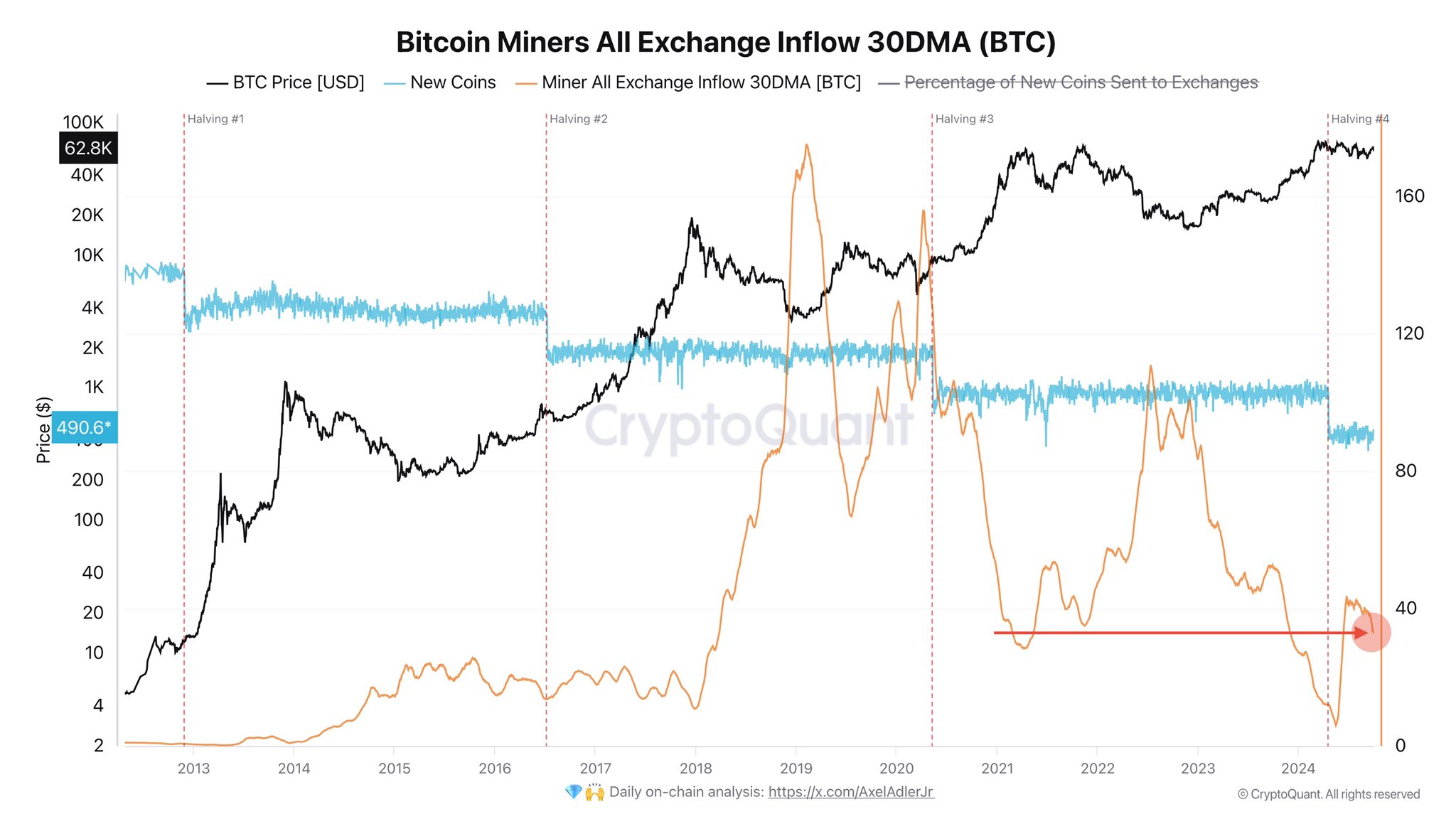

According to a recent post by CryptoQuant author Axel Adler Jr on X, there’s been a trend of miners sending less funds to exchange-linked wallets in recent times. In this context, “exchange inflows” denote transactions that originated from self-custodial addresses and were directed towards wallets associated with centralized exchanges.

In our present discussion, we’re focusing on transactions into exchange platforms, particularly those associated with miner wallets. Miners typically transfer funds to these platforms with the intention of selling. Therefore, significant inflows from miners could indicate that they are liquidating their holdings, suggesting a potential sell-off by the chain validators.

Miners need to regularly sell their output because the continuous expenses like electricity bills are essential for maintaining their operations; otherwise, they would cease functioning.

In simpler terms, routine sales are typically manageable for the market, meaning they often don’t significantly impact the asset’s price. However, continuous large influxes of trades might be worth keeping an eye on, as they could suggest unusual selling pressure coming from that particular group.

As a researcher delving into the world of cryptocurrencies, I’d like to share an insightful graph I received from my analyst colleague. This chart illustrates the trajectory of the 30-day moving average (MA) Bitcoin miner exchange inflows since the inception of this digital currency, offering a valuable perspective on its history.

The initial months of the year saw the moving average of Bitcoin miner exchange inflows drop significantly, but it subsequently experienced a marked increase.

This surge might be due to the fact that the latest halving event took place in April, which reduces the Bitcoin block reward by half during such periods approximately every four years.

In the provided chart, the analyst has included additional data representing the coin issuance within the network (depicted in blue). This data makes it clear that the impact of the Halving event is evident, since miners are now able to produce roughly half the number of coins following each occurrence compared to before.

Miners typically earn money from two primary income streams: transaction fees and block rewards, although a significant portion of their earnings usually stems from the block rewards. Consequently, miners predominantly rely on these block rewards to generate their income.

Following the recent halving event, miners found themselves facing significant financial strain as their earnings significantly decreased. It appears that many of these blockchain validators responded to this revenue crunch by liquidating some of their reserves. This conclusion can be drawn from the trend in exchange inflows.

For some time now, Bitcoin miners have been contributing substantial amounts to the market. However, there’s a hint that this group may be reducing their sales as the 30-day moving average of their exchange inflows has started to decrease – a possible indication of them stepping back. If this trend continues, it could positively impact the price of cryptocurrency.

BTC Price

In simpler terms, after making a comeback, the price of Bitcoin has dipped again over the past few days, and it’s currently at around $60,300.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-04 11:12