According to on-chain information, a large proportion of Bitcoin investors are now making purchases. This trend might be indicative of an upcoming price increase for the cryptocurrency.

Bitcoin Mega Whales Have Shown Net Inflows In The Past Day

Over the past three weeks, Bitcoin’s price has had trouble gaining substantial upward thrust. Instead, it has been bouncing between a set price range, unable to break out and show clear signs of a bull market.

Previously, during that period, the biggest players in the industry had kept still, neither purchasing nor selling any significant amounts. But recent data from the market intelligence platform IntoTheBlock indicates a shift in their behavior over the last day.

Investors with at least 0.1% of all circulating Bitcoins in their wallets are referred to as “Significant Owners” or “Major Stakeholders.”

Approximately 19.7 million digital currency tokens are in circulation. Representing 0.1% of this total would equal around 19,700 BTC. At the present Bitcoin exchange rate, these 19,700 BTC are valued above $1.26 billion.

These enormous Bitcoin holders stand out with their size; they significantly dwarf typical whale investors, who generally manage between 1,000 and 10,000 BTC. Thus, a fitting term for these colossal entities could be “mega whales.”

Due to the greater impact an investor has on the Bitcoin market as their holdings grow larger, these major investors, or “whales,” wield significant power within the network. Consequently, their actions could potentially lead to notable effects for the broader market.

Using the netflow on-chart indicator provided by IntoTheBlock, we can observe the incoming and outgoing Bitcoin transfers for large investors, providing insights into their buying and selling activities.

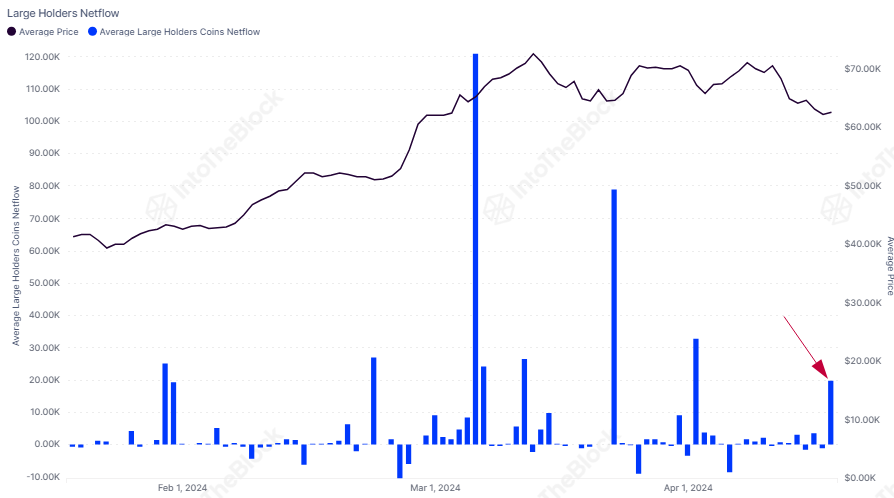

The below chart shows the trend in this metric over the last few months:

Based on the graph shown above, there was a significant increase in Bitcoin moving to large holders’ wallets yesterday, indicating these investors received a substantial inflow of coins. Notably, mega whales were responsible for purchasing 19,760 BTC during this surge, equivalent to over $1.27 billion in value.

Based on historical data, purchases made from these specific addresses have typically occurred before increases in Bitcoin’s value, according to the analytical company. The graph illustrates that significant buying activity from this group played a role in reaching Bitcoin’s current record price for the asset.

In simpler terms, these recent purchases could potentially give the asset a boost and make it trend upwards in the coming days. Nevertheless, it’s important to mention that the size of this latest increase, while significant, is not as substantial as some of the larger acquisitions that occurred previously.

BTC Price

At the time of writing, Bitcoin is trading at around $64,500, down more than 5% over the past week.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-04-20 04:16