In a recent article, well-known cryptocurrency innovator and observer Arthur Hayes forecasted that additional funding infusions into the American economy after President-elect Donald Trump’s swearing-in might trigger a surge in Bitcoin (BTC) prices during the first quarter of 2025.

Money Printing To Propel Bitcoin?

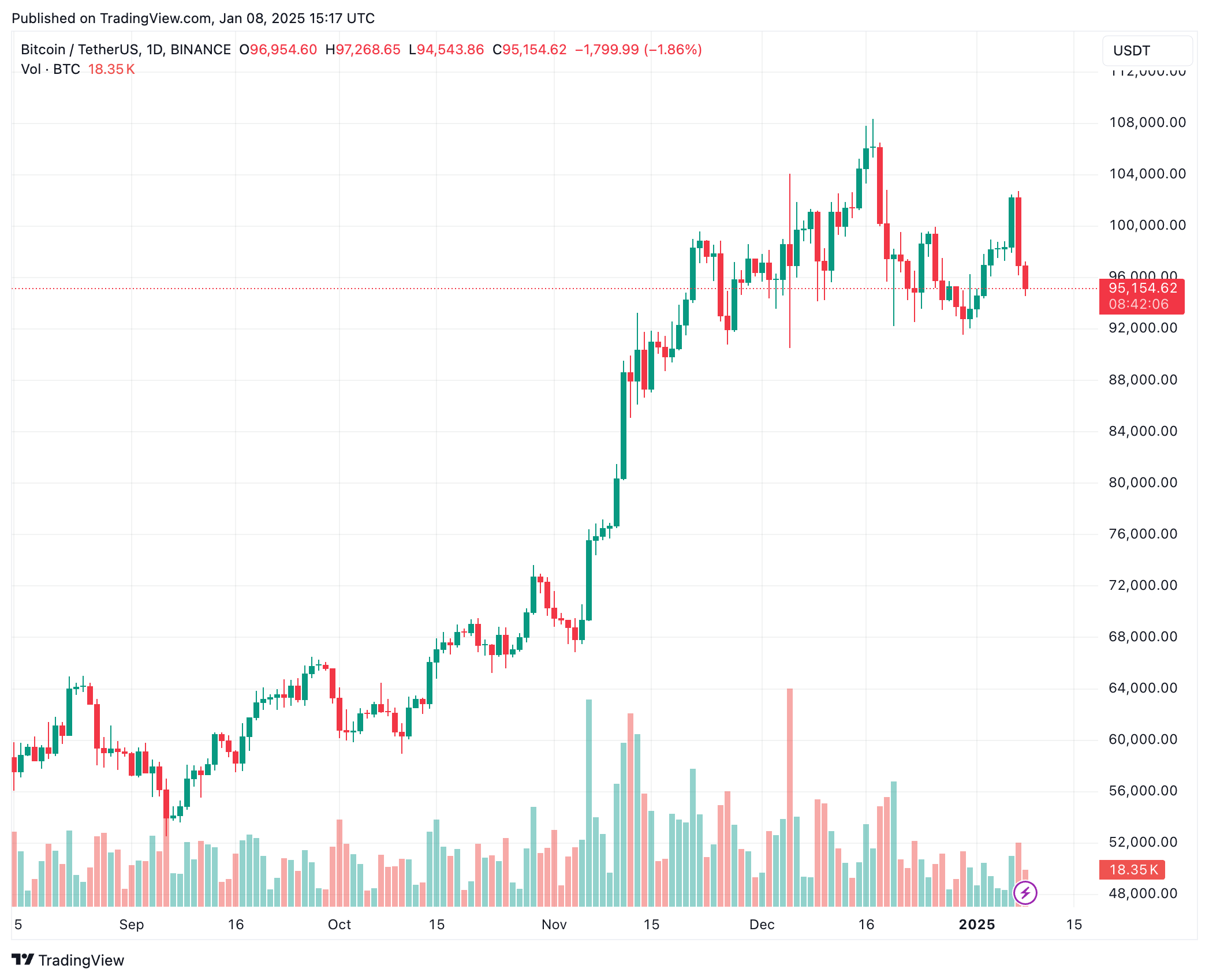

Regardless of hitting over $100,000 on January 6th, Bitcoin experienced a steep drop today, reaching as low as $94,543, causing some uncertainty about the anticipated “Trump rally” that was speculated to persist until Trump’s inauguration on the 20th of January.

The current market trends correspond to Hayes’ forecast from December, where he foresaw a possible steep decline in the cryptocurrency market around President Trump’s inauguration. He based this prediction on anticipated regulatory disillusionment from the new Trump administration.

In his recent update, Hayes proposed that the US Federal Reserve’s (Fed) move to infuse $612 billion into the economy might compensate for the slow regulatory advancements and potentially spark fresh optimism in Bitcoin, as he put it. BitMex’s co-founder made this observation.

An unfavorable outcome from Team Trump’s proposed pro-cryptocurrency and pro-business bill could potentially be offset by a highly advantageous dollar liquidity situation, with as much as a $612 billion surge observed during the initial quarter.

Hayes suggested that following Donald Trump’s inauguration, it is anticipated that the Federal Reserve will increase the rate of printing money, which could potentially push Bitcoin and other digital assets to reach a temporary peak before experiencing a decline. He also noted that dissatisfaction within the market regarding slow cryptocurrency regulations under the Trump administration might intensify this correction.

The crypto business owner recommended that you should consider selling by the end of Q1 2025 and then wait for advantageous market conditions to resurface in Q3 2025. Once new liquidity flows into the market, Hayes suggested it would be appropriate for daring investors to increase their risk tolerance.

Opinion Split On BTC Price Action

Although Hayes predicts an increase in Bitcoin prices during the current quarter, other financial experts and observers show reservation. To illustrate, a study by 10x Research suggests that if the Federal Reserve postpones reducing interest rates, it might weaken Bitcoin’s upward trend.

In a similar vein, some technical analysis indicates that Bitcoin could potentially be shaping a bearish ‘head and shoulders’ pattern on its weekly graph, causing concerns about a potential drop down to around $80,000. Yesterday’s inability to convincingly surpass the $100,000 mark has added to the anxiety among bullish investors.

Conversely, the CEO of the Bitcoin mining company MARA has recently endorsed a long-term “invest and hold” approach for Bitcoin. He posits that establishing a U.S. strategic Bitcoin reserve could ignite a global competition among countries to amass Bitcoin, potentially increasing its value.

The growing enthusiasm for Bitcoin among institutions is apparent now, with an increase in investments seen in US Bitcoin exchange-traded funds (ETFs), reaching new highs. Currently, Bitcoin is trading at $95,154, experiencing a decrease of 3.6% over the past day.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

2025-01-09 12:04