As a seasoned crypto investor who has witnessed the rollercoaster ride that is the cryptocurrency market, I can’t help but feel a sense of déjà vu as we navigate through these August blues yet again. The past two years have taught me to read between the lines and not to make hasty decisions based on short-term price fluctuations.

After experiencing a rocky beginning to this month, the cryptocurrency market continues to grapple with the lingering effects of early August. My own observations have shown that the price of Bitcoin has failed to generate significant momentum over the past week.

There’s growing demand for Bitcoin, currently about 20% below its record high of $73,737, to reenter a bull phase. Notably, a recent analysis of blockchain activity suggests that Bitcoin has faced significant downward pressure over the last two years.

Bitcoin Spot CVD Persists In The Negative — What Does This Mean?

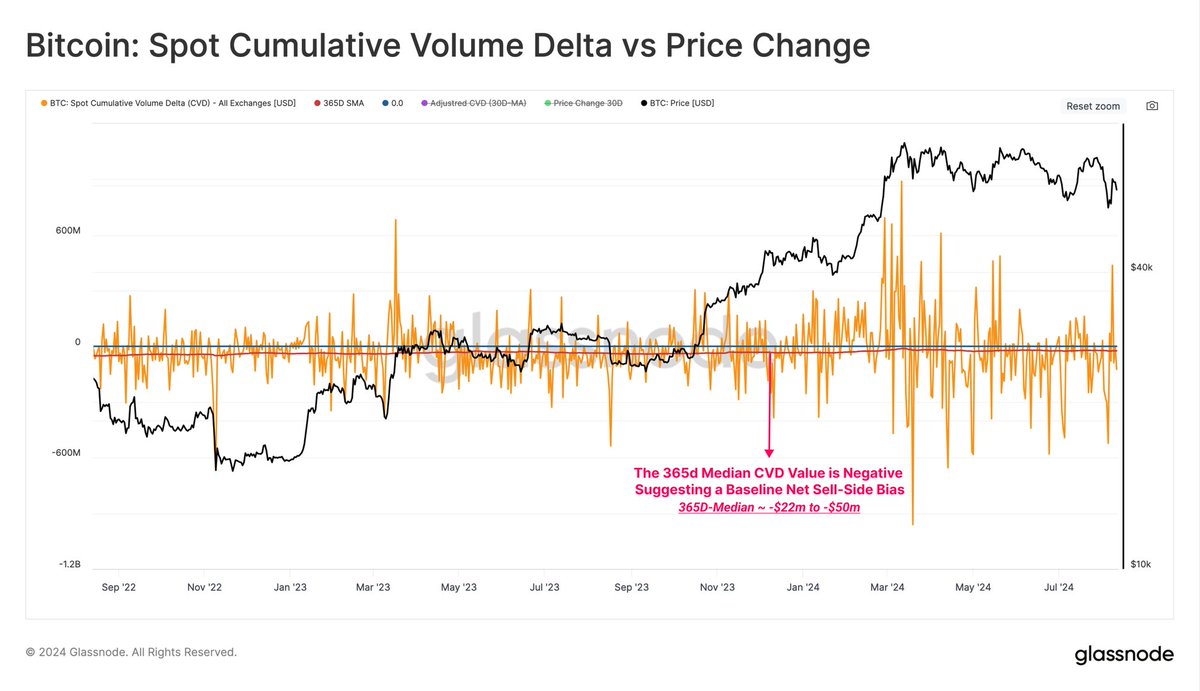

In a recent post on the X platform, blockchain data company Glassnode revealed that the Bitcoin spot market has been experiencing a net-sell side bias over the past two years. This on-chain observation is based on the Spot Cumulative Volume Delta (CVD) indicator, which measures the net difference between buying and selling trade volumes.

Investors utilize the Spot CVD metric to gauge the current market’s general attitude. This metric provides extensive understanding of whether buyers or sellers have greater influence in the market. Generally, a positive Cumulative Volume Delta indicates that there is more buying activity in the market, while a negative value indicates that sellers are dominant.

Based on recent statistics from Glassnode, the average annual Change in MakerDAO Value (CVD) has fluctuated between approximately -$22 million and -$50 million over the last two years. This pattern indicates a predominant tendency towards selling, as the volume of sell orders has consistently outweighed buy orders in the current market for some time.

Although the continued trend of more sellers than buyers (net-sell side bias) might seem like investors are getting rid of their Bitcoins instead of buying more, it doesn’t automatically indicate a bearish outlook for the Bitcoin market. Instead, this pattern underscores a cautious stance among investors, suggesting a decrease in immediate demand for Bitcoin.

While predicting exactly how the cumulative volume delta (CVD) at the spot may evolve in the upcoming months can be challenging, it’s essential for investors to keep an eye on this metric. This is particularly important because a resurgence of CVD into positive territory might indicate growing demand in the Bitcoin spot market, which could potentially boost the price of Bitcoin.

BTC Price At A Glance

From my perspective as a crypto investor, at the moment, Bitcoin’s price hovers slightly above $59,000, showing a rise of over 2.5% within the last day. However, this daily uptick hasn’t been enough to offset the coin’s weekly decline. As per CoinGecko’s data, Bitcoin has dipped by more than 2% in the past week.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-08-17 16:16