As a seasoned researcher with years of experience following the volatile crypto markets, I must admit that the current Bitcoin rally leaves me both awestruck and cautious. The relentless surge towards the six-figure mark is nothing short of extraordinary, reminding me of a rollercoaster ride that refuses to slow down.

For four straight days now, Bitcoin has set new record highs, surging to $99,500 recently. This consistent rise in value is sparking intense optimism among traders, who are hoping to witness Bitcoin breaching the $100,000 threshold for the first time. Nevertheless, on-chain indicators hint at potential obstacles in the rally as hints of profit-taking start to show up.

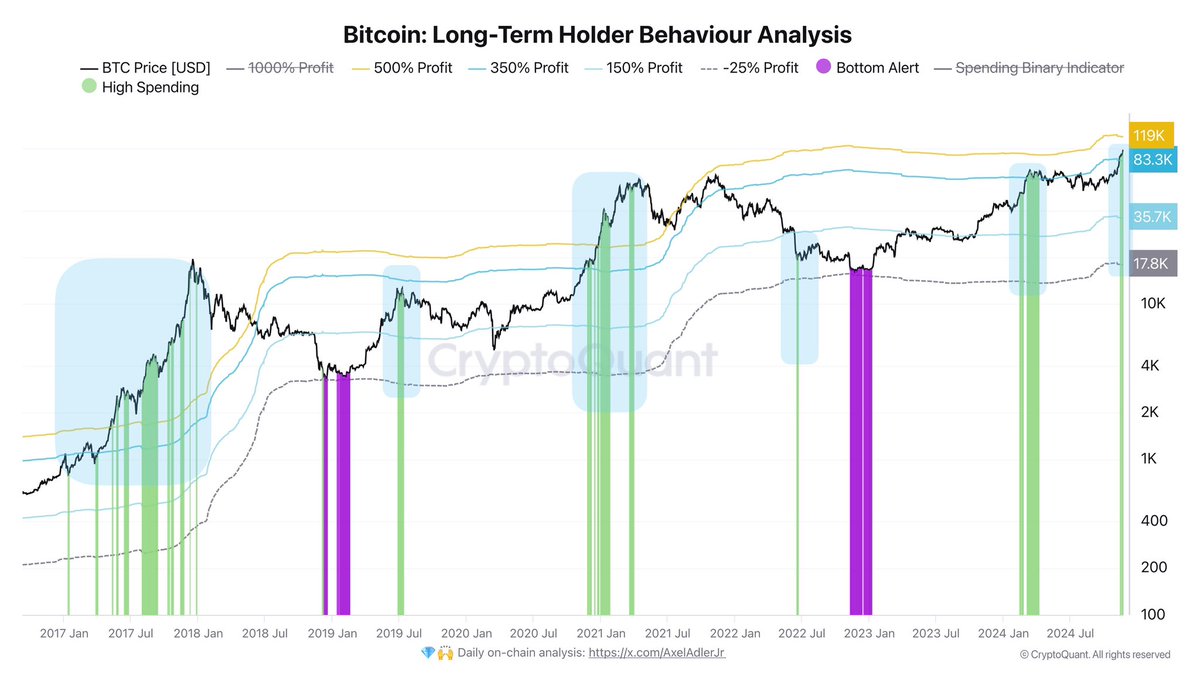

Insights from CryptoQuant show that long-term Bitcoin holders (LTHs) are cashing out their Bitcoins, realizing profits of more than 350%. This suggests that experienced investors are starting to cash in on their profits following the steep upward trend. The increase in whale activity and LTH profit-taking may temporarily halt the rally, possibly leading to a period of consolidation before another surge occurs.

As Bitcoin hovers just below the six-digit mark, investors are carefully considering whether it can continue its upward trajectory or if a downturn is approaching. If Bitcoin manages to hold steady at these levels, it could lay the groundwork for a resumption of its bullish trend and surpassing the significant $100,000 milestone.

Bitcoin Rally Seems Unstoppable

Bitcoin has experienced a strong 45% increase since November 5, showing persistent growth that seems invincible. Even with more sellers emerging, the demand remains robust, propelling Bitcoin to fresh highs and preserving its bullish trend. Investors are now attentively waiting for possible indications of a decrease or adjustment as BTC delves further into unexplored regions.

A CryptoQuant analyst named Axel Adler recently revealed some data that points to a notable pattern among Long-Term Holders (LTHs). As per Adler, LTHs have been actively cashing out their Bitcoin, earning profits of over 350%. This is an important development because these investors are typically seen as market stabilizers. If they continue selling, it could suggest changes in the overall sentiment among investors.

Adler points out that if Bitcoin’s value exceeds $119,000, Large Holder profits would skyrocket by more than 500%. Such massive profit gains could spark a significant selling spree, possibly causing the first substantial correction following this remarkable surge. Nevertheless, he underlines that pinpointing an exact price for this correction is speculative, as there’s no clear boundary to know when Large Holders might massively cash out.

As the rally continues unabated, the interplay between demand and long-term holders selling for profits highlights the necessity of keeping a close eye on market trends. Caution is advisable among traders as Bitcoin’s swift climb progresses.

BTC About To Reach $100K

Currently, Bitcoin is trading at approximately $98,600, just under a 2% gap from the much-anticipated $100,000 threshold. This psychological level is believed to be a potential supply zone, where numerous investors are closely monitoring price fluctuations near this notable milestone. The recent upward trend in Bitcoin’s price has left few opportunities for traders to purchase at lower costs, causing disappointment among those who aimed to accumulate during market dips.

If Bitcoin manages to stay above the significant support of $93,500 over the next few days, it seems that a strong rise beyond $100,000 might occur. Breaking through this level could trigger more positive momentum, potentially propelling Bitcoin into new, unexplored heights and boosting optimism for further increases.

Should the price fail to hold at $93,500, it may encounter selling pressure, potentially causing a price drop. In this case, Bitcoin might be drawn towards areas of lower demand, where $85,000 and $80,000 are important levels to keep an eye on. These zones could offer potential buying opportunities for investors seeking to profit from market corrections.

As Bitcoin nears a significant milestone, the coming days are crucial in deciding whether the market continues its upward trajectory or experiences a period of stabilization. Keep a close eye, traders and investors, as Bitcoin moves through this pivotal point.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-11-22 23:10