As a seasoned crypto investor with a keen interest in Bitcoin’s market trends, I find Rekt Capital’s analysis intriguing and well-reasoned based on historical data. The potential for significant gains following the fourth Bitcoin Halving is an exciting prospect, and his prediction of a peak around September or October 2025 aligns with my own expectations.

After the latest Bitcoin Halving event, Rekt Capital, a well-known cryptocurrency trader and analyst, has put forward an intriguing perspective on Bitcoin’s potential future price movement. According to Rekt Capital’s assessment, Bitcoin could reach its peak price during this ongoing bull market within the next year. His argument is built upon the idea that previous Halving cycles may provide insights into current trends, suggesting the possibility of substantial price increases for Bitcoin in the upcoming months.

Bitcoin Could Mirror Past Halving Cycle

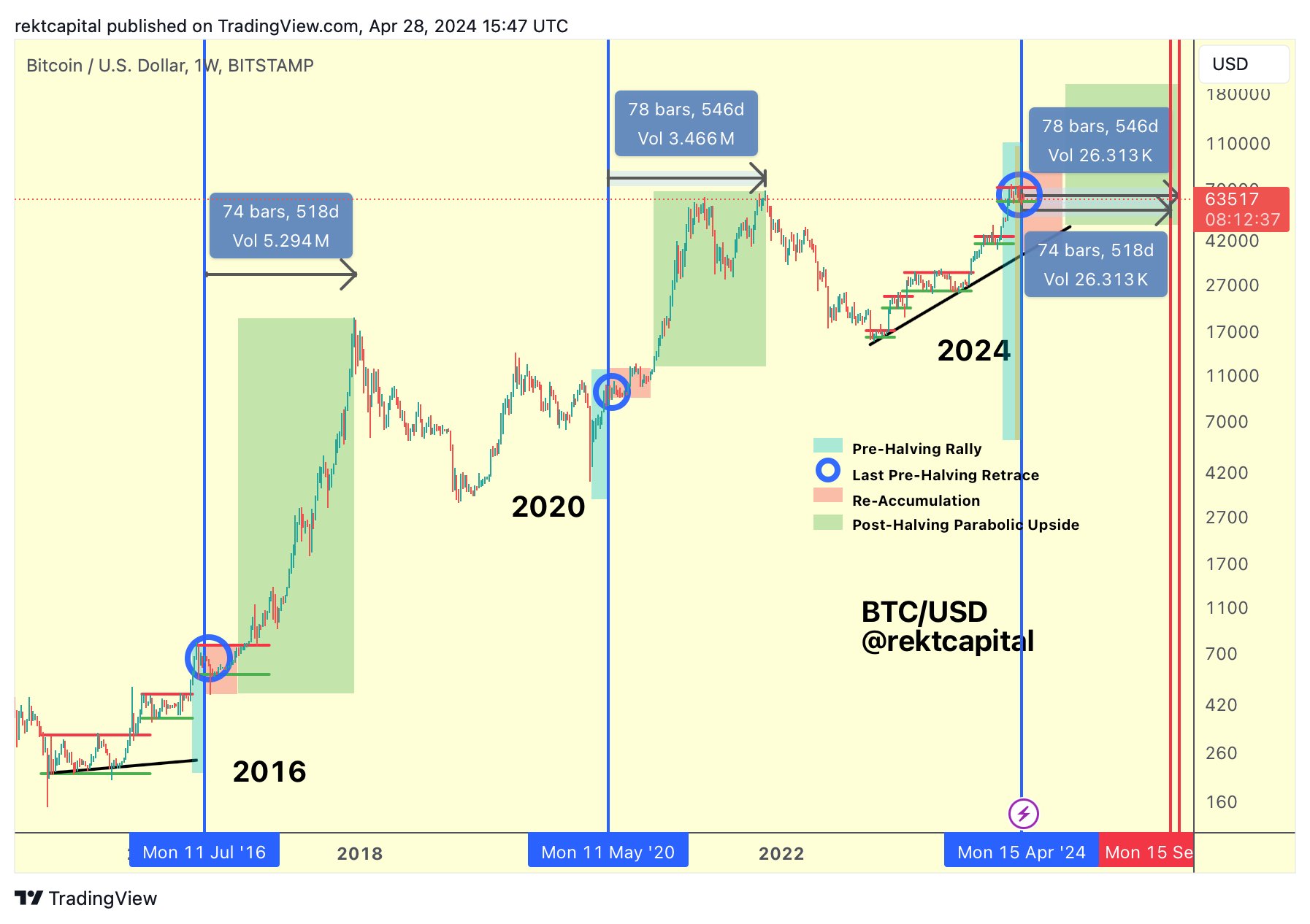

In the Bitcoin market, the peak price was previously achieved approximately 518 days after the halving during the 2015-2017 cycle, as reported by the analyst. Conversely, following the halving in the 2019-2021 bull market cycle, it took Bitcoin around 546 days to reach its highest price yet. These findings indicate that the halving event has consistently led to significant growth for Bitcoin.

Based on historical patterns, the upcoming cryptocurrency bull market peak could fall between 518 and 546 days after the most recent Bitcoin halving event. This timing suggests that the market’s highest point might occur around September or October in the year 2025. (Rekt Capital’s analysis)

The analyst observed that Bitcoin’s current price increase, approximately 220 days long, is gaining speed in this cycle. Consequently, a longer period of consolidation following this Halving could help align the present cycle with past event patterns.

As a researcher studying the Bitcoin market, I’ve observed that historical data from 2016 indicates a potential trend: following the Bitcoin Halving event, the cryptocurrency has experienced further declines over the subsequent three weeks. I refer to this period as the “Post-Halving Danger Zone.” During this timeframe, there is a heightened risk of downward volatility near the lower end of the Re-accumulation Range.

In the year 2016, about three weeks after a significant event, Bitcoin experienced a protracted drop of approximately 11%. Nevertheless, historical data suggests that if there is going to be increased market instability around the Re-Accumulation Range Low during this cycle, it might occur within the subsequent two weeks.

Despite the fact that the risk period following the Halving event is set to conclude within the next two weeks, historical data from 2016 suggests a potential for market downturns during this interval. These downturns might push the price down to the $60,600 minimum.

Parabolic Phase For BTC

After the re-accumulation phase, as predicted by Rekt Capital, Bitcoin is expected to experience a significant surge in value. This phase typically results in Bitcoin reaching new peak prices.

Previously, Bitcoin has typically spent between 150 days in a Re-Accumulation Phase, during which it collects strength in a narrow price range. If Bitcoin adheres to this historical pattern and spends this amount of time consolidating, Rekt Capital anticipates a parabolic price surge for Bitcoin by September this year.

As I analyze the current cryptocurrency market, I notice that Bitcoin (BTC) has experienced a significant decrease of more than 5% in value over the past week, with its price standing at $62,504. Meanwhile, its market capitalization has dipped by 1.53%. Interestingly enough, the trading volume for Bitcoin has surged by over 22% within the last 24 hours.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-04-29 19:17