Recent on-chain data indicates that the supply of Bitcoins held by long-term investors, who had previously been selling aggressively during a prolonged period, has decreased.

Bitcoin Long-Term Holders Have Sold Huge In Past 4 Months

According to an analysis by James Van Straten on X, Bitcoin investors who have held onto their coins for over 155 days significantly decreased their selling activity during the past ten days.

In the Bitcoin market, Long-Term Holders (LTHs) make up one of two major categories, while the other group is referred to as “Short-Term Holders” (STHs). The STHs are simply investors who have purchased Bitcoin within the previous 155 days.

In statistical terms, as an investor keeps holding Bitcoin for a longer duration, the chances of them selling decreases. Consequently, Long-Term Holders (LTHs) signify the dedicated segment of the Bitcoins market.

The STHs, on the other hand, are fickle-minded hands who may sell at the first sight of any FUD or profit-taking opportunity. As such, selling from the STHs is usually not that noteworthy. However, Selloffs from the LTHs can be something to watch for, as they rarely occur.

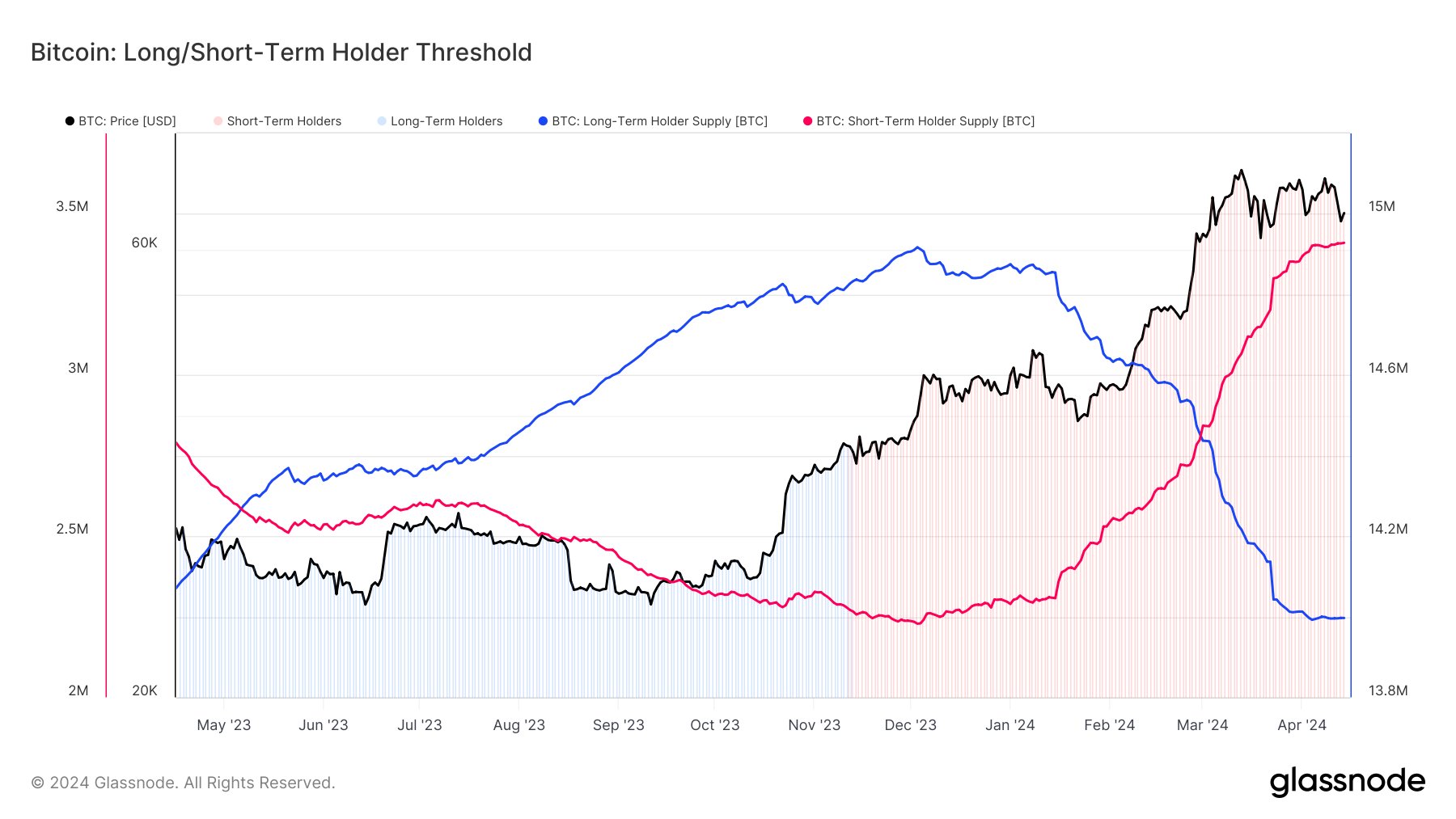

By monitoring the total Bitcoin holdings in their aggregated wallets, we can observe the patterns of behavior for the large and small investors (STH and LTH) as depicted in the chart below. (This version tries to make the sentence flow more smoothly while retaining the original meaning.)

In the graph above, we observe that the number of Bitcoins held by long-term investors (LTHs) generally rose during the year 2023. Simultaneously, the quantity of Bitcoins owned by short-term holders (STHs) tended to diminish.

A point worth mentioning is that the rise in Long-Term Holder (LTH) supply didn’t necessarily mean new purchases by these investors. Rather, some Short-Term Holders (STHs) made buys 155 days ago and have since then kept holding, reaching the threshold to be categorized as LTHs.

After coins have been hoarded for 155 days by large holders (LTHs), a rise in their supply is observed. In contrast, when it comes to selling, there is no delay for LTHs; they transfer coins instantly on the blockchain and are then classified as small holders (STHs).

The graph indicates that the number of diamond hand investors supplying Bitcoin in the market has increased this year, while Large Holder investors have been disposing of their 700,000 Bitcoins over the past four months.

The sale of coins from Grayscale Bitcoin Trust (GBTC), which started after the US SEC approved spot exchange-traded funds (ETFs) in January, is not included in this. These coins were now eligible to be classified as Long-Term Holder (LTH) coins due to their maturity.

In recent times, with Bitcoin’s price experiencing a downturn, the number of coins held by long-term investors, or LTHs, has stayed constant. This could suggest that these investors have ceased selling their coins for now. However, it is yet to be determined how the value of Bitcoin will progress following this new trend.

BTC Price

Following the latest drawdown in Bitcoin, its price has dropped towards the $63,200 level.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-04-16 22:16