As a researcher with experience in on-chain analysis, I find Checkmate’s latest post on the Bitcoin short-term holder Sell-Side Risk Ratio intriguing. The indicator’s recent decline suggests that short-term holders have become exhausted, and Bitcoin is currently sitting like a coiled spring, ready to unleash its energy.

As a crypto investor, I’ve come across an intriguing analysis from an on-chain expert. They’ve pointed out that Bitcoin currently resembles a coiled spring. This is a condition the asset doesn’t typically maintain for long periods.

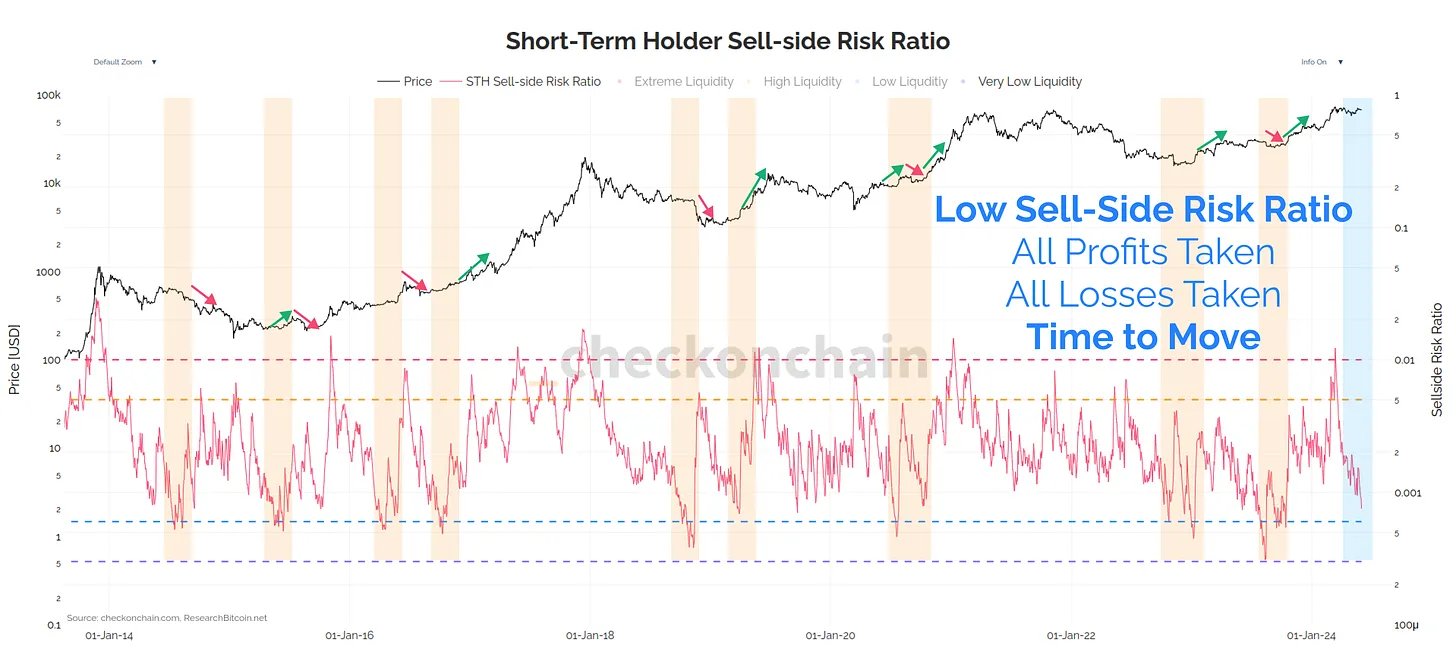

Bitcoin Short-Term Holder Sell-Side Risk Ratio Has Declined Recently

Analyst Checkmate has written a new piece on X, where they explore the current development in the Short-Term Holder Sell-Side Risk Ratio for Bitcoin. This metric signifies the relationship between the actual profits and losses that investors are facing and the total value of all previously realized Bitcoin transactions (Realized Cap).

As a financial analyst, I would describe the Realized Cap as the cumulative amount of capital that has been invested in purchasing cryptocurrencies, based on historical on-chain transaction data.

The Sell-Side Risk Ratio, calculated by taking the ratio of the total gains and losses from an investment to the initial cost, offers insights into the magnitude of profits or losses realized by investors compared to their original investment. A high indicator value signifies significant profit or loss realizations, often in conjunction with price volatility for the asset.

In contrast, a low metric indicates that investors are offloading coins near their initial investment cost. Such a pattern might signify that active traders, both realizing profits and cutting losses, have run out of steam within the market.

When discussing the present subject, it’s not the market-wide Sell-Side Risk Ratio that holds significance, but rather the ratio for a particular market sector: short-term holders (STHs). These investors are usually identified as individuals who have acquired their assets within the previous 155 days.

The below chart shows the trend in the metric for this cohort over the past decade:

From my analysis of the graph, I can observe that the Sell-Side Risk Ratio for Bitcoin STHs reached unprecedented heights during the market rally leading to the new all-time high (ATH). Historically, these investors have been known for their quick selling tendencies, often driven by fear of missing out (FOMO) or fear, uncertainty, and doubt (FUD) in the sector. Consequently, it comes as no surprise that they aggressively cashed in on profits during the market upswing.

After reaching that high point, however, the indicator has experienced a significant drop due to the prolonged stagnation of the cryptocurrency’s price. Post-decline, the figure has reverted back to its more subdued range.

It seems that the recent tight sideways movement has led some sellers among the large traders (STHs) to feel exhausted. An analyst comments that Bitcoin, which has risen significantly to reach $71,000 in the past day, often doesn’t remain still for long. As a result, this potential unwinding of positions might already be underway.

BTC Price

In the last 24 hours, Bitcoin has experienced a approximately 3% price rise, reaching a new level of $70,900.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-06-05 18:05