As a seasoned researcher with over two decades of experience tracking market trends and observing the ebbs and flows of the financial landscape, I have witnessed more than my fair share of bull runs and bear markets. The current Bitcoin scenario is reminiscent of the dot-com bubble, where exuberance was met with a hard dose of reality.

Following a remarkable rise, Bitcoin encountered its initial significant downturn, dropping approximately 7% from its peak of $99,800. This slide follows an outstanding increase from $67,500 on November 5, which represented nearly a 50% jump in a short span of time. The price trend has mainly been moving upwards, sparking considerable interest among traders and investors alike.

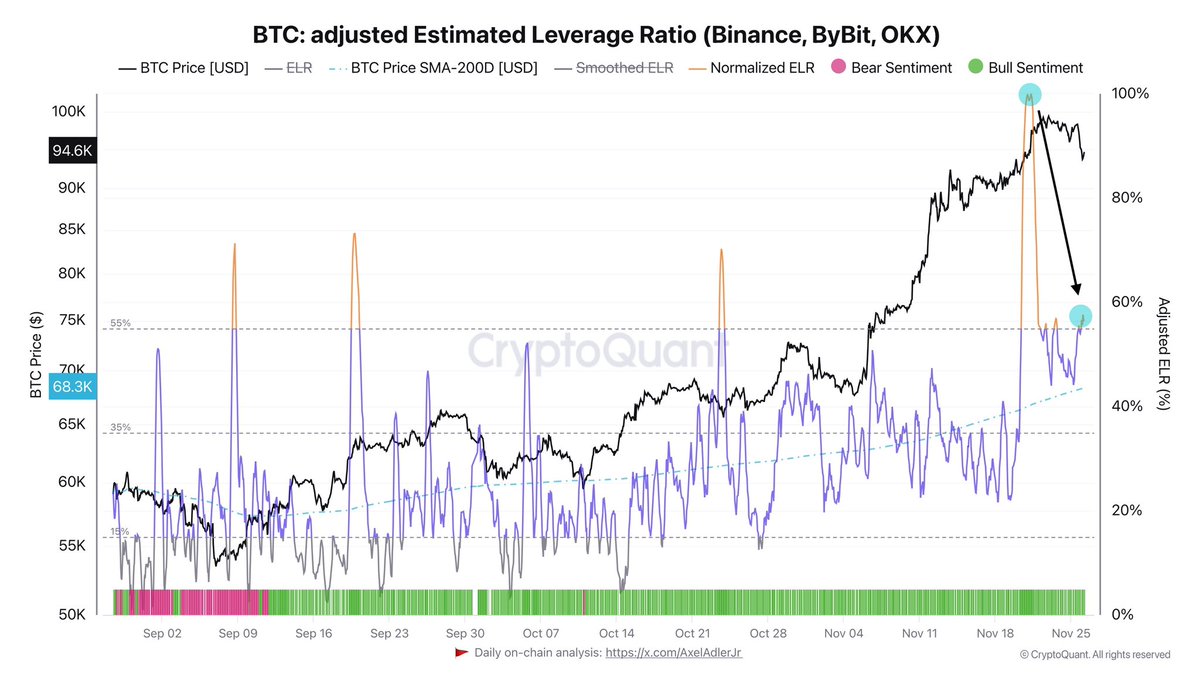

Nevertheless, the recent market retreat underscores a growing sense of apprehension. Despite attempts to reduce leverage, market anxiety persists as indicated by high levels of leverage. Adler’s analysis suggests that the surge in short positions and consolidation below the significant $100,000 threshold have played a role in this correction.

Although Bitcoin continues to perform well overall, this recent drop suggests a possible change in investor attitudes. It’s unclear if Bitcoin will build enough steam to surpass the $100,000 mark or if it will instead experience more stabilization in the near future.

Many investors consider this pullback a healthy pause in a bullish cycle, but the high leverage levels suggest continued volatility. All eyes are on Bitcoin as it navigates this critical phase, with the next few days likely to determine its short-term direction.

Bitcoin Bears Showing Up

Following nearly three weeks of scant opposition from bears, hints of their comeback start to appear as Bitcoin finds it challenging to surpass the $100,000 barrier. This crucial milestone, initially anticipated to serve as a launchpad for additional growth, has instead underscored a growing wave of pessimism among investors. As per CryptoQuant analyst Axel Adler, the recent market behavior might signal a change in momentum trends.

Adler’s examination of X shows that although there has been a recent trend of reducing debt, market leverage remains high. Important long positions were set up near $93,000, offering bears a chance to make money since Bitcoin didn’t manage to rise significantly. Now, this level serves as a contested area, with Bitcoin’s failure to maintain an upward trend suggesting the potential for additional downward movement.

The price of Bitcoin tends to stay near a significant point, increasing the chance that it will decrease toward approximately $88,500 or continue moving sideways below $100,000. This situation could influence Bitcoin’s behavior and determine how altcoins perform in the upcoming weeks.

Over the coming fortnight, Bitcoin’s price fluctuations will be critical to observe as they could significantly impact the overall cryptocurrency market. A clear trend, either an increase or decrease, may signal whether the current market movement is just a temporary halt in a larger bullish trend or the beginning of a more substantial bearish correction.

BTC Testing Fresh Demand

As a crypto investor, I’m observing that Bitcoin has dropped to $93,500 following a period where bears took over after it reached an all-time high last Friday. This dip indicates a change in momentum, but if the price can hold strong above the crucial support level of $92,000, it would keep the overall trend bullish and demonstrate Bitcoin’s resilience amidst increased selling pressure, potentially allowing the bulls to regain control again.

If Bitcoin continues to hold its position above $92,000, the short-term perspective stays positive, possibly leading to another effort at overcoming significant resistance points. Yet, falling below this level could indicate temporary vulnerability, potentially causing additional decreases. The vital area to monitor closely would be approximately $84,000, where the 4-hour 200 Exponential Moving Average serves as a potential support boundary.

This price point signifies a significant boundary for buyers. Dropping below it might intensify the downward trend, prolonging the correction and weakening market optimism. Conversely, staying above $92,000 would strengthen bullish conviction, preparing the ground for a rebound and a possible resurgence toward past peaks.

As a researcher, I’m intently observing the current levels, particularly the $92,000 mark for Bitcoin. If Bitcoin can sustain its position above this level, it suggests a continuation of the short-term bullish trend. However, if it falls below this point, it might indicate a shift towards bearish conditions.

Read More

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- Brody Jenner Denies Getting Money From Kardashian Family

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

2024-11-26 16:34