As a seasoned crypto investor with over five years of experience navigating the volatile cryptocurrency market, I find myself cautiously optimistic about the current state of Bitcoin. The recent price fluctuations have left me on edge, as I’ve learned time and again that no trend lasts forever in this realm.

This weekend, Bitcoin‘s price growth has eased off compared to its surge on Friday, October 4. Instead of building upon that momentum, it stayed near the $62,000 level, representing only a slight 0.3% dip over the past 24 hours.

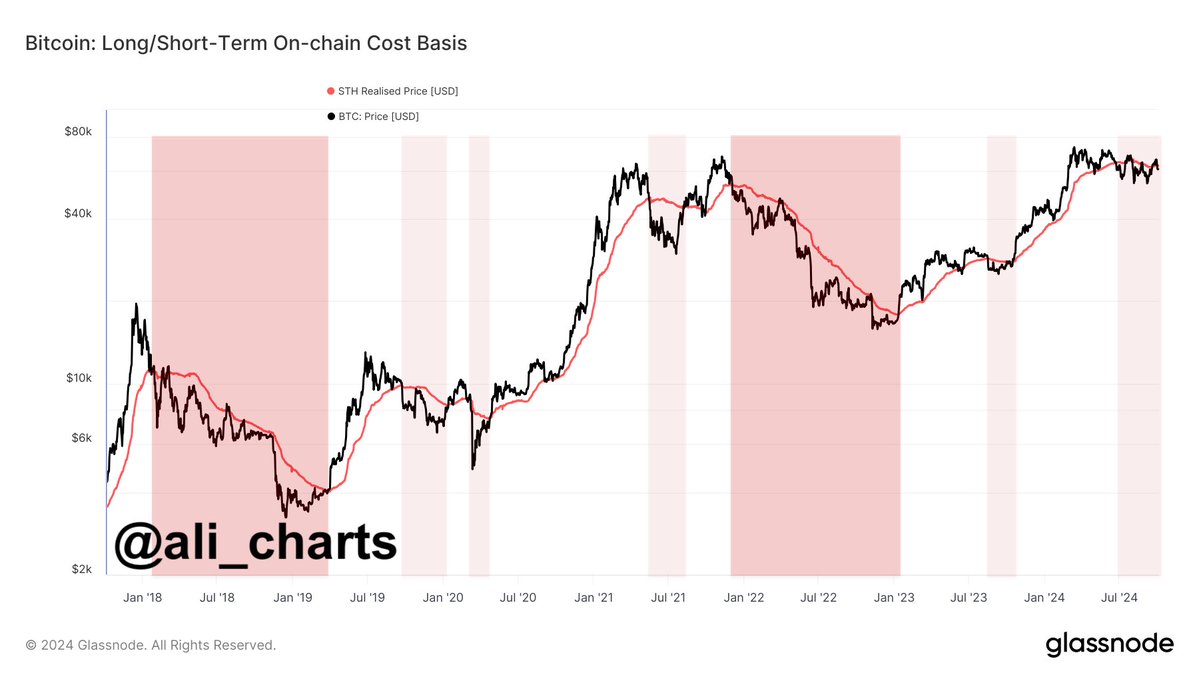

Current blockchain information indicates that Bitcoin’s price may persist in a slow trend, given that short-term investors are experiencing stress. In more detail, this dominant cryptocurrency is being traded below the average purchase price of these short-term holders (STH).

What Does This Mean For Bitcoin Price?

In his latest post on the X platform, crypto expert Ali Martinez disclosed that the short-term cost basis for Bitcoin is approximately $63,000. He explained how this price point could impact Bitcoin’s future stability, considering that the short-term holder realized price represents the average buy price for investors who have held their Bitcoin for a relatively short period.

As a researcher studying cryptocurrency markets, I’ve observed an intriguing pattern: When the current spot value of Bitcoin surpasses the average purchase price for short-term holders, it suggests that most recent investors are seeing profits (or ‘in the green’). This trend often sparks interest among traders to invest further, fostering a positive market atmosphere and possibly igniting an upward price trend.

Conversely, if the current price falls below the Short-Term High (STH), it suggests that many short-term investors are experiencing unrealized losses. In such a situation, some investors might choose to minimize these losses by selling their holdings. This action could put pressure on the price to decrease even more and potentially trigger additional sell-offs.

As per Martinez’s analysis, Bitcoin has been trading below the average purchase price of short-term holders since June. Given that the current short-term holder’s realized price stands at $63,000, there seems to be a potential for further drops in Bitcoin’s value, particularly in the immediate future.

BTC Holder Behavior Similar To 2016 And 2020

2024’s last quarter looks optimistic regarding Bitcoin’s price, as suggested by CryptoQuant’s recent weekly report. The behavior of current Bitcoin holders seems to resemble that from the 2016 and 2020 halving years, which could hint at possible price escalation for the market leader in the future.

According to the analysis by the firm specializing in on-chain data, an increase in Bitcoin held for short-term trading was observed following the debut of spot exchange-traded funds (ETFs) in early 2024. After this surge, there was a period of cooling down. However, CryptoQuant warned that another increase in short-term supply might happen—if past patterns persist.

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

2024-10-06 13:16