As a seasoned market analyst with over two decades of experience under my belt, I have witnessed numerous financial shifts and cycles, from the dot-com boom to the 2008 global financial crisis. In this context, Alex Krüger’s perspective on Bitcoin being in a supercycle resonates with me, especially given the unprecedented change we are currently experiencing within the crypto industry.

As an analyst, I find myself aligning with Alex Krüger’s viewpoint that Bitcoin might be in the midst of a supercycle. Krüger elucidated this opinion through X, underlining the unique path Bitcoin is following at present, contrasting it significantly with past market cycles.

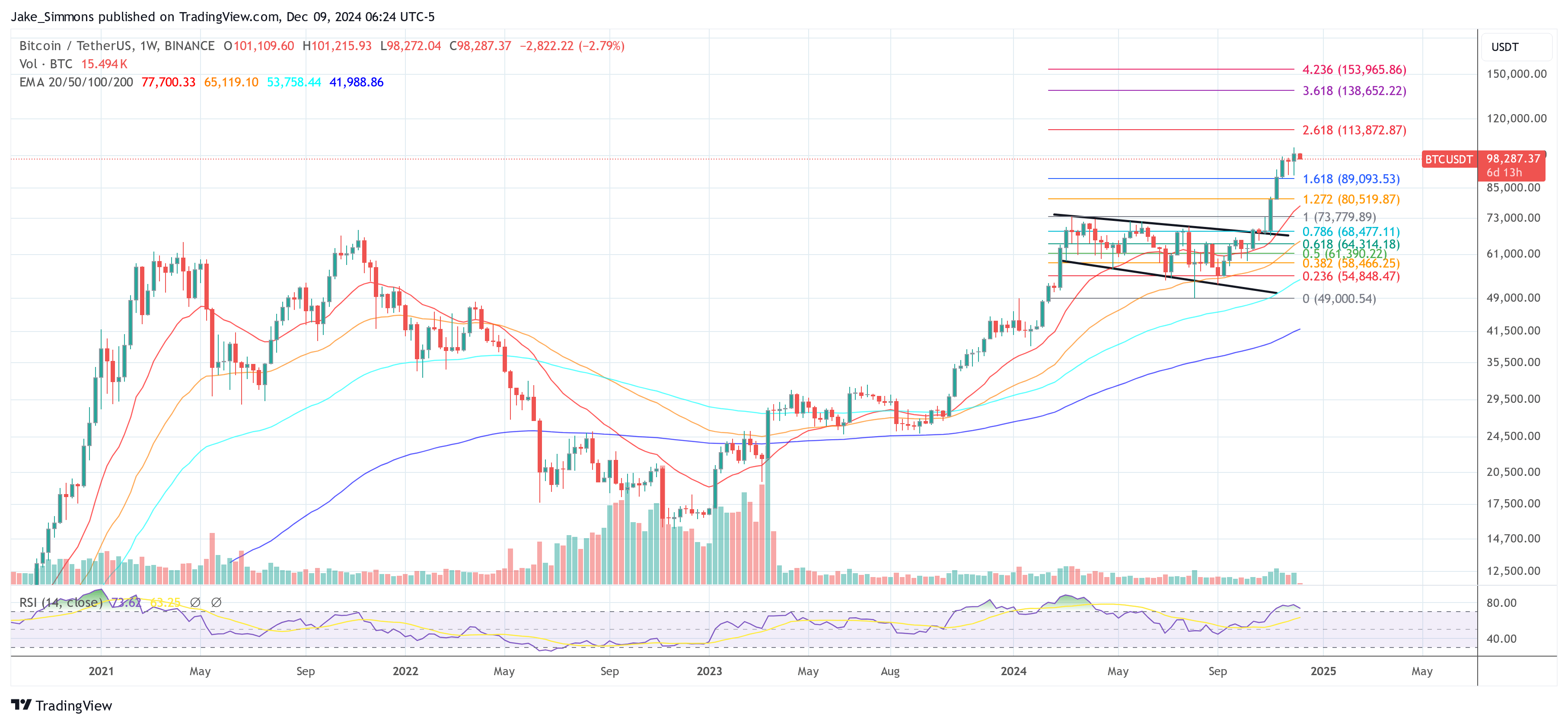

A Bitcoin supercycle refers to an extended period of substantial price increase for Bitcoin, surpassing its usual boom-and-bust cycles. This concept suggests a prolonged phase of growth primarily driven by increased mainstream adoption, leading to a much stronger and more persistent upward trend compared to the traditional four-year pattern of growth followed by Bitcoin during halving events.

Is Bitcoin In A Supercycle?

Referring to President-elect Donald Trump’s shift in support for Bitcoin and his proposal to create a strategic Bitcoin reserve, Krüger advised: “Don’t draw similarities with past cycles. It’s highly probable that we’re witnessing a supercycle for Bitcoin. The cryptocurrency sector has undergone its greatest transformation ever, marking a 180-degree reversal driven by fundamental changes,” the analyst emphasized.

Krüger additionally highlighted the swift evolution of the Bitcoin and cryptocurrency marketplace. He pointed out that this sector transformed “from a nearly illegal outcast scorned by the government, to one of the leading industries welcomed by the government” in a matter of weeks – a transition he deemed “so dramatic it’s challenging to find similar examples in contemporary history.

Reflecting on historical financial upheavals, I find myself drawing parallels between the transformative role of gold during the 1970s and potential future events in the cryptocurrency market. Just as gold skyrocketed from $35 per ounce to an astounding $850 in 1981 following Nixon’s abandonment of the Gold Standard in 1971 and the collapse of the Bretton Woods agreement, I believe that a similar event could propel certain cryptocurrencies to unprecedented heights. This is an intriguing thought as I ponder the future evolution of this exciting and dynamic market.

Krüger also touched upon when Bitcoin might reach its peak potential, reasoning that considering a significant local peak around March is plausible according to his past assessments. However, he cautioned that mistaking a major local peak for the start of a bear market would be an oversimplification. The likelihood of this peak depends on factors such as the rate of increase, funding rates, and overall economic conditions.

Although he acknowledged the potential for a market downturn, he strongly suggested that the necessary conditions for it haven’t materialized yet. He also warned against anticipating a peak too soon. Bitcoin bull markets tend to persist for several months, and it has only been 33 days since President Trump announced his cryptocurrency-related policies.

As a researcher delving into market sentiment, I can’t help but issue a word of caution: “Once everyone wholeheartedly agrees with what I’ve just shared, it might signal the peak.” This statement serves to emphasize the profound role psychology plays in shaping market behavior, often influencing when and how market peaks occur.

User Paradox Parrot (@Paradoxparrot) replied to Krüger’s statement, saying, “I concur. However, ‘this time is unique’ can be a trap that leads us back to the same point.” To this, Krüger admitted the recurring doubt about altcoins and explained, “Indeed, altcoins tend to return most of their value. That’s just how it works. It’s important to note that ‘this time has been different’ before on many occasions. I’ve been discussing and predicting this since mid-2023. By the way, altcoins cycle down due to two main reasons: A) a lack of demand driven by strong fundamentals. More significantly, B) illiquidity, which also explains why they spike so dramatically.

Although Krüger maintains a positive perspective, not all specialists agree with the supercycle theory. Chris Burnsike, a partner at Placeholder VC, presented a different perspective on X on December 7: “Mark it for future reference: there’s no such thing as a supercycle – everything is cyclical, but cycles can differ. […] Believing in the concept of a supercycle means you never sell and go round-trip. Just ask anyone who didn’t sell in 2021.

At press time, BTC traded at $98,287.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

2024-12-09 19:16