As a seasoned crypto investor who has weathered countless market cycles and navigated through the crypto wilderness since its inception, I must admit that Bitcoin‘s recent surge has brought a renewed sense of excitement and anticipation. The swift rally on Christmas Eve, breaking through key resistance levels, is reminiscent of the early days when BTC was still the Wild West frontier.

On Christmas Eve, Bitcoin thrilled investors with a significant jump, moving from $92,300 to an intraday peak of $99,400. This rapid ascent has sparked optimism among traders, suggesting that Bitcoin has the power to surpass the symbolic $100,000 mark. Investors are now eagerly watching Bitcoin’s next steps, hoping for continued growth in the near future.

As a crypto investor, I recently came across an insightful technical analysis by top analyst Carl Runefelt on digital currency X. He pointed out that Bitcoin (BTC) has been forming a symmetrical triangle on the hourly timeframe, which is typically a sign of consolidation before a substantial breakout. Runefelt’s prediction is that BTC is about to experience such a move, and a confirmed break above this triangle could send Bitcoin into new price territory, potentially setting off further gains and representing a crucial turning point in its current market cycle.

The high demand and favorable technical indicators suggest that Bitcoin’s journey towards $100,000 is becoming more obvious. Yet, traders are staying vigilant because volatility might influence short-term movements. The spotlight is on Bitcoin as it moves into a crucial stage, with investors closely watching for signs of another phase in its remarkable bull market.

Bitcoin Looks Ready To Rally Again

Bitcoin seems poised for another price surge, continuing to exhibit a bullish pattern by holding key support zones. This tenacity suggests that the market believes Bitcoin can regain its value of $100,000 and potentially reach even higher prices, as experts and investors keep a close eye on its movements to validate this prediction.

Top analyst Carl Runefelt recently shared an insightful technical analysis on X, highlighting a symmetrical triangle pattern on Bitcoin’s hourly chart. Symmetrical triangles often indicate a period of consolidation before a breakout, and Runefelt suggests that BTC is poised to break upward.

He also pointed out that the figure of $100,700 is crucial; if it’s exceeded, it could suggest robust bullish energy, possibly propelling Bitcoin towards unprecedented record highs. On the flip side, a dip to $95,200 might indicate weakness, hinting at an imminent bearish shift in the near future.

Runefelt’s assessment aligns with widespread trader opinion that Bitcoin’s current period of holding steady is a sign of upcoming major increases. If Bitcoin manages to break free from the triangle, it might spark a flurry of buying, potentially pushing the price into new regions not seen before. But, if it can’t maintain momentum beyond crucial thresholds, this could result in increased volatility, making the bullish forecast for Bitcoin more challenging.

Currently, the top cryptocurrency maintains its position steadily, with everyone watching the crucial $100,700 threshold. Should Bitcoin manage to surpass this resistance level, it could trigger the next stage of its upward trend, further confirming its status as the powerful leader in the crypto sector.

Price Action: Key Levels To Watch

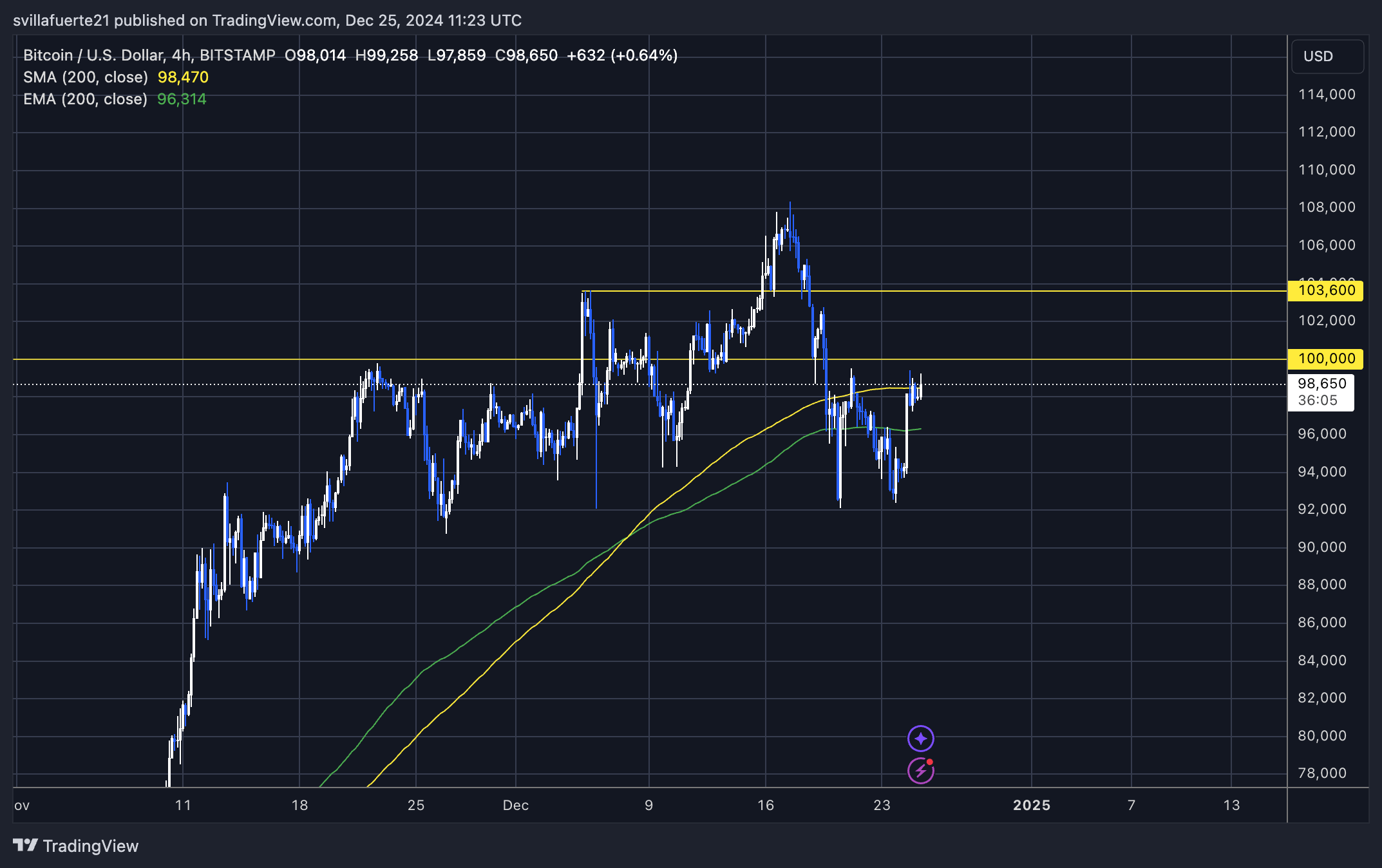

At present, Bitcoin is being traded around $98,400, representing a substantial 7% increase from its recent minimal points of $92,000. This upward trend suggests a return of bullish sentiment, as the price regained the crucial 4-hour 200 Exponential Moving Average (EMA), a significant marker of short-term strength. Currently, Bitcoin encounters a major challenge as it endeavors to surpass the 4-hour 200 Moving Average (MA), which stands at $98,470.

Recovering the 200 Moving Average (MA) would strongly suggest that Bitcoin’s upward trend is secure, possibly sparking intense buying sprees to drive the price beyond the significant $100,000 barrier. Clearing this hurdle wouldn’t just bolster investor confidence but could also initiate additional bullish momentum, propelling Bitcoin towards new record highs.

From another perspective, not recovering the 200 Moving Average might cause Bitcoin to stay below $100,000, resulting in a phase of unchanging prices. Traders would then be on the lookout for new triggers to decide the next direction.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- All Elemental Progenitors in Warframe

- How to get all Archon Shards – Warframe

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

2024-12-25 20:46