As an analyst with over two decades of experience in the financial markets, I find myself intrigued by the current state of Bitcoin, particularly as we enter October – a month historically associated with bullish trends for the cryptocurrency. However, the recent price decline and the subsequent cautious approach taken by investors have left me questioning whether this year’s October will live up to its reputation.

Contrary to the optimistic views about Bitcoin, it started October with a pessimistic trend, dropping by more than 7% in its first three days. Yet, there was a minor recovery on Friday, following news from the US Labor Department suggesting interest rate reductions. Still, most investors seem to be adopting a cautious stance.

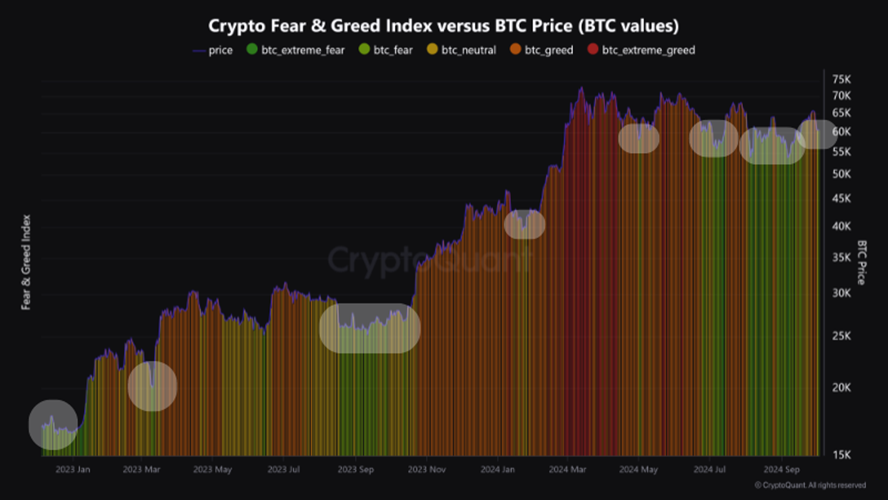

Bitcoin Fear And Greed Index Touches 37 As Investors Become Uncertain

In a Quicktake post on CryptoQuant, an analyst with username maartunn shared that the Bitcoin Fear and Greed Index currently signals fear following the asset’s recent price slump

As an analyst, I examine the Fear and Greed Index, a tool that gauges the emotional state, attitudes, and actions within the cryptocurrency market, while also forecasting possible trends based on investor feelings. This index functions on a scale of 0 to 100; readings above 50 indicate greed, with values exceeding 74 indicating extreme greed. Conversely, numbers below 50 signal fear, and those under 24 represent extreme fear.

Based on maartunn’s analysis, the Fear and Greed Index currently stands at 37, suggesting that numerous investors are hesitant about incorporating the primary cryptocurrency into their investment portfolios due to fear. Notably, each time the Fear and Greed Index has dropped to this level since 2023, Bitcoin’s price has typically marked a bottom – the lowest point during a price drop – and is poised for an upward trend or reversal.

On Friday, Bitcoin demonstrated an uptrend after a downward trend at the start of October. Yet, it’s important to note that this might not signal the end of the price drop since the cryptocurrency’s daily chart indicates it remains above its next crucial support level, which follows several months of fluctuation between $55,000 and $70,000.

If it’s assumed that the leading cryptocurrency has reached its lowest point, there’s a possibility it may experience a price surge, aligning with the widespread anticipation for a bullish “uptober”. Notably, October has historically been the month with the highest frequency of bullish trends for Bitcoin, resulting in an average increase of approximately 22.90% over the past 11 years.

Dominant Activity Of Stablecoins Supports Fear And Uncertainty Among Investors

Beyond the Bitcoin Fear and Greed Index reading 37, it’s worth noting that there’s been a rise in trading activity for stablecoins like Tether USD (USDT) and USD Coin (USDC) within the crypto market.

As a crypto investor, I’ve noticed a trend lately where investors are choosing to invest in less volatile assets rather than risky coins like Bitcoin. This shift is largely due to uncertainty and fear of an impending price crash. According to CryptoQuant analyst BaroVirtual, this fear stems from several factors: a weak retail market participation, escalating geopolitical tensions in the Middle East, and the Securities and Exchange Commission’s hesitation to launch a Spot Ethereum ETF Options.

Currently, as I speak, Bitcoin is being traded at approximately 62,071 dollars after a 2.17% increase in the past day. Simultaneously, its daily transaction volume has decreased by 17.91%, with a value of around $29.71 billion.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2024-10-06 05:10