As a researcher with experience in the cryptocurrency market, I believe that Bitcoin’s recent decline below the $60,000 support level is not cause for alarm. Based on historical data and analysis from industry experts, this price movement is considered normal and to be expected during a bull market cycle.

As a crypto investor, I’ve witnessed a significant drop in Bitcoin‘s price on Wednesday, falling below the vital $60,000 support level. However, despite this recent market downturn, my confidence as an investor in Bitcoin remains unshaken. I firmly believe that the flagship crypto has the potential to reach new heights during this market cycle. Some experts even suggest that this decline might be exactly what Bitcoin needs before making another breathtaking surge towards higher prices.

Bitcoin’s Decline Is Nothing To Be Scared Of

As a crypto investor, I’d like to share some reassuring words from Raoul Pal, the CEO of Real Vision. In a recent post on X (previously known as Twitter), he eased concerns over Bitcoin’s recent price drop by emphasizing that it’s “nothing out of the ordinary.” He also highlighted that this was Bitcoin’s fourth significant correction within the past year, emphasizing the normalcy of such price fluctuations.

Recent Trend: Cryptocurrency Funds Experience Third Successive Week of Redemptions Totaling $435 Million

Alex Thorn, the Head of Research at Galaxy Digital, had previously expressed this warning: “Bull markets don’t advance in a steady upward trajectory.” He pointed out that similar price drops occurred during the 2021 and 2017 Bitcoin rallies, with each instance seeing approximately 13 price decreases exceeding 10% or more.

According to crypto analyst Rekt Capital in recent posts, this prolonged period of price stagnation in the cryptocurrency market is necessary for Bitcoin to align with historical pricing trends and the traditional Bitcoin Halving Cycle. He further believes that the longer this phase lasts, the more beneficial it will be. In another post, he encouraged his followers by stating that Bitcoin is approaching its final low point with each passing day.

Just like Rekt Capital, crypto analyst Mikybull Crypto expressed certainty that Bitcoin’s recent dip in price was simply a necessary component of its broader upward trend, which they believed would culminate in a peak for the current market cycle. In other words, this downturn could be considered the last major correction before a significant price increase.

Thomas Fahrer, the CEO of Apollo, expressed his optimistic viewpoint on Bitcoin. He believes that the cryptocurrency’s volatility is what makes it an attractive investment. “The price could dip to $40K, but it could surge to $400K. It’s unpredictable by nature, and that’s what makes Bitcoin a fantastic wager,” Fahrer wrote on platform X.

Bitcoin Bull Run Is Far From Over

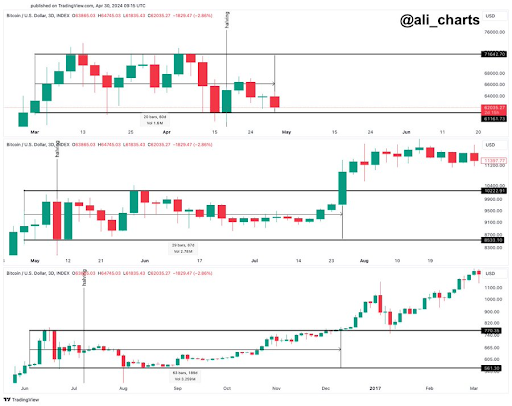

As a researcher studying cryptocurrency markets, I’ve observed Bitcoin analyst Ali Martinez’s perspective on the ongoing bull market. He draws parallels between Bitcoin’s current price action and the two previous halving events that occurred in 2016 and 2020. After each halving event, Bitcoin underwent a consolidation period for approximately 189 days in 2016 and 87 days in 2020 before experiencing renewed growth.

The expert commented that Bitcoin has been holding steady for 60 days in this particular rally. Consequently, he anticipates that Bitcoin’s price surge will resume eventually. In a later Reddit post, the analyst suggested that based on historical trends from past bull markets, Bitcoin could be approximately 538 days away from reaching its next peak price.

Related Reading: Ethereum Flashes Bullish Signals, Can It Rally 50% From Here?

As a crypto investor, I’ve previously heard Martinez predict that Bitcoin could reach a new record price of $92,190 once it surpasses the current resistance level of $69,150.

Currently, Bitcoin is priced approximately at $59,600 based on information from CoinMarketCap, representing a decrease of more than 5% within the past 24 hours.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

2024-05-02 05:23