As a seasoned crypto investor with over five years of experience navigating through the rollercoaster ride that is the cryptocurrency market, I find myself standing at a familiar crossroads – one of cautious optimism and calculated risk-taking. September has historically been a month of moderate losses for Bitcoin, and this year seems to be following suit. However, the unusual drop in buying interest amidst these price declines is intriguing.

To begin September, Bitcoin market is experiencing substantial setbacks following a 9.16% drop over the past week as reported by CoinMarketCap. During this timeframe, the value of Bitcoin has dropped below $53,000, a price level not seen since early August. Interestingly, even with low Bitcoin prices, there seems to be an unexpected decrease in investor demand for purchasing it.

Investors Hold Back On Bitcoin Accumulation – What Could Be Behind It?

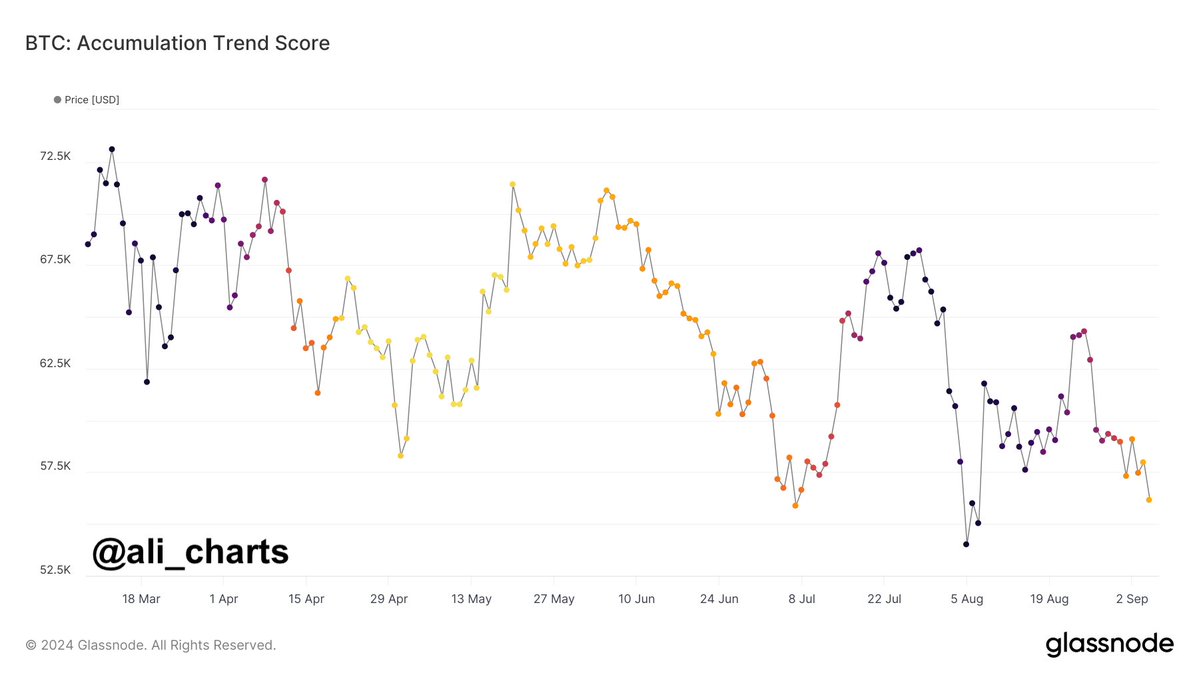

In a recent post on Friday, Ali Martinez pointed out that the Accumulation Trend Score (ATS) for Bitcoin was approaching zero. To clarify, the ATS gauges the equilibrium between buying and selling actions in the Bitcoin market. According to Martinez’s explanation, a score close to 0 indicates that Bitcoin investors might be either selling off their assets or actively buying the leading cryptocurrency.

This downward trend in buying interest, occurring during Bitcoin’s price drop, might seem peculiar but presents a chance to acquire tokens at reduced prices through dollar-cost averaging methods. One possible explanation for this decline could be that investors anticipate the Bitcoin market hasn’t yet reached its lowest point, creating an attractive entry opportunity.

It’s worth noting that Arthur Hayes, one of the co-founders of Bitmex, anticipates that Bitcoin might drop below $50,000 over the coming weekend due to its current slump in value. However, Hayes hasn’t specified a particular support level for the cryptocurrency at this point.

What’s Next For Bitcoin?

As a researcher studying the crypto market, I can’t help but find it predictable that Bitcoin has begun September on a bearish note. After all, if we look back at its past performances over the last 11 years, it’s averaged a loss of about 4.78%. Given that it dropped by almost 10% in just the first week, it seems plausible that Bitcoin might suffer a double-digit loss by the end of this month, as was the case in both 2014 and 2019.

Given the recent Non-Farm Payroll data indicating a 142,000 rise in U.S. jobs and an employment rate of 4.2%, Citi analysts had earlier forecasted that the US Federal Reserve might reduce interest rates by 25 to 50 basis points during their meeting on September 18.

Should this prediction hold up, there’s a possibility that Bitcoin might experience an increase in its value during the later stages of September and carry over into October. This is based on past trends, as the cryptocurrency market leader has historically shown significant double-digit price growth around this time frame.

presently, Bitcoin was being exchanged for approximately $53,855, marking a decrease of 4.13% over the past 24 hours. Simultaneously, its daily trading volume has increased by 58.82%, currently standing at around $49.3 billion.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-09-07 17:46