It’s likely that the new Trump Administration will be favorable for Bitcoin and the broader crypto market. Yet, this week’s market fluctuations and a temporary dip below $90K have brought attention to an important short-term risk factor worth monitoring – the short-term Bitcoin holders (STH).

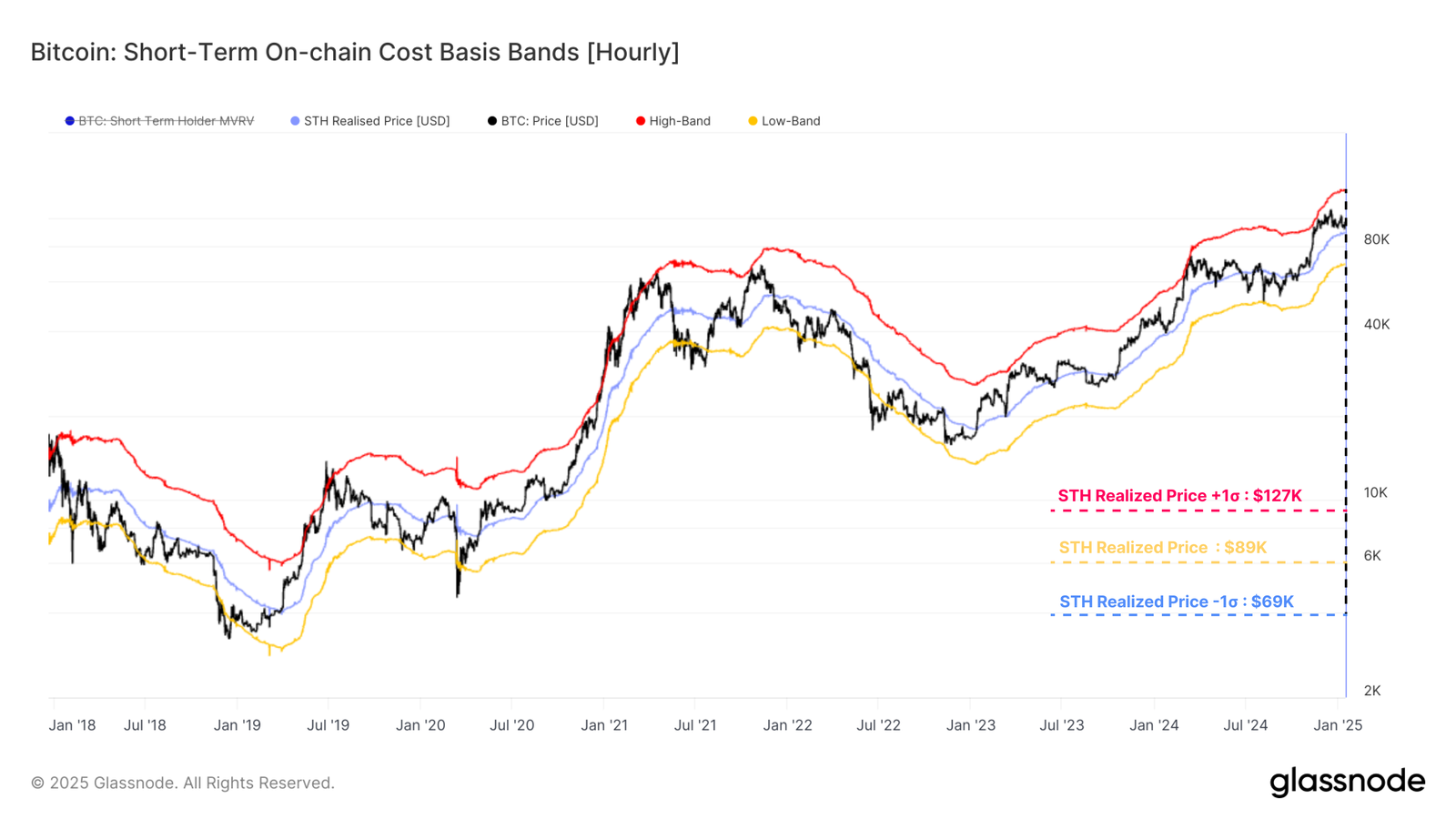

These investors have been holding Bitcoin for approximately 6 months, with the average price at which they acquired it serving as a crucial support level for its value. Here’s a breakdown of their holdings:

– Bitcoin: $99,790

– 24h volatility: 0.4%

– Market cap: $1.98 trillion

– 24h volume: $55.82 billion

Their cost basis, or the average price they paid for their Bitcoin, has proven to be a significant factor in maintaining its value.

Furthermore, their profitability significantly affects the market because they can choose to sell at a loss if the price drops below their initial investment. This tactic was evident during the downward spiral on both August 5th and December 5th, leading to a decrease in BTC‘s value.

According to Glassnode, Bitcoin’s realized price stands at approximately $88,400, which is quite close to the lowest point of $89,250 seen on January 13th. In simpler terms, if Bitcoin can maintain its value above this level for a prolonged period, it could signal a continuation of an upward trend.

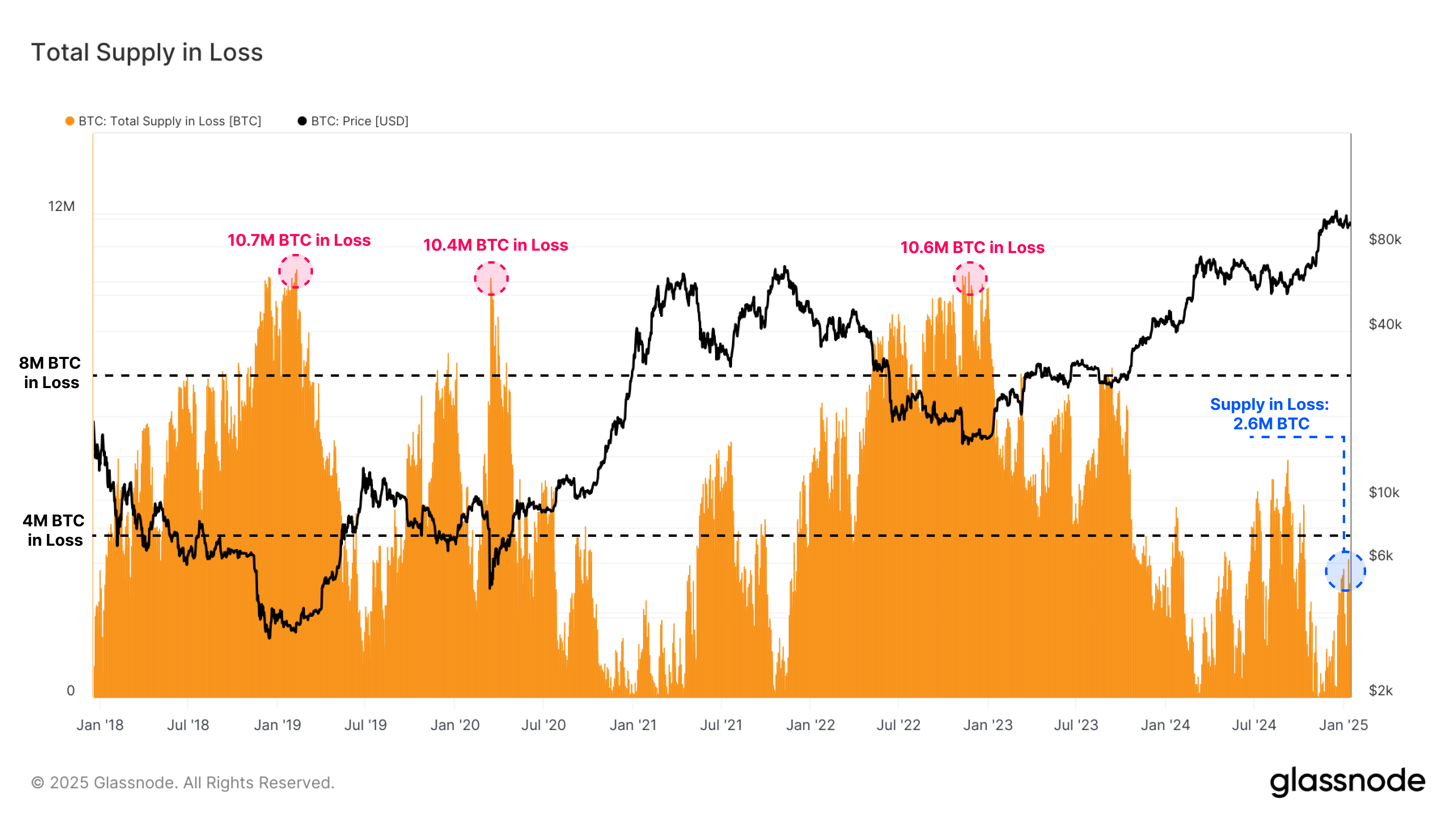

Over 2 Million BTC underwater

According to Glassnode’s analysis, the recent market fluctuations have caused around 2 million to 3.6 million Bitcoin held by STH to fall below their purchase price. Nevertheless, it’s important to note that these numbers are below a significant historical benchmark, which means they don’t necessarily signal an immediate concern.

Although this range is substantial, it’s worth noting that it’s smaller than the 4 million coins lost during the market low between July and September 2024. This implies that the current market condition might be less strained compared to the previous correction period, as suggested by Glassnode.

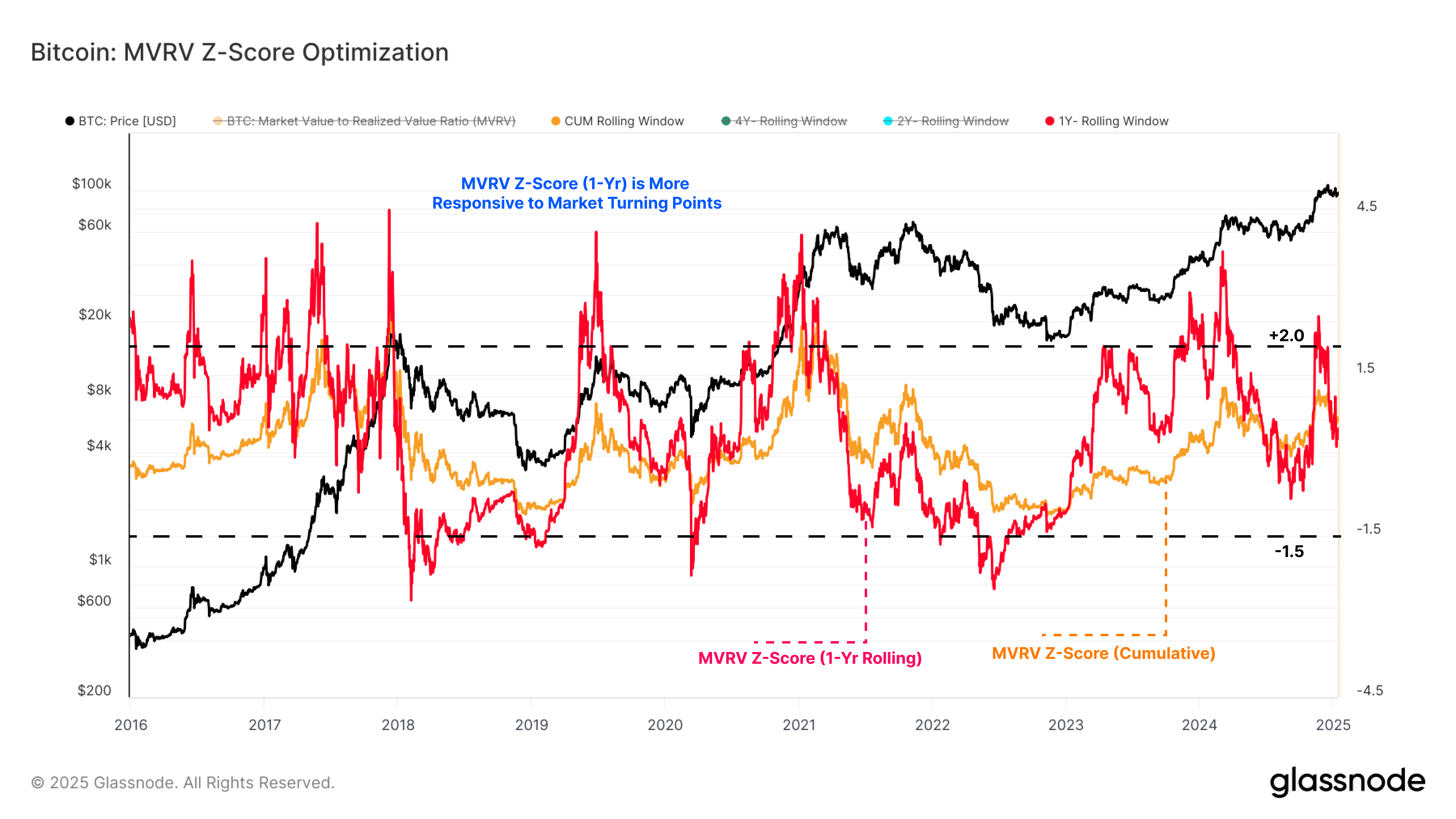

- That said, analysts expect a surge to $118K in the medium term, which could bring most of STH BTC back to profit. The optimism was also supported by the MVRV-Z score (1-year-rolling), a valuation and market cycle indicator.

As an analyst, I’ve observed that the specified metric, when it surpassed the 2 threshold, served as a warning for both local and cycle peaks in Bitcoin. This occurred in March, when BTC reached $73K, and again in December, when it peaked at $108K.

At the moment, the indicator is moving beneath 1.5, implying there might be ample space for Bitcoin (BTC) to escalate further before reaching a local or cycle top. In other words, this trend suggests that BTC could be currently underpriced compared to its market value.

Keep in mind that even though Bitcoin (BTC) has promising growth possibilities, if its price falls below the break-even point of $88.4K, it might dampen the current optimistic outlook in the market. Therefore, it’s essential to monitor this as a precautionary measure for risk management purposes.

Currently, I find myself observing Bitcoin at a value of approximately $99,900 at this moment in time. This figure represents a modest 7% gap when compared to its all-time high of $108,300.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

2025-01-16 22:36