As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I find myself constantly intrigued by the enigma that is Bitcoin. The current state of the market, as indicated by the Fear & Greed Index, is a fascinating study indeed. With the index hovering around 50, we are witnessing a neutral sentiment among investors – a state of indecisiveness that could potentially lead to either direction.

The data indicates that at present, the feelings among Bitcoin traders lean towards ambiguity, suggesting that investors are uncertain about whether the cryptocurrency will rise or fall.

Bitcoin Fear & Greed Index Is Right In The Balance Right Now

The “Fear & Greed Index,” developed by Alternative, serves as a gauge, reflecting the overall mood or sentiment of traders within the Bitcoin and broader cryptocurrency marketplaces.

As a crypto investor, I’m always keeping an eye on this index that measures the overall sentiment in the crypto market. It takes into account five key factors: trading volume, volatility, the size of each coin’s dominance in the market, social media buzz, and Google search trends. This index then converts all that data into a score from zero to hundred, making it easy for me to quickly understand the current sentiment.

If the metric exceeds 53, it signifies that investors are currently feeling greedy. Conversely, when the indicator falls below 47, it indicates a predominant fear among investors. In areas between these thresholds, the sentiment tends to be neutral.

Now, here is how the latest value of the Bitcoin Fear & Greed Index has been like:

From what you see, the indicator currently stands at 50, suggesting that the market mood is perfectly balanced right now. Moreover, it’s important to note that this neutral state isn’t just a recent development; over the weekend too, the metric indicated a balanced market.

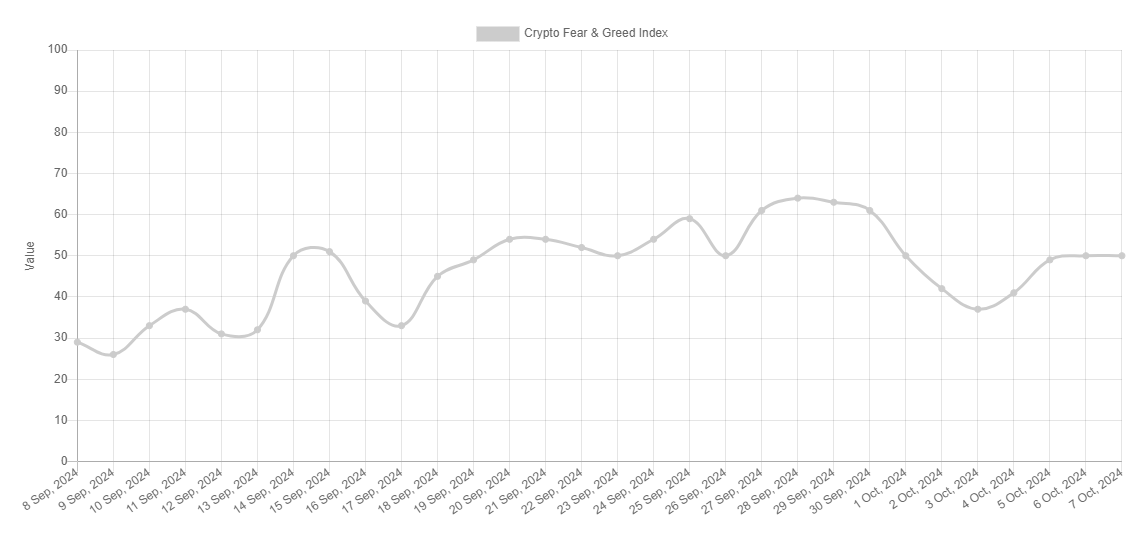

The below chart shows how the index’s value has changed over the past month.

Looking at the graph, it’s clear that the Bitcoin Fear & Greed Index moved into the ‘fear’ zone during the first part of this month. This shift was likely due to the overall bearish trend that the market has experienced recently.

Despite the recent market drop, the traders didn’t appear overly anxious because the indicator merely dipped to a minimum of 37. However, with the subsequent price increase, the overall mood among traders has positively shifted and is now at a 50 level.

Despite October often being referred to as ‘Uptober’ due to Bitcoin typically performing well during this timeframe, it appears that the market has yet to be swayed by greed at present.

Given that investors remain impartial even as a potential bull market appears to be gaining momentum following the recovery, it seems they are presently cautious and not easily enthused by the idea of an upcoming surge.

Historically, Bitcoin’s price trend has often gone against what most people expect. When there’s a lot of optimism and bullish sentiment, it usually signals a downturn in the future. However, with current investors showing less excitement, this could unexpectedly foster Bitcoin’s growth instead.

BTC Price

Earlier today, Bitcoin surpassed the $64,000 mark, but later on, there seems to be a retreat as its current price stands at around $63,600.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-10-08 09:40