As a seasoned crypto investor with a knack for deciphering market trends and a penchant for on-chain data analysis, I find the recent bearish signal given by the Bitcoin MVRV Z-Score intriguing. Historically, this crossover has served as a potential warning sign, but it’s not always a definitive red flag.

The current reading of the Bitcoin Market Value to Realized Value (MVRV) Z-Score suggests a bearish trend in the Bitcoin market.

Bitcoin MVRV Z-Score Has Seen A Bearish Crossover Recently

In a recent article on X, Axel Adler Jr from CryptoQuant has delved into the current movement in the Bitcoin MVRV Z-Score. This MVRV Z-Score is a tool that calculates the gap between the total value of BTC in the market and its realized value, then averages this figure by the standard deviation of the market cap.

In simpler terms, the market capitalization refers to the total worth of a cryptocurrency at its current price point. On the other hand, the realized capitalization is a method based on blockchain data that evaluates the value of the coins differently.

Instead of considering the current price uniform across all coins, it employs the latest transaction price on the blockchain as the unique value for each coin.

Because the last transaction involving a coin probably marked its previous ownership change, the price at that moment serves as its current purchase price. As a result, the realized capitalization (cap) is simply the total of the purchase prices for all coins currently in circulation.

An alternative way to perceive this total amount is as a representation of the investors’ investment in cryptocurrency. By comparing the current market value (which simply reflects the investors’ current capital) with their original investment through the MVRV Z-Score, we can determine the level of investor profitability.

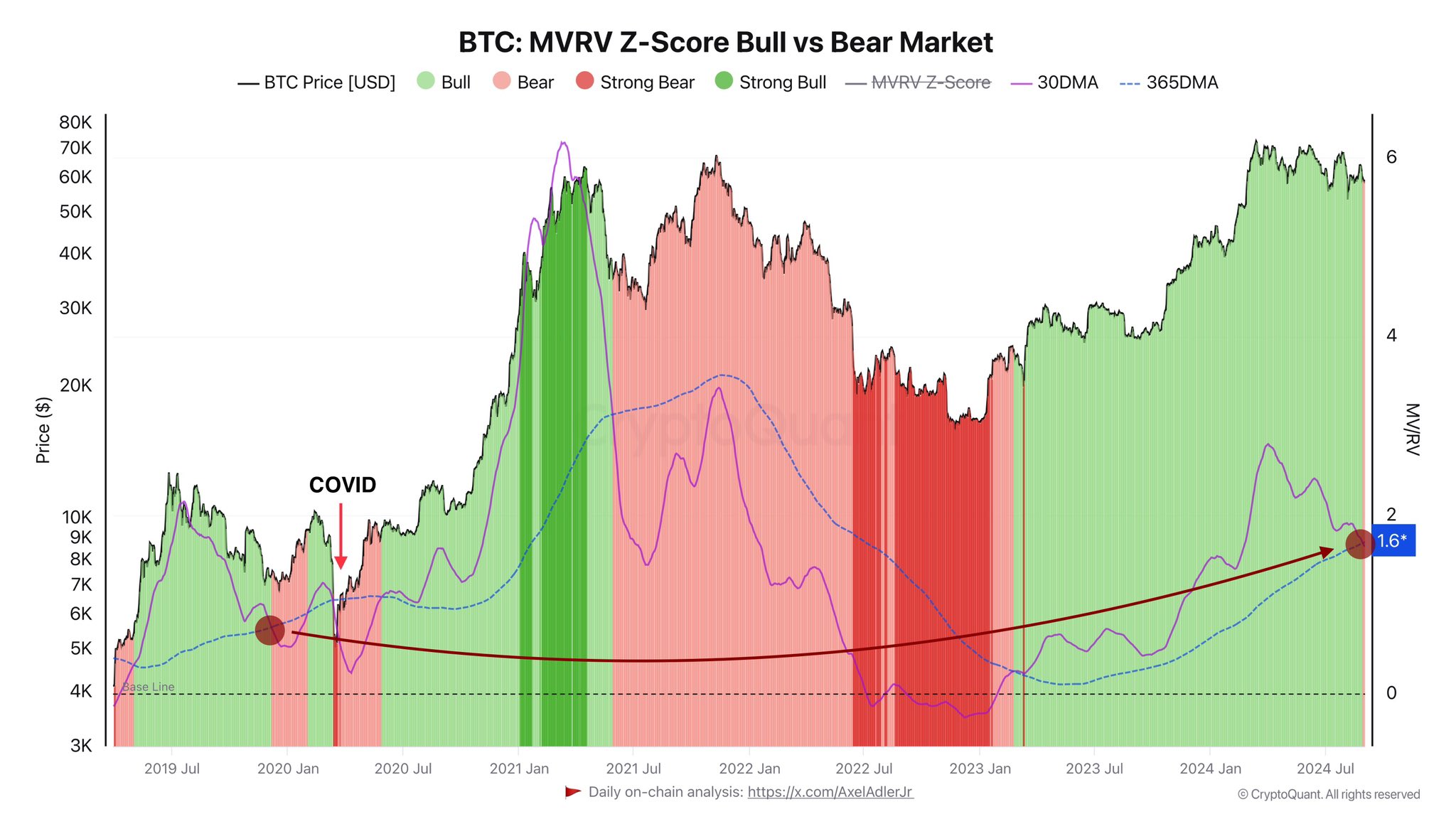

The analyst has provided a graph illustrating the pattern in the 30-day and yearly moving averages (MAs) for this Bitcoin measure during recent years.

Looking at the graph, it’s clear that the 30-day Moving Average of the Bitcoin MVRV Z-Score has been lower in more recent periods, implying a decline in investor profitability.

As a researcher, I’ve noticed a concerning dip that’s taken my moving average (MA) below the 365-day mark. This downturn indicates that the MVRV Z-Score’s average value over the past month has fallen lower than it was for the entire previous year.

In the given chart, the creator of CryptoQuant marks certain areas for an indicator using patterns from these two lines. Traditionally, when the 30-day Moving Average drops below the 365-day, it indicates a potential bearish period for Bitcoin (shown in a light red color).

Remarkably, a similar bear market signal occurred in January 2020, following a cooling-off phase from the 2019 rally. This bearish phase was then followed by another entry into the bull territory (light green), but an unanticipated COVID-19 crash reset the market again before the true bull market commenced.

Although the recent MVRV Z-Score signal might indicate a shift from the ongoing Bitcoin bull market to a bear market in this cycle, it’s equally plausible that it could instead function as a rejuvenating reset, paving the way for an impressive bull run similar to what we witnessed in January 2020.

BTC Price

At the time of writing, Bitcoin is trading at around $57,700, down more than 6% over the past week.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-09-04 12:41