As a researcher with several years of experience in studying market trends and sentiment analysis, I find the current state of the Bitcoin Fear & Greed Index to be of significant concern. The index’s extreme greed territory value of 77 suggests that investors are feeling extremely greedy at the moment, which historically has been a sign of potential market reversals.

As a crypto investor, I’ve noticed with great interest that the data indicates a significant surge in investor sentiment towards cryptocurrencies, specifically Bitcoin. This shift towards extreme greed suggests that many investors are feeling overly optimistic about the future price movements of Bitcoin. However, experience tells me that such exuberance can sometimes lead to less than ideal market conditions. It’s essential to remember that markets often correct imbalances, and a sudden change in sentiment could potentially result in a correction or pullback. As always, it’s crucial to approach the crypto market with a well-thought-out strategy and risk management plan in place.

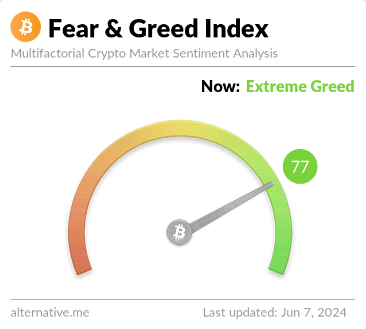

Bitcoin Fear & Greed Index Is In The Extreme Greed Territory Right Now

The “Fear & Greed Index,” devised by Alternative, monitors and quantifies the prevailing emotions among Bitcoin and cryptocurrency traders – be it fear or greed.

As an analyst, I would describe it this way: The index assigns a numerical value between 0 and 100 to convey the intensity of this sentiment. To determine the score, it evaluates five key factors: the degree of price fluctuations (volatility), the amount of trading activity, public perception as reflected in social media, the market capitalization influence, and the popularity trend as indicated by Google Trends.

As an analyst, I would interpret the Fear & Greed Index in this manner: When the Index exceeds 54, my perspective as an investor is one of greed, suggesting a potential overbought market. Conversely, when the Index falls below 46, my outlook becomes fearful, possibly indicating an oversold market situation. The zone between these two thresholds represents a more neutral stance towards market conditions.

Beyond the three fundamental emotions, the index features two distinctive areas: “extreme greed” and “extreme fear.” These emotions manifest when the measurement exceeds 75 for extreme greed, and drops below 25 for extreme fear.

Currently, the emotion in the Bitcoin market can be described as follows according to the Fear & Greed Index:

From my perspective as an analyst, the current reading of the Bitcoin Fear & Greed Index stands at 77. This indicates that collectively, investors are exhibiting intense feelings of greed towards Bitcoin.

The current market situation implies that we’re barely within this zone. Previously, the indicator showed a smaller value, but recently, the stock price exceeding $71,000 triggered a significant influx of investor interest, making them hop aboard the bullish trend.

Below is a chart showing how the sector’s sentiment has changed over the past year.

The graph indicates that the most recent readings of the Cryptocurrency Fear & Greed Index have reached their peak levels since the beginning of April’s first half.

As a researcher analyzing this data, I’ve noticed that the indicator only entered the “extreme greed” zone on two occasions, with the other instance being in May. At that time, the metric reached its peak at 76, which was just at the boundary of the region under consideration.

Historically, the price of Bitcoin has often gone against the grain of popular belief. The more firmly entrenched an expectation becomes among the majority, the greater the likelihood that a price movement in the opposite direction will transpire.

In simpler terms, when the market becomes excessively emotional at its extremes, whether through intense fear or excessive greed, it often signals a potential shift in direction. These emotional peaks represent good opportunities for reversals, with bottoms typically forming during periods of extreme fear and tops occurring due to extreme greed.

The recent surge into excessive greed could potentially dampen the ongoing market recovery. However, it’s important to mention that the current gauge reading is not extraordinarily elevated when compared to past bull markets. For instance, the rally leading up to the new record high price in March reached a peak of 90 on the indicator.

BTC Price

So far in its recovery run, Bitcoin has risen towards the $71,500 level.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

2024-06-07 22:17