As a seasoned researcher with a keen interest in cryptocurrencies and market psychology, I find the current state of Bitcoin fascinating. The Fear & Greed Index is a unique tool that provides insights into trader sentiment, and its current value of 34, indicating fear, aligns with my observations from the field.

The data indicates that Bitcoin investors are still experiencing apprehension, with the currency’s value remaining relatively stable.

Bitcoin Fear & Greed Index Is Currently Pointing At ‘Fear’

The “Fear & Greed Index,” developed by Alternative, offers a quick glimpse into the overall mood or sentiments of traders predominantly within the Bitcoin and broader cryptocurrency marketplaces.

To ascertain the sentiment, the index analyzes information associated with these five elements: volatility, trading activity, public opinion on social media, market share influence, and Google search trends. This analysis is expressed as a score ranging from zero to one hundred.

When the value exceeds 53, investors tend to exhibit an excessive desire for gain, often referred to as greed. Conversely, if the value is below 47, it suggests that fear predominates in the market. The area between these two thresholds represents a neutral sentiment.

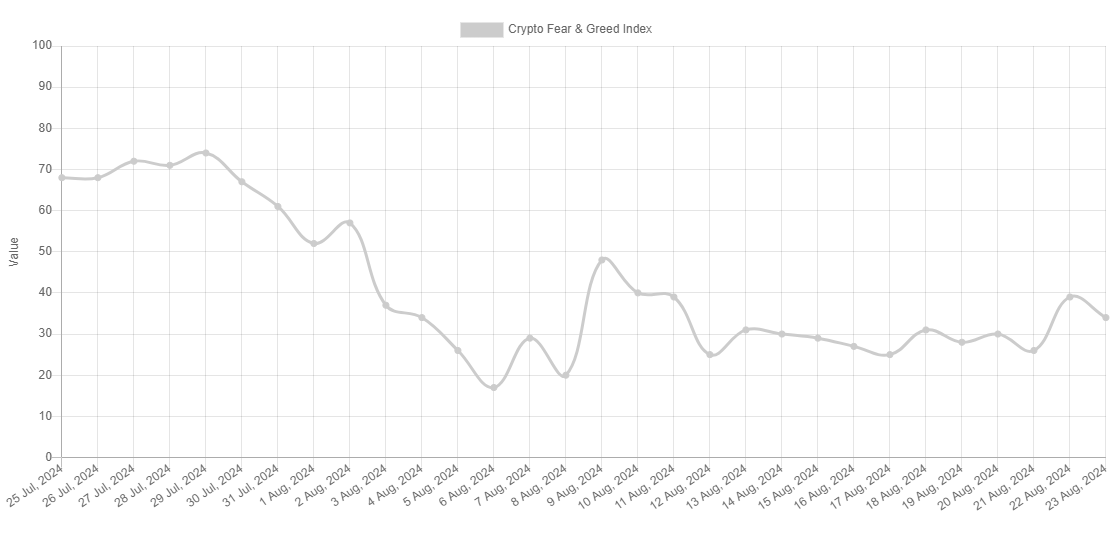

Now, here is what the current value of the Fear & Greed Index looks like:

At present, the Bitcoin Fear & Greed Index stands at 34, implying that investors are experiencing a degree of fear. However, this level of apprehension is relatively mild compared to the proximity to the neutral zone.

Earlier in the month, the indicator had shown particularly low values, as the chart below displays.

On August 6th, the Fear & Greed Index reached an all-time low of 17, which was its lowest point in over two years. At such low levels, the index is no longer merely indicating fear but rather an intense emotion known as “extreme fear.”

Fear at an extreme level can be described as the range between 0 (no fear) and 25 (high fear). Similarly, on the side of greed, extreme greed lies within the range above 75 (low greed).

It’s worth noting that Bitcoin’s lowest point around $50,000 occurred at a time when there was a peak in fear, which seems to be a pattern seen consistently throughout its history.

It seems that Bitcoin (BTC) often moves in a direction opposite to what most people expect. This strong expectation can typically be seen in the areas of extreme sentiment. Therefore, it’s logical to assume that significant price reversals might take place within these highly expected zones.

As a researcher observing the current market, I find the sentiment hovering around normal fear levels, and the Bitcoin price stabilizing. If we’re to witness a new surge of bullish momentum for Bitcoin, it might be beneficial to delve deeper into the extreme fear territory in the near future. However, the direction the indicator takes over the next few days is still uncertain.

BTC Price

In simpler terms, Bitcoin hasn’t managed to sustainably climb above $61,000 lately, and its most recent effort seems to have fallen short, with the price now back at approximately $60,800.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-08-23 19:37