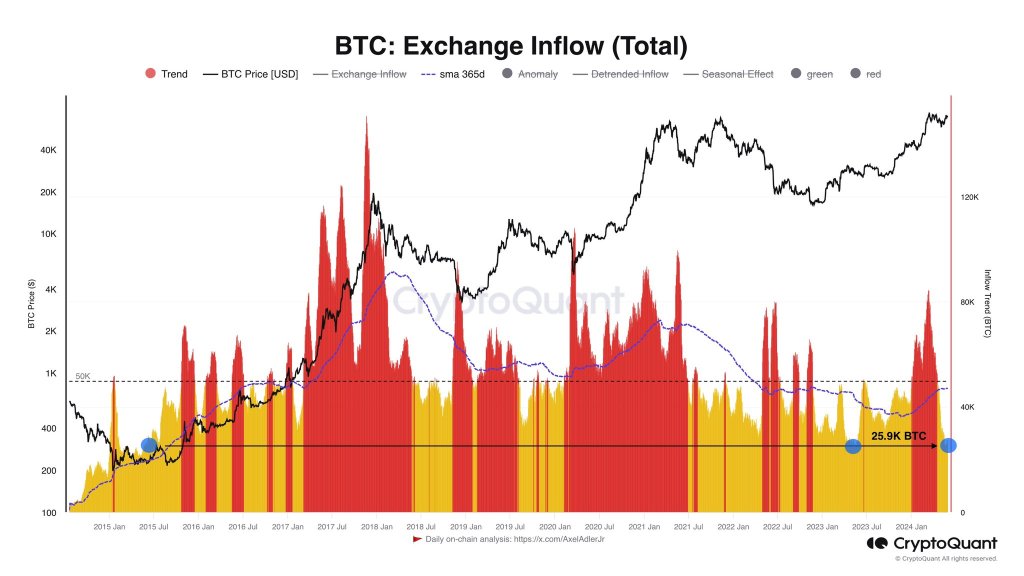

As a researcher with a background in cryptocurrency markets and experience tracking exchange inflows, I find the current trend of low Bitcoin inflow to exchanges intriguing. The data from CryptoQuant showing exchange inflows at 2016 levels is a significant observation that could indicate a shift in market sentiment towards holding rather than selling.

Yesterday, Bitcoin experienced a brief surge above $70,000 before dipping back down to around $69,000. Despite some signs of vulnerability, one market analyst points out that the inflow of coins to exchanges such as Binance and OKX has remained relatively low. This suggests that investors are not eager to sell their Bitcoins, even with prices taking a hit and failing to surpass $72,000.

Bitcoin Inflow To Exchanges Remain Low

According to the analysis, the daily influx of Bitcoin into cryptocurrency exchanges has been relatively low as of May 28th, with approximately 25,900 BTC being added each day. This current exchange inflow rate aligns with data from CryptoQuant, which indicates a similar level last seen in 2016.

I’ve observed a noticeable increase in activity starting from 2016, but there’s been a decline in investments to cryptocurrency exchanges since the beginning of this year. It is worth mentioning that nine Bitcoin spot exchange-traded funds (ETFs) received approval from the United States Securities and Exchange Commission (SEC) around the same time.

Large whales in the US may have opted to exchange their physical coins for Bitcoin ETFs with this product. By doing so, they transferred the responsibility of holding their assets to a trusted custodian selected by the specific Bitcoin ETF provider they picked.

Mt. Gox Moving BTC: How Will Prices React If They Sell?

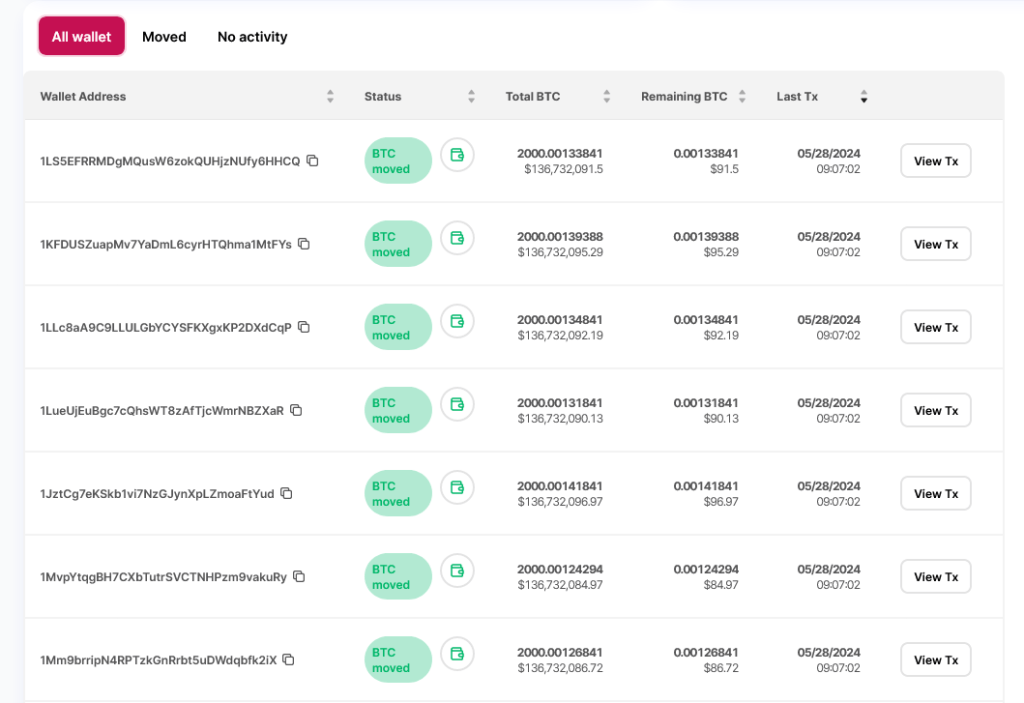

Although the daily Bitcoin inflow to cryptocurrency exchanges is currently reminiscent of figures from 2016, potential shifts may emerge in the upcoming months. A notable occurrence took place on May 28 when Mt. Gox, the defunct exchange that experienced a major hack in 2014, transferred approximately $9.4 billion worth of Bitcoin according to data from Token Unlocks.

The sudden transfer without prior notice has raised anxieties among market participants. At present, it’s unclear what their intentions are. However, potential consequences could be severe if they choose to sell off their holdings in the markets.

Despite the potential for Mt.Gox creditors to sell their Bitcoin holdings, which could increase the supply on exchanges, the analyst is confident that the market can handle it. The low average exchange inflow to exchanges acts as a buffer, reducing the price impact significantly. In simpler terms, even if there’s a large sell-off, the market is expected to remain stable and the price change will be minimal.

Prior to being breached and subsequently losing approximately 800,000 Bitcoins, Mt. Gox was a widely-used Bitcoin exchange. At a certain time, it controlled around 70% of all global Bitcoin trading volume. In the ensuing months, those impacted by the hack will receive compensation.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-05-29 00:04