As a seasoned analyst with over two decades of experience in financial markets, I’ve seen more than my fair share of market cycles and trends. The current state of Bitcoin is reminiscent of the dot-com boom, where an innovative technology was met with skepticism but ultimately redefined the financial landscape.

The price of Bitcoin is currently hovering around $75,000 due to Donald Trump’s election win in the U.S., which has sparked renewed enthusiasm within the cryptocurrency market. Analysts and investors are optimistic about potential supportive policies for digital assets under Trump’s administration, fueling this excitement. As Bitcoin reaches new record highs, some believe this could mark the start of a new upward trend in its value.

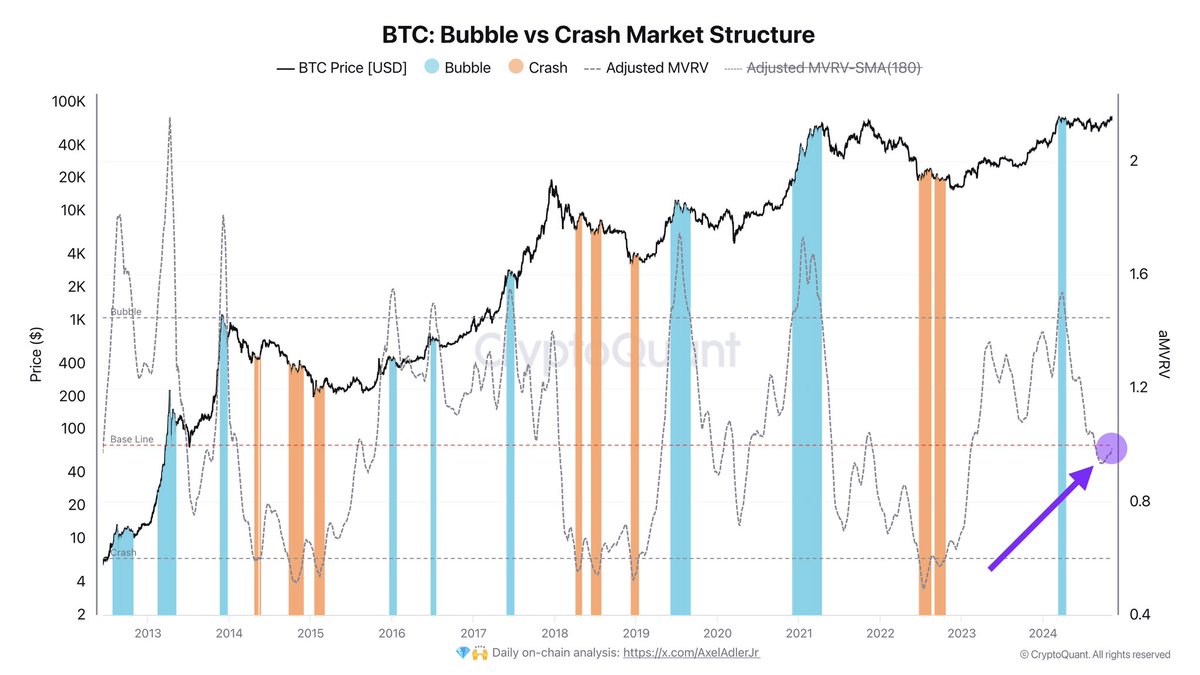

According to information from CryptoQuant, Bitcoin’s current price seems balanced, implying that there are no significant market factors pushing the price down. This equilibrium, however, points towards a favorable perspective and suggests a solid base for potential future growth. Analysts speculate that Bitcoin might scale new heights with fewer impediments in the upcoming weeks.

As a crypto investor, I find myself at a pivotal juncture as confidence in this digital currency grows. This moment is seen by some as crucial for Bitcoin to cement its status within a favorable regulatory landscape. The technical foundation appears strong, bolstered by Trump’s election win, which seems to be generating optimistic vibes across the crypto community. Many of us are hoping that this positive sentiment will fuel an impressive upward trajectory, possibly lifting the entire crypto market to new heights.

Bitcoin Enters A Bullish Phase

After surpassing its prior record highs, Bitcoin is now in an upward trend, hitting a new peak at around $76,500. This price point is garnering attention among financial experts who see it as a possible barrier to further growth, known as a resistance level.

As a crypto investor, I’ve been keeping a close eye on the market analysis by CryptoQuant analyst Axel Adler. His insights indicate that we’re teetering between a “Bubble” and a “Crash” phase right now. However, his findings, which incorporate crucial on-chain data, suggest that Bitcoin’s market structure is currently balanced, implying there are no major fundamental reasons to predict a sudden drop. Instead, this equilibrium presents a solid base for potential continued growth in Bitcoin’s upward trend.

Today marks the day when the Federal Reserve will announce its interest rate decision. The upcoming weeks are shaping up to be crucial, as a positive or steady decision from the Fed could boost optimism within the market, leading to increased demand and further strengthening Bitcoin’s position above $76,000.

With institutional investors and financial experts anticipating increased action from larger entities, especially considering Bitcoin’s robustness near this significant mark, the market’s equilibrium at this moment is pivotal. As Bitcoin preserves its existing form, it holds the capacity to keep rising significantly without a considerable risk of reversal.

As a researcher, I’m closely monitoring the current market trends, where renewed demand is pushing Bitcoin forward and favorable macroeconomic conditions are providing a strong foundation. At present, the focus lies on Bitcoin reaching new heights, particularly surpassing the $76,500 mark following the Federal Reserve’s recent announcement. This consolidation phase could act as a springboard for further growth, reinforcing Bitcoin’s bullish momentum.

BTC Key Levels To Watch

As a researcher, I’m observing that Bitcoin is currently trading around $75,000, maintaining its position above its earlier record high of approximately $73,800. This price range now serves as a crucial support area, given the steady 4-hour uptrend Bitcoin is experiencing. This trend can be traced back to a robust rebound from the 200 exponential moving average (EMA) at $66,800, suggesting a resurgence of bullish sentiments among investors.

To maintain the current positive trend, it’s crucial that the price of Bitcoin stays above $73,000. This significant level increases market confidence and offers a potential launchpad for future growth. If we see a strong hold at this price point, it could indicate further gains, attracting more buyers and possibly leading to new record highs for Bitcoin.

If Bitcoin doesn’t maintain its current level, there’s a chance it could dip down to approximately $70,500 where demand might be lower. Yet, the present market behavior isn’t showing any strong indications of a decline. The persistent uptrend and robust support levels indicate that Bitcoin’s bullish trend continues, with few signs pointing towards an immediate fall.

So far as Bitcoin’s structure holds strong, the route for further growth appears unobstructed, bolstering faith in the continuing uptrend.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- What Happened to Kyle Pitts? NFL Injury Update

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

2024-11-07 19:56