As a researcher with experience in analyzing Bitcoin’s market trends, I find the current market conditions intriguing. The price volatility and choppy market condition of Bitcoin may have dashed some investors’ hopes for a quick breakout to new highs, but the bull cycle is far from over.

As a crypto investor, I’ve noticed that Bitcoin‘s price has become erratic again, dashing any expectations of hitting new record highs anytime soon. However, this doesn’t necessarily mean the end of the current bull cycle. It’s true that Bitcoin’s advance has slowed down, but it could be just a pause before resuming its upward trend.

As a researcher studying the intricacies of Bitcoin’s on-chain behavior, I’ve observed an intriguing development over the past few months: a distinct “euphoria wave.” This phase is characterized by heightened activity and enthusiasm among Bitcoin holders and investors. The implications of this euphoria wave for the current bull run are significant.

How Old Is The Current Bitcoin ‘Euphoria Wave’?

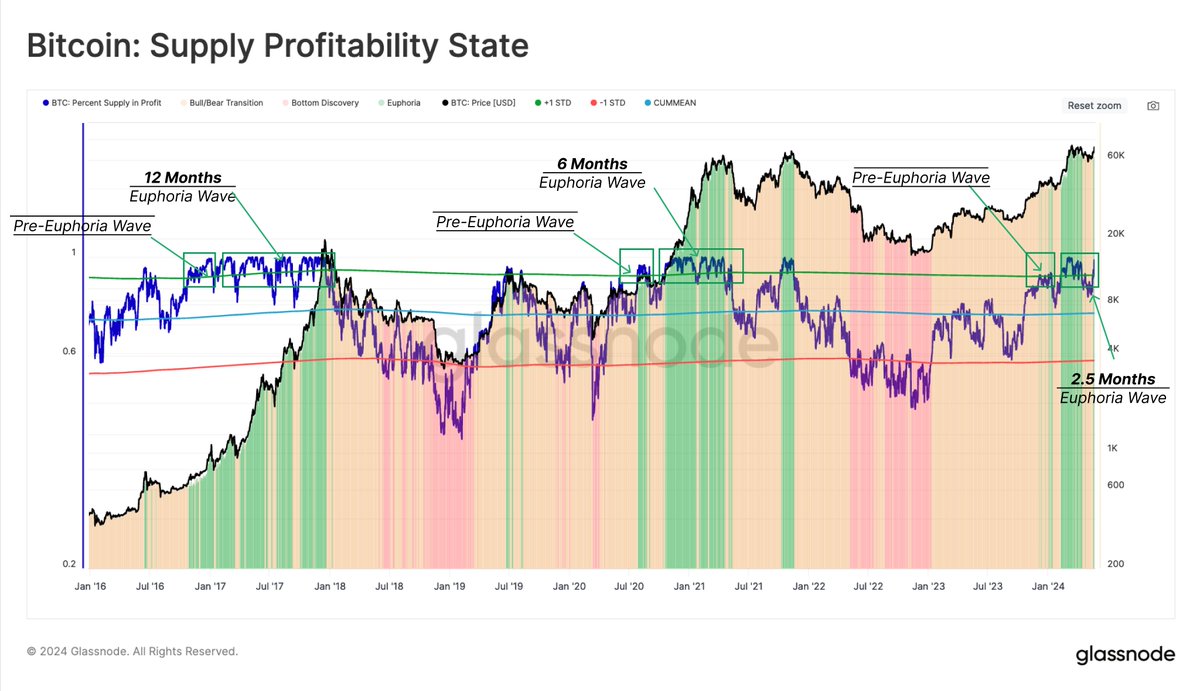

According to Glassnode’s analysis posted on the X platform, Bitcoin has entered the exhilarated stage of its market cycle based on the “Percent Supply in Profit” indicator. This metric assesses the proportion of the entire circulating Bitcoin stock that is currently generating profits for its owners.

Based on Glassnode’s analysis, the “Euphoria Wave” refers to a time frame when approximately 90% of Bitcoin supply is in profit. This phase can last anywhere from six to twelve months and is marked by surging investor optimism and intense market conjecture.

According to Glassnode’s analysis, approximately 93.4% of the total Bitcoin supply is currently in profit, with the Euphoria Wave being quite fresh at just over two and a half months old.

Just as every market cycle has its ups and downs, the Euphoria Phase in Bitcoin’s price movement will eventually reach its conclusion. Historically, this phase has indicated market peaks and has been followed by a period of correction, signified by a decrease in Bitcoin’s value.

Based on the previous 6-month Euphoria Wave in the last cycle, we might have around three to four months left in the current bitcoin bull run. The profitability of bitcoin during this period could significantly influence how long this bull market lasts and what its future trend looks like.

Rise Of BTC Accumulation Addresses Continued In May: Analyst

A clear indicator of optimistic attitudes towards Bitcoin is the persistent growth in the count of wallets amassing Bitcoins. As reported by a cryptocurrency analyst using CryptoQuant’s platform, there has been a substantial surge in the creation of new Bitcoin hoarding addresses.

As a researcher studying the Bitcoin market, I’ve noticed an intriguing development: despite the comparatively sluggish price movement of Bitcoin in May, the positive trend has persisted uninterrupted. Simultaneously, large-scale Bitcoin investors have been actively accumulating more coins, as evidenced by substantial purchases made over the past month.

From my research as of now, Bitcoin is currently worth $67,744 with a minimal 0.4% price change over the last 24 hours. However, according to the data I’ve gathered from CoinGecko, Bitcoin has experienced a noteworthy increase of approximately 15% in value over the past month.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-06-02 13:52