As a researcher with experience in cryptocurrency markets, I’ve been closely monitoring the recent price action of Bitcoin (BTC). The digital currency has extended its losses below the crucial $67,500 support zone, testing the waters at the $66,000 level.

As a researcher studying Bitcoin‘s price movements, I’ve observed that Bitcoin’s value dipped below the $67,500 support level. It then underwent testing at the $66,000 support zone before commencing an attempt to bounce back.

-

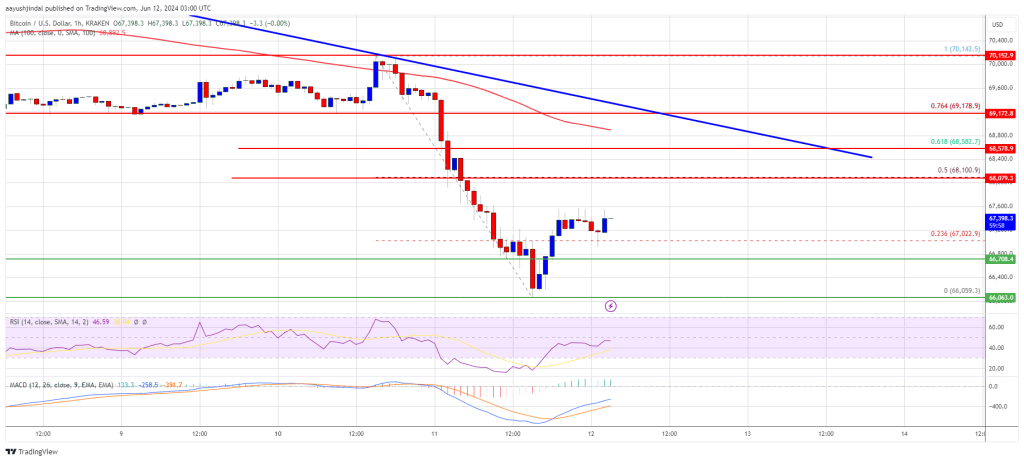

Bitcoin started another decline below the $68,500 support zone.

The price is trading below $68,000 and the 100 hourly Simple moving average.

There is a connecting bearish trend line forming with resistance at $68,650 on the hourly chart of the BTC/USD pair (data feed from Kraken).

The pair could recover but the upsides might be limited above the $68,500 level.

Bitcoin Price Dives

The price of Bitcoin fell short of rising above the $68,500 mark for further growth. Instead, it retreated and dipped beneath the $68,000 threshold. A decline ensued below crucial support levels at $67,500 and $67,000.

The price dipped down to touch the $66,000 mark, resulting in a new low at $66,059. Currently, Bitcoin is regrouping above the 23.6% Fibonacci retracement level of its recent decline from the peak of $70,143 to the low of $66,059. At present, Bitcoin trades beneath the $68,500 threshold and the 100-hour Simple Moving Average.

One potential way to rephrase this statement in a more conversational and clear manner is: The price has hit a roadblock around $67,600, with potential obstacles at $68,000 and the 50% mark of the recent price drop from the peak of $70,143 to the trough of $66,059.

As an analyst, I’ve identified a potential resistance level for Bitcoin (BTC) against the US Dollar (USD) at $68,500. Moreover, there seems to be a bearish trend line emerging on the hourly chart, with resistance set around $68,650. This trend line comes in close proximity to the 100-hour Simple Moving Average, adding credence to its significance as a potential barrier for price advancement.

As a researcher, I would rephrase it as follows: Breaking above the $68,500 resistance could potentially propel Bitcoin’s price further up. Should this occur, the next level of resistance at $69,000 might be tested. If Bitcoin continues to gain ground, it may push towards the near-term resistance at $70,200.

More Losses In BTC?

Should Bitcoin be unable to surpass the $68,500 barrier, there’s a risk of another price drop. The nearest support lies around $66,700.

$66,200 is the initial significant level of support. A new support is emerging around $66,000. Should the price decline further, it could approach the $65,500 support area in the immediate future.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $66,700, followed by $66,000.

Major Resistance Levels – $68,000, and $68,500.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

2024-06-12 06:22