As a Seasoned Researcher and Cryptocurrency Analyst with Battle-Scars from Past Market Swings:

The data indicates that social media activity surrounding Bitcoin increased significantly following its recent surge, possibly explaining why Bitcoin’s price has subsequently declined.

Bitcoin Topped Out As Hype Around The Coin Shot Up

Based on data from analytics firm Santiment, there’s been a significant increase in positive sentiment towards Bitcoin as indicated by the “Positive-to-Negative Sentiment Ratio.” This metric measures the gap between positive and negative remarks about Bitcoin that appear on various social media sites.

The indicator separates posts related to negative and positive sentiments by putting them through a machine-learning model devised by the analytics firm.

If this metric exceeds zero, it indicates that social media users are engaging in more constructive discussions rather than negative ones. Conversely, when it falls below this level, it’s a sign that pessimistic views are prevailing on these platforms.

Here’s a graph displaying the trend of the Positivity to Negativity Sentiment Ratio over its recent period:

The graph shows that the ratio of positive to negative sentiment towards Bitcoin experienced a substantial increase as Bitcoin approached its peak at around $66,000.

Yesterday, as Santiment posted an update, there were approximately 3.6 times more positive social media posts about the asset compared to negative ones. Consequently, traders seemed quite hopeful following the rise in price. Nevertheless, this upswing might not be beneficial for the coin.

Historically, Bitcoin (BTC) often moves against the general expectation of the crowd. As the sentiment becomes increasingly one-sided, the likelihood that it will go in the opposite direction increases.

Currently, Bitcoin is once again dipping below the $64,000 mark, which might suggest that the enthusiasm on social media about it may have turned sour, much like it has on previous occasions.

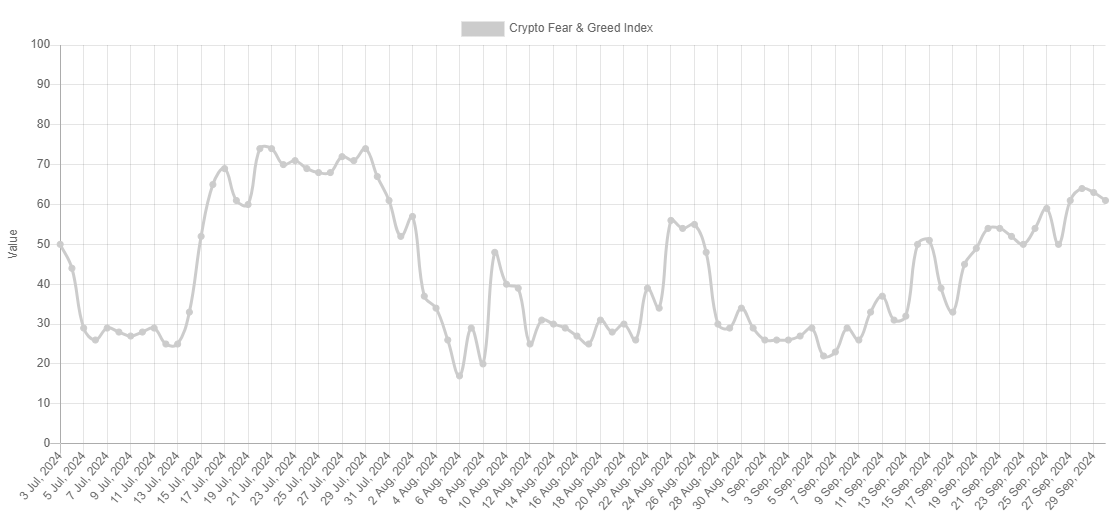

Recently, both ordinary people and financial analysts alike have shown growing enthusiasm in the industry, as reflected not only in social media activity but also in the Fear & Greed Index, a tool developed by Alternative that takes multiple factors into account beyond just social media sentiment.

Currently, the Fear & Greed Index stands at 61, indicating that investors are generally feeling optimistic or ‘bullish’ about Bitcoin and the broader cryptocurrency market.

In the upcoming days, we might see the appearance of indicators related to public opinion, which could signal whether Bitcoin will resume its upward trend. A decrease in public excitement or anxiety would be a positive sign, as it often indicates market stabilization based on historical trends.

BTC Price

After the latest plunge, Bitcoin has returned to the $63,400 level.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-01 10:16